|

ブラジル・中南米食肉ニュース |

|

|

<ジャマイカ> 観光業発展しホテル部屋数が増加、政府が高級牛肉の輸入関税の引き下げを検討 Govt to Relax Import of 'Prime

Beef Cuts' for Tourism 10

May 2017 JAMAICA

- With hotel rooms expected to double over the next few years, the Government

is looking at reducing the duties on imported prime beef cuts to satisfy the

demand from tourists. According

to Industry, Commerce, Agriculture and Fisheries Minister Karl Samuda hotel

rooms are expected to increase to more than 40,000 rooms, resulting in significant

increases in demand across all food categories. According

to Jamaica Observer, Mr Samuda told the

House of Representatives yesterday that the Government supports the call by

the tourism industry for the provision of imported prime cuts of beef to that

sector. “This

will allow them to offer internationally acceptable standards of prime cuts

to our visitors, whose tastes are becoming ever more discerning,” he said. “We

will, therefore, recommend to the Ministry of Finance that special treatment

be given to these hotels, as we support efforts to improve the quality of the

product, so that we can compete better with other destinations,” he added. The

demand for high-quality prime beef cuts comes primarily from the local hotel

industry, since per capita beef consumption remains relatively low among

Jamaicans. Mr

Samuda, who was speaking in the sectoral debate in the House, said that the

Government is mindful of the enormous opportunities for sustainable

agricultural growth and improved livelihoods for farmers, through tapping

into the robust tourism sector. “For

tourism to be sustainable it has to work for everybody, including our

farmers, and within the framework of the Linkages Council. We are determined

to iron out all the kinks to ensure a consistent and uninterrupted flow of

produce from farm to the hotel dining room,” he said. He

noted that the total annual value of demand for agricultural products by the

tourism sector is estimated at approximately $19.4 billion, based on the 2015

demand study. Food items in the poultry, meats, seafood and fruits categories

account for more than 75 per cent of this total value. “Locally

sourced agricultural products account for a minimum of about $14.5 billion or

74.5 per cent of the total value of agricultural products consumed by the

tourism sector,” he stated. TheCattleSite

News Desk <トリニダードトバコ・ブラジル> トリニダードトバコがブラジル産コンビーフ輸入の停止を解除 T&T Ambassador Lifts Ban on

Brazilian Corned Beef 11

April 2017 TRINIDAD

& TOBAGO - If some of the largest consumers of Brazilian meat such as

China and the EU as well as several countries in the region have expressed

confidence in the safety of the meat products from the South American country

and lifted their import bans, T&T should follow suit also. Brazilian

Ambassador to T&T Paulo Sérgio Traballi Bozzi said this was a positive

course of action that should be seriously considered by the T&T

Government. Mr

Bozzi, speaking to the Sunday Guardian from the Brazilian

Embassy in St Clair, Port-of-Spain on Thursday, said of the 4,800 meat

processing plants in Brazil, only 21 were under investigation and T&T’s

supply of corned beef did not come from any of them. Mr

Bozzi also said one of the plants under investigation was 700 kilometres away

from the facilities that T&T’s corned beef came from and there was little

chance of contamination. Brazilian

police unveiled on 17 March an investigation codenamed “Operation Weak Flesh”

which found evidence of meat packers bribing inspectors and politicians to

overlook health and safety violations such as processing rotten meat and

shipping exports with traces of salmonella. Mr

Bozzi said considering that most of the large importers such as China (the

biggest national consumer of Brazilian meat), EU, US, Hong Kong, Egypt and

even in the region, Jamaica, Barbados and Cayman Islands had already lifted

the ban on imported meat products and actually returned the goods back to the

supermarkets for retail after the authorities clarified details of a police

investigation into alleged bribery of health inspectors, the Brazilian

Government was now talking with T&T Government representatives to see if

it can lift the ban. Agriculture

Minister Clarence Rambharat said on Tuesday that a temporary restriction on

imports and retail sales of meat products from Brazil since 21 March, will

stay in place for T&T. Mr

Bozzi said: “The problem with Brazilian beef is not a sanitary problem, it’s

a problem of corruption. “All

the men responsible are either now in jail or being processed by the

Brazilian justice system. “The

stance by the T&T Government took us as a very big surprise because

T&T doesn’t buy Brazilian whole meat, Brazil doesn’t export fresh or

frozen meat to T&T. “What

T&T importers buy from Brazil is corned beef which is processed meat

which goes through many stringent safety measures for the health of

consumers.” Mr

Bozzi said another point that he wanted to stress was that the Brazilian meat

industry was very transparent, anyone from any country can arrange a site

visit and view a meat plant which met international health and safety

standards as well as countries’ religious and dietary customs regarding the

processing of meat. He

said Brazil was the second largest meat exporting country in the world and

exported meat to Israel and the Jewish country which kept a team of

veterinarians and health inspectors in Brazil to ensure that the meat was

kosher, satisfying the requirements of Jewish law. Mr

Bozzi said Arabic countries as well kept teams of inspectors in Brazil to supervise

the exportation of meat bound for their market and that it was halal. He

said he hoped that the authorities in T&T can understand that a country

that sells meat to 150 countries all over the world such as the US, China and

Japan and also exported more than 1 million metric tons of beef in 2016 would

jeopardise its reputation because of the graft of a corrupt few. Mr

Bozzi said the Government of T&T was right to preserve and protect the

health of its citizens but the Brazilian Government was waiting for the

lifting of the ban. “We

believe by now that it has been amply shown that there is no danger and these

measures should be reviewed,” Mr Bozzi said. Agriculture

Minister Clarence Rambharat said on Friday that T&T had asked the

Brazilian Government to provide the ministry with specific assurances

regarding the integrity of the certification process on which the ministry

relied. He

said that it was one thing for the Brazilian Government to make a blanket

statement about which plants were being investigated. Mr

Rambharat said, however, that did not tell the ministry that other plants

would not be added to the list. He

said T&T’s Ambassador to Brazil Dr Amery Browne met with some of the key

people on Friday and he was awaiting his advice. Mr

Rambharat said once they were assured that the certification process was

being carried out with integrity, the ban and recall will be reviewed. When

Supermarket Association of T&T (SATT) president Dr Yunus Ibrahim was

contacted on Friday, he said most of the importers had proof their corned

beef did not come from any of these 21 plants. Regarding

the stocks of unsold corned beef in supermarket owners’ inventories, Dr

Ibrahim said association members took it upon themselves to voluntarily

remove them from their shelves. TheCattleSite

News Desk <ブラジル・世界> 腐敗・サルモネラ菌汚染肉の出荷目こぼしー衛生検査官の贈収賄スキャンダルで、中国・EUがブラジルからの食肉輸入を停止(中国国内生産はもっと酷い?) :ブラジルは世界最大の牛肉・鶏肉輸出国、米・豪でも資本参入・トップクラスシェア :BRF、JBS社の21カ所の食肉処理工場が問題に、これにミネルバ・マフリグ社は含まれず China, EU Cut Imports of Brazil

Meat Amid Scandal 21

March 2017 BRAZIL

- China and the European Union curtailed meat imports from Brazil on Monday

after police, in an anti-corruption probe criticized by the government as

alarmist, accused inspectors in the world's biggest exporter of beef and

poultry of taking bribes to allow sales of rotten and salmonella-tainted

meats. As

the scandal deepened, Brazil's Agriculture Minister Blairo Maggi said the

government had suspended exports from 21 meat processing units. But

he also criticized the investigation by Brazil's Federal Police into

meatpacking companies, calling their findings "alarmist" and saying

they used a few isolated incidents to tarnish an entire industry that

maintains rigorous standards. An

all-out ban on Brazilian meat exports would be a "disaster," Mr

Maggi added. "I pray, I hope, I work so that does not happen," he

said, speaking to reporters outside his office in Brasilia. With

other import curbs expected to follow, the scandal stemming from a police operation

codenamed "Weak Flesh" could deal a heavy blow to one of the few

sectors of Latin America's largest economy that has thrived during a two-year

recession. Police

on Friday named BRF SA and JBS SA , along with dozens of smaller rivals, in a

two-year probe into how meatpackers allegedly paid off inspectors to overlook

practices including processing rotten meat, shipping exports with traces of

salmonella and simply not carrying out inspections of plants. JBS

is the world's largest meat producer and BRF the biggest poultry exporter. The

companies have denied any wrongdoing, and authorities have said no cases of

death or illness have been linked to the tainted meat investigation. New

allegations of unsavory business practices in Brazil come as the country is

still reeling from a massive graft scandal centered on state-controlled oil

company Petrobras that is widening into other sectors. Brazil's

President Michel Temer has sought to downplay the meatpacking probe, saying

it involved only 21 of Brazil's more than 4,800 meat processing units. But

Francisco Turra, head of Brazilian beef producers association ABPA, told

reporters it had put the entire meat industry in jeopardy and

"destroyed" a hard-won image of quality products. China,

which accounted for nearly one-third of the Brazilian meatpacking industry's

$13.9 billion in exports last year, suspended imports of all meat products

from Brazil as a precautionary measure. The

European Union suspended imports from four Brazilian meat processing

facilities, ABPA said, citing the nation's agriculture ministry. Ricardo

Santin, ABPA's vice president of markets, said two of the suspended plants

process poultry, one beef and the other horse meat. One of the poultry plants

is operated by BRF, said Santin. In

a statement, BRF said the company has not received any formal notice from

Brazilian or foreign authorities related to the suspension of its plants. South

Korea's agriculture ministry said in a statement that it would tighten

inspections of imported Brazilian chicken meat and temporarily bar sales of

chicken products by BRF. More

than 80 per cent of the 107,400 tons of chicken that South Korea imported

last year came from Brazil, and BRF supplied almost half of that. BRF shares slide BRF

closed down nearly 2.2 per cent Monday, while JBS ended the day up 0.75 per

cent as investors bet the scandal would have less effect on the world's

largest meatpacker. BRF

could prove more vulnerable to the scandal since a larger share of its

operations are physically based in Brazil, while JBS derives most of its

sales from abroad, according to a report by Goldman Sachs analysts led by

Luca Cipiccia. Shares

of Minerva SA and Marfrig Global Foods SA, which are not involved in the

investigations, also fell as traders fretted over the possibility of further

import bans. The

scandal "could be enough to compromise temporarily Brazilian protein's

acceptance worldwide," Credit Suisse Securities analyst Victor

Saragiotto wrote in a Monday note to clients. Chile

is also temporarily banning imports of all Brazilian meat products, the

agriculture ministry said on Monday. The

European Commission said the scandal would not affect negotiations between

the European Union and South American bloc Mercosur about agreements on free

trade. On

the streets of Rio de Janeiro, Brazil's second-largest city, the scandal left

many consumers in doubt. "My

freezer at home is full of meat, and I don't know what to do," said

Maria Fonseca, a saleswoman. "Should I eat it or just throw it all away? "It

is an enormous waste. If I lived in the countryside, I'd start raising my own

cows and chickens!" TheCattleSite

News Desk <ブラジル> 大統領はブラジル食肉の信用失墜回復に懸命 :ブラジル食肉の年間輸出総額は120億ドル(1兆3千億円!!) :問題の21工場は全国の4,800工場のごく一部、また33名の贈収賄衛生検査官は全体の11,000人中のほんの一部に過ぎないと苦しい言い訳 Brazil President Seeks to Calm

Health Fears Over Beef Exports 21

March 2017 BRAZIL

- President Michel Temer, confronting a corruption scandal tarnishing

Brazil’s lucrative meat industry, met with executives and foreign diplomats

to assuage their health concerns over a sector responsible for US$12 billion

in annual exports. The

hastily called meeting on Sunday followed raids by police investigating

whether companies paid bribes to conceal unsanitary conditions at

meatpackers, Reuters reports. According

to Ejinsight, addressing diplomats from Europe,

the United States, China and elsewhere, Temer said Brazil’s government

“reiterates its confidence in the quality of a national product that has won

over consumers and obtained the approval of the most rigorous markets”. President

Temer, who even took some of the diplomats to a lakeside steakhouse after the

meeting, portrayed the raids as isolated, if necessary, efforts against

corruption. He

sought to dispel fears of systemic flaws in a sector that is now the world’s

largest exporter of beef and several other meat products. He

said investigators would accelerate the probe and underscored that Friday’s

raids affected just 21 of more than 4,800 meatpackers in operation. Only

33 of over 11,000 inspectors are being investigated, he added. Despite

allegations by police that some producers had sold rotten and adulterated

meat products, Luis Eduardo Rangel, a senior Agriculture Ministry official,

said: “There is no sanitary risk.” The

allegations, he added, were "worrisome from a corruption and crime point

of view”, but “from a health perspective we are very confident that the

sanitary issues alleged do not represent a risk for consumers or

exports." As

such, government officials after the meeting were quick to point out that

Brazil’s success as a meat producer in part stems from what has been an

efficient and highly-regarded system of sanitary controls. They

noted that none of the more than 150 countries that already buy Brazilian

meat has suspended imports. Still,

some customers are wary. “You cannot play around with food,” said André

Regli, Switzerland’s ambassador to Brazil, adding the problems were

“worrying.” On

Saturday, officials from the European Union said they sent two letters to

Brazil’s government seeking details about any systemic risks to imports. China’s

government asked for similar information. On

Friday, regulators from the US, which recently began importing fresh beef

from Brazil, said they were monitoring the issue but that inspections at

import terminals there should prevent any health risks. After

Sunday’s meeting, the head of Brazil’s powerful farm association said he

hoped for fast and severe punishment for those caught breaking laws. “We

producers are victims of this,” said João Martins, president of the National

Agriculture Confederation, speculating that the price of Brazilian beef could

fall in the coming days. In

damage-control efforts, Brazil’s two biggest meat companies launched a public

relations campaign over the weekend to make clear they did not sell rotten

beef. TheCattleSite

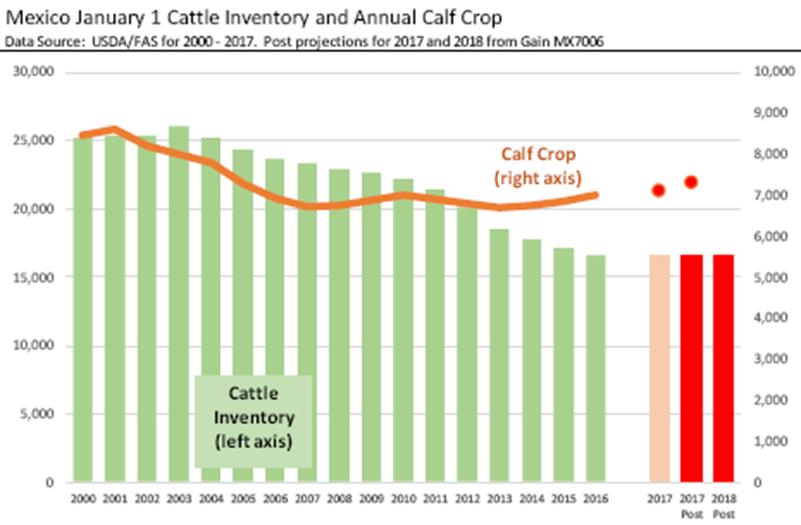

News Desk <墨> 米資料ではメキシコ牛飼養頭数は1,662万頭で昨年並み―国内牛肉価格はインフレ高 CME: Total Mexican Cattle

Inventory at About Same Level as January 2016 20

March 2017 US

- The latest update from our Ag officials in Mexico contained some

interesting insights about that market, reports Steiner Consulting Group, DLR

Division, Inc. To

be clear, these are not official numbers from USDA, which means they have not

been reviewed and corrected by USDA staff in Washington. It is our opinion

that the ag market information for Mexico is more opaque than what we find

either in the US or Canada so the updated reports from our embassy staff are

always welcome. Below

are some of the highlights from the latest report (you can see the entire

report here): The

total cattle inventory in Mexico at the start of 2017 is currently estimated at

16.620 head, slightly higher than the official USDA forecast last fall. If

correct, this would put the cattle inventory at about the same level as it

was in January 2016. Cattle

inventories in Mexico appear to have not increased by an appreciable amount

even as the calf crop is reported to be higher. This would mean more calves

going into the US rather than staying in the herd. The

beef cow herd in Mexico is currently estimated at 7 million head, about

100,000 head more than the number presented in the last USDA forecast and

200,000 head more than in January 2016. If correct, this is the largest

Mexican beef cow herd since 2011 but still much lower than the +10.8 million

head of beef cows that the country had in 2000. The

larger beef cow herd matches up with the increase in the calf crop, which the

latest Post report now pegs at 7.3 million head compared to the 7.1 million

head that was projected by USDA last fall. One of the points that the report

made repeatedly is that Mexican officials appear intent on diversifying the

number of markets where they currently source both beef and pork. Part

of this effort has been the introduction of a tariff free quota system for

countries that are not part of NAFTA. Brazil looms large here given its

outsize production of beef, pork and chicken products. The

new TRQ system now provides for 200,000 MT of beef that can enter Mexico duty

free. We assume this would be on a product weight basis. USDA reported that

Mexican beef imports in 2016 were around 180,000 MT on a carcass weight

basis. On

a product weight basis this would be around 125‐130 MT (not sure exactly the

conversion USDA is applying). The main point is that the new tariff free TRQ

would be more than enough to replace US products. Mexico

has significantly increased its beef export volumes, largely to the US in

recent years and in 2017 it is forecast to run a positive beef export balance

with the US, shipping 290,000 MT (cwe) while importing 190,000 MT (cwe). Any

disruptions of trade with the US likely would not cause a net decline in beef

availability in Mexico.

TheCattleSite

News Desk <デンマーク・米・ブラジル> デニッシュクラウン社が米のプラムローズ社をブラジルのJBS社に売却 Danish Crown Sells Plumrose USA 15

March 2017 DENMARK

- Danish Crown has signed an agreement to sell its American subsidiary Plumrose

USA to Brazilian-based JBS, which is the world’s largest meat-processing

company. The sale is based on the 4WD strategy, under which Danish Crown has

decided to focus its business on Northern Europe and Asia. Group

CEO Jais Valeur, Danish Crown, said: "The focus of Danish Crown’s 4WD

strategy is to lead our home markets in Northern Europe, to further grow our

positions in Asia and to expand our leading position in casings globally. "We

have therefore decided to sell Plumrose USA. I am certain that JBS, with its

wide presence and access to raw materials in North America, is a perfect

match for Plumrose USA and will help fortify its business for the benefit of

many loyal customers. "Plumrose

USA is an excellent company, which has made significant progress in recent

years, and I would like to take this opportunity to thank the Plumrose USA

management and employees for their committed efforts." For

more than 80 years, Plumrose USA has been a supplier of quality products to

consumers across the USA. In 1932, the company started production of sliced

cooked ham, and over the years it has developed into a company offering a

wide selection of products including premium bacons, packaged deli meats,

quality deli counter hams, cooked ribs and canned hams. CEO

Andre Nogueira, JBS USA Food Company, said: "Plumrose USA is a highly

respected business with an outstanding professional team, a strong portfolio

of branded cooked and prepared foods, and first-class, well-invested assets

in strategic geographic locations that complement our current business

structure. "We

are excited to welcome the more than 1,200 dedicated team members of Plumrose

USA to JBS and look forward to building on the legacy of high-quality

products and outstanding service established by Danish Crown." Four

months ago, Danish Crown launched its ambitious 4WD strategy with the

predominant aim of growing its four home markets in Denmark, Sweden, Poland

and the UK. The

strategy includes plans to expand exports to Asia in general, and to

establish a production facility in China based on Danish pork. Also, Danish

Crown is focused on achieving global leadership in selected categories. Mr Valeur

said: "Selling Plumrose USA is a step forward in achieving the long-term

goals of the 4WD strategy. We have strengthened our financial capacity quite

substantially. "This

gives us extensive room for manoeuvre and for taking part in what I would

call a necessary consolidation of the food sector in our four home

markets." In

the most recent financial year, Plumrose USA posted revenue of DKK 3.4

billion. The company manages five plants and two distribution centres with

1,200 employees across the USA. JBS pays DKK 1.6 billion to acquire Plumrose

USA. The

sale of Plumrose USA to JBS is contingent on approval by the US competition

authorities. ThePigSite

News Desk <墨> ここ2-3か月高かった豚肉価格が落着き Mexico Hog Market Report 09

March 2017 MEXICO

- Mexico, as a price taker from US prices, has experienced relatively unusual

behavior over the last few months, with higher prices compared to its North

American counterpart. However, during recent weeks the price has started to

stabilize a few pesos lower than it was, writes Fernando Ortiz. Some

of the causes for this is happening are: ·

Vespers of Lent – seasonally

during Lent and Easter time, consumption get lower. ·

Diseases – talking to a senior

swine vet this week, he mentioned that DEP and PRRS continue to be of big

impact on areas like Jalisco, Guanajuato, Sonora and western Mexico in

general. Less pigs equal highest prices. ·

Exchange rate – Mexico peso

devaluation on front of the American currency has made pork import into

Mexico a little weaker (specially hams and shoulders) In

spite of all the above, the price in Mexico remains relatively strong and

producers are still making money. However, the price has been coming down

from 34 pesos/kg ($0.79/lb) (December 2016) to about 27 pesos/kg ($0.63/lb)

today. One

positive thing to keep markets up is consumption. Mexico has increased its

per-capita pork consumption by two kilograms over the last decade. You can do

the math based on a population of 110 million people. This deficit has been

filled by imports, mainly from the United States and Canada. At this time,

the EU (Spain) is pursuing a slice of this pie as well. Per capita pork

consumption in Mexico is currently about 18 kg. Cost

of production has remained steady due to stability of grain prices and

commodities in general. People in the industry look positive and optimistic

for the rest of the year. One

interesting point to highlight here is that in Mexico, some of the largest

pork producers are also the largest egg producers. They have faced a terrible

last year of losses on their laying hens business. Losses that have been

cushioned in part by profits from their pig business. On

the other hand, Mexican pig producers are constantly challenged by factors

like: ·

Exchange rate and commodities

fluctuation – Since Mexico is a country that depends on imports of grains,

these two factors are of higher risk ·

Financial cost – Credit

accessibility and bank interest rate are too high in Mexico – around 12 to 13

per cent. ·

Pork import (ham and shoulders

mainly) – At a lower cost than produced in Mexico. From 650,000 tons of meat

imported/year, 90 per cent are ham and shoulders from United States mainly. ·

NAFTA – uncertainty about what is

going to happen ·

The demand of farm labour is

declining – The expansion of the larger producers is being done at the expense

of the small and medium producers causing a displacement of labor of the

farms towards the cities (social problem) Again,

in general, the overlook of the market is positive and as we head into

summer, I believe we will continue towards an overall higher price. <キューバ> ビラ・クララ州で牛飼育の為の地下水汲み上げに投資 Investment in Cattle Sector in

Province of Villa Clara 13

February 2017 CUBA

- The province of Villa Clara has begun an investment process in the cattle sector

with the installation of 50 turbines to extract deep water sites with an

investment process in the cattle sector which includss 86 new pumps. The

work inlcudes the perforation of 22 wells with entities that lacks water to

guarantee for the cattle to drink the precious liquid for their development

and milk production. Fausto

Vega, representative of the Ministry of Agriculture in the territory, told

the press that not only have they improved the technology of the cattle but

the necessary actions for the control of the reservoirs have been established

for the control of the reservoirs and avoid the unnecessary use of the

resources. Among

the sector's priorities in Villa Clara is to maintain some 40 dams clean and

in good shape in order to allow divert the flowing of the rivers towards the

cattle or pasture area. He

added that they are working in the refurbishing of 15 wells locate in

different municipalities to guarantee the correct use of the water sources. Mr

Vega recalled that the agricultural drought in recent years that damaged the

province severely affected the cattle inflicting high numbers of death and

malnutrition in the animals. Since

then a program aimed at avoiding the same outcome which also includes

planting 6,600 hectares with a variety of highly nutritious cereal. Santos

Martin Alonso, director of the Benito Juarez Agricultural Company in

Placetas, told ACN that the 10 new turbines installed are currently

working. He

believes that these tasks benefit the work of the cattle raisers and allows a

better use of the cattle both in the milk production sector as well as beef. Source:

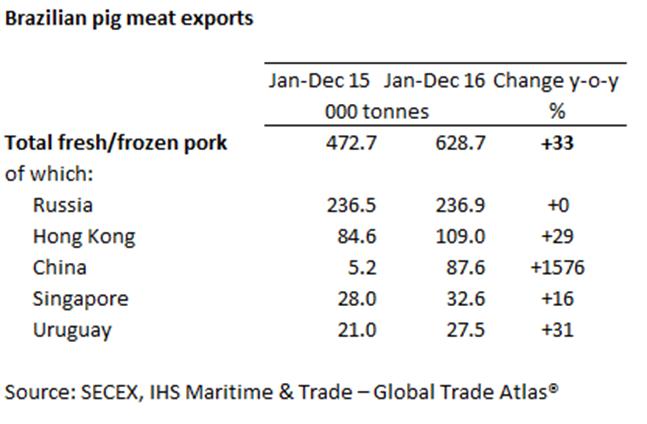

ACN Cuban News Agency <ブラジル> 2016年の豚肉輸出は30%増の628,600トン、うち約20万トンは中国・香港向け Brazilian Pork Exports Increase By

a Third Driven by Asian Demand 19

January 2017 BRAZIL

- The volume of fresh/frozen pork exported from Brazil in 2016 was a third

higher than 2015 at over 628,600 tonnes. Brazil’s

pork industry has been rapidly expanding in recent years and it is now a

large global producer and exporter. Brazil regained direct access to the

Chinese market in late 2015 and with the number of Brazilian plants gaining

approval to ship to China increasing in 2016 they now represent a key

competitor to the UK and the EU for shipments there. The

increase in shipments on the year was largely driven by increased access to

the Chinese market. In 2015 Brazil exported just 5,200 tonnes of pork to

China, however in 2016 Brazil shipped more than 15 times this amount, with

exports to China totalling 87,600 tonnes. Furthermore,

full year 2016 exports from Brazil to Hong Kong, increased by nearly 30 per

cent on the year to 109,000 tonnes. The smaller markets also played a role in

the overall annual increase, with shipments to other South American

destinations such as Uruguay, Argentina and Chile all up on the year. However

in 2016, exports to Brazil’s largest market, Russia, remained relatively the

same as 2015 at just under 236,900 tonnes, this led to the overall share of

volume traded that Russia holds falling to just over a third compared to 50

per cent in 2015. Nonetheless,

it is worth noting that volumes remain above those seen in 2014 which was

before the Russian import ban on pork from the EU, US and Canada.

The

export value also increased on the year in 2016 by 18 per cent to reach

R$4.65 billion compared to R$3.95 billion in 2015. The value of shipments to

Hong Kong increased by 30 per cent on the year at R$773 million and the value

of exports to China in 2016 were more than 17 times as much as 2015 at R$645

million. Nonetheless, the value of the volume shipped to Brazil’s largest

market, Russia decreased 18 per cent in 2016 to R$1.8 billion.

<ブラジル・南ア> 南アへの非加熱豚肉の輸出を再開 Brazil Resumes Fresh Pork Exports

to South Africa 13

January 2017 BRAZIL

- Brazil will resume exports of fresh pork to South Africa following the

lifting of the ban South African Department of Agriculture, Forestry and

Fisheries (DAFF). Since

2005, negotiations for reopening the market have been held between the two

countries. The

ban was implemented due to outbreaks of foot-and-mouth disease in Brazil that

year and only cuts intended for the sausage industry were accepted. In

2014, shipments of pork to South Africa totaled $25,000. In 2015, shipments

were $538,000 and last year $3.7 million. ThePigSite

News Desk <チリ> 発生した鳥フルはローパソ(低病原性) Chile Bird Flu Outbreak Not Very

Dangerous 10

January 2017 CHILE

- An outbreak of avian influenza in Chile that was discovered last week has

been confirmed to be low pathogenic, or not as dangerous as some viruses,

following sample testing in the US. Chilean

authorities at the Agricultural and Livestock Authority (SAG) announced the

discovery of an outbreak in Quilpué, in the region of Valparaiso, on 4

January. In

a joint effort between the SAG and the Ministry of Health, existing protocols

were immediately activated to eliminate the outbreak and eradicate this

disease from Chile, which could affect both wild and domestic birds. The

flock of turkeys, reported to number 350,000, on the affected farm was

destroyed and the area isolated to prevent disease spread. However,

Chile's own testing and testing at the US Department of

Agriculture's Animal and Plant Health Inspection Service (APHIS)

laboratories confirmed the virus was of low pathogenicity. These viruses

cause less severe symptoms in birds. Chilean

authorities said the results meant that the country's animal health standards

are still high, and a normal flow of trade should soon resume with other

countries, following normal global procedures. <ブラジル> サンタ・カタリーナの日本向けパッカーのパムプローナ社に、初めての「ブラジル産豚肉ラベル」の使用許可 Santa Catarina Pork Producer First

to Receive the Brazilian Pork Label 05

January 2017 BRAZIL

- Pamplona, a pig producer and exporter with headquarters in Rio do Sul

(SC), has become the first company in Brazil to have the right to use the Brazilian

Pork seal, maintained by the Brazilian Animal Protein Association (ABPA). To

use the seal, the company passed a check list and met all the requirements

established by the Brazilian Pork Setorial Project, maintained by ABPA in

partnership with the Brazilian Agency for the Promotion of Exports and

Investments (Apex-Brasil). The

approval of the use of the seal was analyzed by a technical committee, in a

careful evaluation with more than 70 items related to animal welfare, quality

of food, control and respect for sanity and environmental management. The

seal was adopted by the company for exports to Japan - one of the most

traditional customers of Brazilian chicken meat imports, which recently

opened its doors to pork made in Brazil. "The

meat produced by Brazil already has excellent perception of quality by the

Japanese consumer. In this context, the beginning of the application of the

Brazilian Pork label should be favored by an advertising campaign that we are

conducting in Tokyo, highlighting the quality and sanitary status of

Brazilian poultry and pork production," says Francisco Turra, chief

executive of ABPA. ThePigSite

News Desk <ブラジル> 大手のレストランがケージフリー卵に切換え One of Brazil's Largest Restaurant

Companies Switching to Cage-Free Eggs 21

December 2016 BRAZIL

- Brazil Fast Food Corporation (BFFC), which operates approximately 1,250

restaurants in Brazil, including Bob’s, Yoggi, Doggis, Pizza Hut, and KFC,

has committed to sourcing only cage-free eggs throughout its entire supply

chain. Most

laying hens in Brazil are housed in battery cages, but the company made the

policy switch following discussions with animal welfare organisations. In

its statement, BFFC stated: “One of our goals is to use only eggs from hens

not confined in cages, and we are undertaking a public commitment to work

together with our supply chain to achieve this goal by 2025." Fernanda

Vieira, corporate policy and program manager for animal welfare organisation

Humane Society International (HSI) Farm Animals in Brazil, stated: “We

congratulate BFFC for improving animal welfare in its supply chain by

pledging to switch to cage-free eggs. BFFC’s cage-free policy is another

clear sign that the future of egg production in Brazil is cage-free.” The

policy follows a shift to cage-free egg production in the US, UK and across

Latin America. For example, Burger King and Arcos Dorados, which operates

McDonald’s in Brazil and 19 other countries in the region, committed to

switching to 100 percent cage-free eggs, as did other leading restaurant

operators, totalling thousands of restaurants in Brazil and Latin America

alone. ThePoultrySite News Desk <ブラジル> 引続き豚肉輸出は好調 Positive Year for Brazil's Pork

Exports 13

December 2016 BRAZIL

- According to figures compiled by the Brazilian Association of Animal

Proteins (ABPA), pork exports continued the good performance registered in

early 2016. Raw

pork exports reached 58.3 thousand tons in November, 5.6 per cent more than

the same month in 2015 (55.2 thousand tonnes). It

was the second best performance recorded this year, only behind exports in

August (63 thousand tons). In

the year (January to November), shipments of fresh products totaled 585.6

thousand tons, 34.6 per cent higher than the 435 thousand tons exported in

the same period of 2015. Due

to the good performance of shipments, international sales revenue reached

US$152.8 million in November (25.3 per cent higher than the $121.9 million

recorded in the previous year). For

the year (January - November) sales reached $1.251 billion, surpassing the

total for the previous year by 14.2 per cent. "One

of the great highlights of this month was Russia, the main importer of

Brazilian pork. This is the period in which Eastern Europe intensifies its

purchases, advancing imports to avoid the logistical problems caused by the

harsh winter in the region, "explains Rui Eduardo Saldanha Vargas,

Technical Vice President of ABPA. <ブラジル> 国内の鳥フル侵入防御に警戒警報 Brazil Issues Flu Health Alert,

Urging Poultry Keepers to Protect Birds 13

December 2016 BRAZIL

- The Ministry of Agriculture, Livestock and Food Supply (MAPA) issued a

health alert on Friday to intensify defence efforts to prevent the spread of

bird flu in the country. This

is not the first time the department has issued this type of alert because

the disease is a permanent threat in the world. Because it is free from bird

flu, MAPA says Brazil needs to redouble its efforts to protect the health of

its poultry sector. The disease has been widespread in Europe, Asia and the

Middle East in the past few weeks. According

to the director of the Department of Animal Health at MAPA, Guilherme

Marques, the poultry sectors should apply stricter biosecurity measures:

"Our greatest concern is the migratory birds that come to the country to

escape the winter in the Northern Hemisphere. Commercial production already

has very strict sanitary controls. "All

the members of the productive chain must be aware of the risk and prepared to

face it. Any high bird mortality must be immediately reported to the official

veterinary service so that veterinarians can be on the property within 12

hours to start the investigation," said Guilherme Marques. According

to him, Brazil has been doing continuous work to prevent bird flu, some

strains of which also pose a risk to human health. With

this latest alert, access to farms (people, animals and vehicles) will become

more restricted. In addition, the training of veterinary teams will be intensified.

MAPA has also purchased materials and equipment for emergencies and reviewed

plans to contain the disease. The

Brazilian territory has 20 (local) sites to monitor the entry of migratory

birds, with active surveillance for avian influenza and Newcastle disease in

domestic birds that live around 10 km from these sites. In these places there

is also passive surveillance for migratory and wild birds. At

least 197 bird species can migrate. Of this total, 53 per cent (104 species)

reproduce in Brazil and 47 per cent (93 species) have breeding sites in other

countries. Migrating birds are thought to be a major factor in the spread of

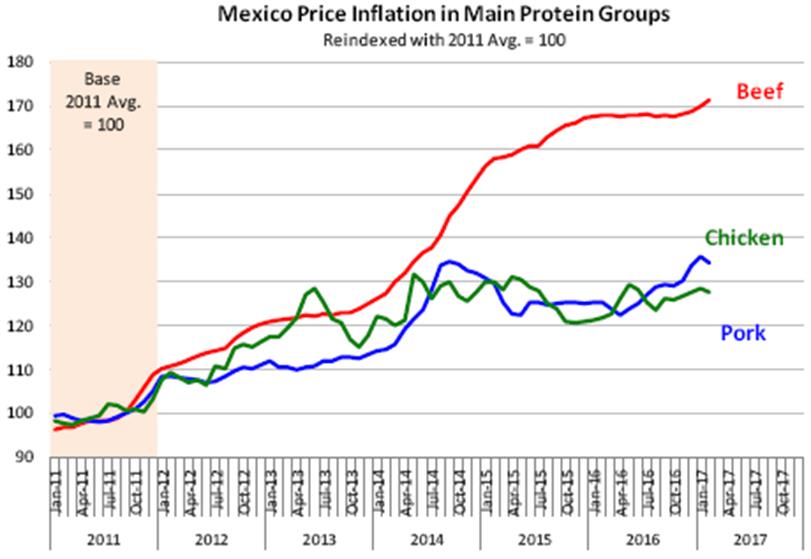

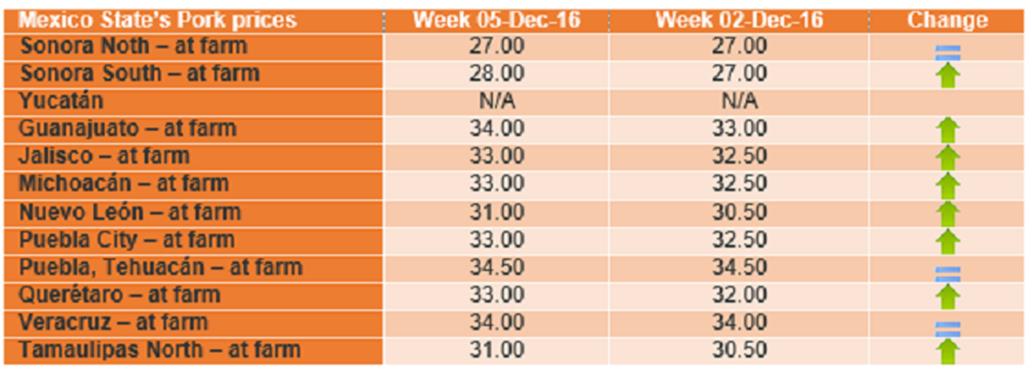

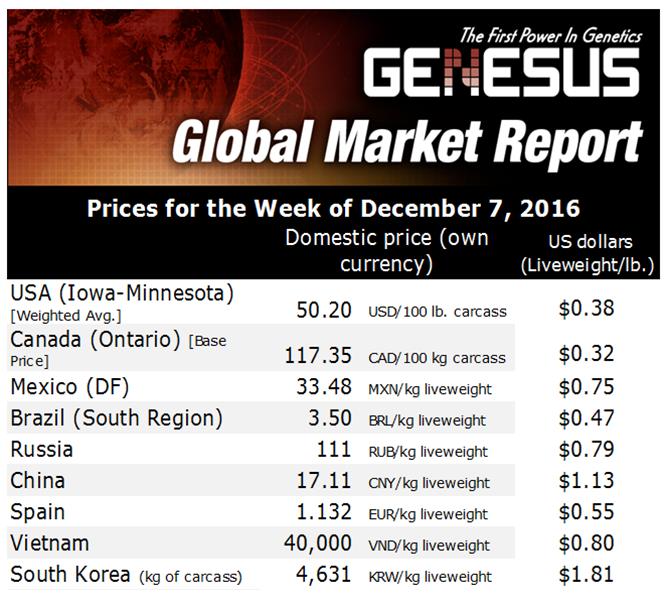

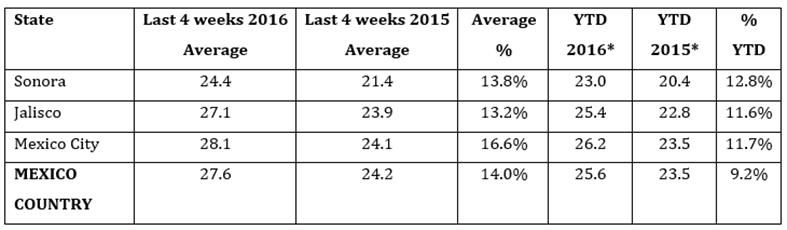

avian flu. <墨> 全国的に豚肉価格が上昇 Mexico Hog Market 09

December 2016 MEXICO

- About six weeks ago I reported prices for Mexico with an average of 28.1

MXN pesos/kg (68¢/lb USD) liveweight, a higher average of 16.6 per cent from

the same 4 weeks the year before, writes Fernando Ortiz, Genesus

Ibero-American Business Development. About

six weeks later, Mexico has experienced an even higher market in terms of

prices. Mexico City’s pork price has increased by 11.8 per cent, from 28.1

MXN pesos/kg (68¢/lb USD) to 33.16 MXN pesos/kg (74.2¢/lb USD). On

the other hand, the average national pork price is not bad at all, going from

27.6 MXN pesos/kg (62¢/lb USD) to 31.98 MXN pesos/kg (71¢/lb USD), a higher

average of 11.58 per cent over the last six weeks.

Similar

trends are shown in prices by State in Mexico as follows:

Exchange

Rates Another

factor has been the action of the Mexican peso against the American dollar.

Two years ago, the Mexican Peso was 12.50:1 against the USD. From then until

now, there has been significant dollar revaluation, like most of the other

currencies around the world. This week, the US dollar was quoted around 20.25

Mexican pesos, almost 11 per cent devaluation over the last six weeks. This

has been positive for the domestic swine industry, as it has avoided a major

overflow of American pork to Mexico. We believe that this factor, paired with

a relatively expensive American pork, is supporting higher prices in Mexico.

The lower value of the Mexican peso, compared to the US dollar, is

influencing the import demand of pork being produced in North America.

Mexican currency has come under significant pressure against the US dollar.

That makes US pork more expensive and is probably having a negative impact

(to the US) on the volume of pork exports. It

seems that disease factors are also pushing Mexican pork prices higher. It

appears that outbreaks of PED and PRRS are raging in several regions of the

country, causing considerable losses and negatively impacting hog supply to

the market, according to some producers we have talked to. The fact is there

is a shortage of pigs in Mexico. We

asked ourselves this question last time “How long will this high price last?”

and our answer was “We believe not that long.” To be honest, there is a

little panic in Mexico about these unusual prices, but the current market

situation is a mere reflection of demand and supply. Canada

- Mexico The

Canadian government has opened its market to Mexican pork after recognizing

Mexico as a country free of classical swine fever (CSF). Mexico

has requested recognition of its health status by the Canadian authorities

since 2009. Canada

is considered a leader in pork products, meaning the achievement is of the

highest importance to Mexico.

www.genesus.com <ブラジル> 1−11月鶏肉輸出402.2万トンで前年比3%アップ Positive Year for Brazil's Chicken

Exports 06

December 2016 BRAZIL

- Even after the drop registered in November, Brazilian chicken exports have

still increased this year. According

to figures compiled by the Brazilian Association of Animal Proteins (ABPA),

shipments reached 4,022 million tons between January and November, a volume 3

per cent higher than in the first eleven months of 2015, with 3.904 million

tons. In

November, 328.3 thousand tons were shipped, 15.5 per cent less than in the

same period of last year, with 388.7 thousand tons. "The

contraction of the volumes shipped in the last two months has, among other

causes, the slowdown in Brazilian production, due to the crisis in input

markets experienced in 2016. With the smaller scale, Brazilian agribusinesses

are balancing supply to the domestic and foreign markets," explains

Francisco Turra, chief executive of ABPA. Revenue

from November shipments reached US $ 528.8 million, 12.8 per cent lower than

in the eleventh month last year (US $ 606.4 million). In the accumulated of

the year the reduction is 4.4 per cent, with a total balance of US $ 6.275

billion - compared to US $ 6.567 billion obtained in 2015. <ブラジル> 増え続ける牛肉輸出―中国向けが激増 Brazilian Beef Exports Continue to

Grow 17

November 2016 BRAZIL

- The Brazilian beef industry ended the month of October with more than US$

449 million in exports, according to the Brazilian Association of Meat

Exporters (Abiec). During

the period, shipments totalled 107,000 tonnes. China

returned to the first place among the countries that bought Brazilian beef,

with billing of US$ 94 million (38 per cent more than the previous month),

which generated a volume of 21.3 thousand tonnes exported (35 per cent

increase compared to the previous month). In the same period, Hong Kong grew

by 5 per cent in value of exports from Brazil (to US$ 91 million) and 1 per

cent in the volume exported from Brazil to there (25 thousand tonnes). In

the year so far, from January to October 2016, beef exports grew by 4 per

cent in the volume shipped, worth US$ 4.637 billion. <米・墨> 9月も8月に続きメキシコ向け豚肉輸出が増加 US Pork Exports to Mexico Continue

Strong Momentum 14

November 2016 US

- September was another solid month for US red meat exports, with pork, beef

and lamb totals well above year-ago levels, according to statistics released

by USDA and compiled by the US Meat Export Federation (USMEF). After

a somewhat slow first half of the year, pork exports to Mexico moved higher

in August and continued to climb in September – posting the second-largest

monthly volume on record (66,567 mt, up 14 per cent from a year ago). September

value to Mexico was $131.4 million, up 25 per cent from a year ago and the

highest since December 2014. For January through September, exports to Mexico

pulled within 4 per cent of last year’s record pace in volume (510,737 mt)

and moved 1 per cent higher in value ($939.7 million). USMEF’s

efforts to bolster pork demand in Mexico continue to pay dividends, as per

capita pork consumption has increased nearly 20 per cent since 2011 and now

exceeds 40 pounds per year. Another

positive factor for pork exports to Mexico has been the slowdown in shipments

to China/Hong Kong, where the product mix tends to be similar. While still

well above last year, September exports to China/Hong Kong (36,184 mt, up 26

per cent) were down significantly from the May peak of 58,000 mt, reflecting

a rebound in China’s domestic pork production. For

January through September, exports to China/Hong Kong were up 70 per cent

from a year ago in volume (406,422 mt) and 57 per cent higher in value

($787.3 million). Other

January-September highlights for US pork exports include: ·

While pork exports to Japan were

below last year’s pace in both volume (289,594 mt, down 8 per cent) and value

($1.16 billion, down 5 per cent), higher-value chilled exports remain on a

record pace – climbing 10 percent from a year ago to 164,087 mt. During

periods of large US production, chilled exports to Japan provide an

especially important outlet for loins and butts. ·

A rebound in Korea’s pork

production led to a slow start for US exports in 2016, but exports to Korea

are poised for a strong finish as September results moved higher

year-over-year for the second consecutive month. Compared to last year’s

large totals, January-September exports to Korea were down 27 per cent in

volume (94,774 mt) and 33 per cent in value ($252.1 million). ·

Exports to Colombia have slowed in

2016 (24,851 mt, down 22 per cent, valued at $56 million, down 30 per cent)

due to a spike in domestic pork production and other headwinds, including the

weak Colombian peso. But exports to Colombia rebounded in September, climbing

35 per cent in volume (3,456 mt) and 29 per cent in value ($8.2 million). ·

Pork exports to Central America

cooled in September but remain well above last year’s pace in 2016, totaling

46,426 mt (up 16 per cent) valued at $110 million (up 11 per cent). Exports

were higher year-over-year in mainstay markets Honduras and Guatemala and

more than doubled to Nicaragua, as every Central American market except

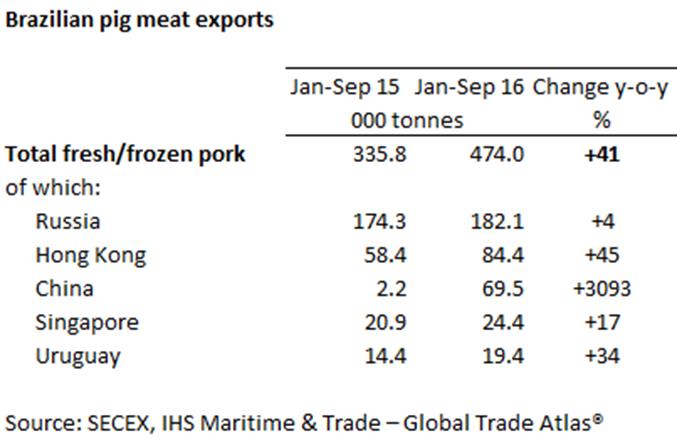

Belize is currently a top 20 volume destination for US pork. <ブラジル・中国> 1‐9月の豚肉輸出は41%アップの活況:特に中国向けが激増 Far East Buoys Brazilian Export

Market 03

November 2016 BRAZIL

- Brazilian fresh/frozen pork export volumes for the January- September

period were up 41 per cent this year, relative to 2015, at over 474,000

tonnes. This

substantial increase was largely driven by increased access to the strong Chinese

market, where negligible 2015 shipments have been replaced by volumes just

shy of 70,000 tonnes this year. Similarly,

trade with Hong Kong also made significant gains of 44 per cent on the same

period last year. Smaller players equally played a role, with shipments to

fellow South American destinations Chile and Argentina more than doubling on

the first nine months of 2015. In

contrast, exports to Russia, which still account for over a third of volume

traded, have shown a less substantial increase during 2016 so far. While

volume was up 4 per cent overall to the end of September this year, a

decrease of 14 per cent was actually seen during Q3. It is worth noting,

however, that volumes remain well above those seen before the imposition of

the Russian import ban on pork from the EU, US and Canada in 2014.

Export

value did not keep pace with the rise in volume, though it was still up 21 per

cent for the first nine months of 2016 relative to the same period last year,

reaching R$3.4 billion. However during the third quarter, value showed a

marginal decline of 1 per cent. Increases

in value were limited due to the average unit price of Russian shipments

declining by 25 per cent in reals this year, to the end of September, with

discounts seen across all cuts. On top of this, Russia also imported an

increasing proportion of cheaper whole/half carcases instead of cuts of pork. These

changes have likely been necessitated by the stagnating Russian economy. An

overall loss of value was avoided due to increases in unit prices shipped to

other countries, with China showing a significant 17 per cent rise during the

period. <墨> 今度は外食チェーンのスシイット社がケージフリー卵に切換え Another Mexican Company Shifts to

Cage-Free Egg Supply Chain 28

October 2016 MEXICO

- As part of its ongoing commitment to improve sustainability in its supply

chain, Sushi Itto, the leading Asian cuisine restaurant company in Mexico,

has committed, through its supplier Nova Foods, to switching to an

exclusively cage-free egg and gestation crate-free pork supply chain. Nova

Foods has announced that it will work together with Humane Society

International, one of the largest animal protection organisations in the

world, to complete the transition by 2022. Ernesto

Nuñez Hernández, purchasing manager for Sushi Itto, stated: “We’re proud to

join the global cage-free egg and gestation crate-free pork movement.

Switching to a cage-free supply chain reflects our values as a socially

responsible company, and allows us to meet our clients’ demands for more

sustainable and higher animal welfare products. "We

source from the highest quality suppliers, and we will work with them to meet

our goal. We look forward to working with Humane Society International to

continue improving animal welfare in our supply chain.” Sabina

Garcia, corporate policy and project manager for HSI Farm Animals in Mexico,

stated: “We congratulate Sushi Itto and Nova Foods for joining the cage-free

movement in Mexico and for taking its customer’s concerns about the way

animals are treated seriously. Animal welfare has become one of the most

important corporate social responsibility issues in Mexico and we look

forward to working with other companies on similar policies.” <墨> 生豚価格が14%アップ Mexico Pork Market 21

October 2016 MEXICO

- Over the last four weeks, liveweight hog prices in Mexico showed an average

of 27.6 MXN pesos/kg (67¢/lb USD), up 14 per cent compared to the same period

of time in 2015, writes Fernando Ortiz, Genesus Ibero-American Business

Development. For

the last 4 weeks, Mexico City has recorded an average of 28.1 MXN pesos/kg

(68¢/lb USD) liveweight, a higher average of 16.6 per cent from the same 4

weeks the year before. The

following table shows three key Mexican regions in terms of price of pork

(all prices are in Mexican currency). At the bottom is the National Average

Price.

The

important point here is that Mexico has not only maintained a good price, but

that it has risen slightly from one year to another despite a substantial

fall in pork prices in the United States. Mexico still has decent prices that

allow producers to obtain margins of about $30 per head. How long will this

last? We believe that it will not last long. Historically, low prices in the

US have caused an overflow of American pork into Mexico, and consequently

exert great pressure on the domestic price of pork. It is only a matter of

time before we begin to see the impact of the current North American markets

reflecting realities in Mexico as well. The old economic adage is that when

the US pork price catches a cold, the Mexican pork price catches pneumonia. If

Mexican producers are looking for some comfort on future prices, there is

one, and the good news is that pork consumption in Mexico has reported a

growing trend over the last two years (about 3.3 per cent). Jalisco and

Sonora are the main pork producers by state, contributing 18.9 per cent and

17 per cent of the domestic supply in 2015, respectively. Next in order of

importance are Puebla (12.3 per cent), Veracruz (9.2 per cent), Yucatán (8.6

per cent), Guanajuato (8.3 per cent) and Michoacán (3.2 per cent). However,

Sonora and Yucatan are the foremost pork export States. Mexican

Peso devaluation (USD revaluation?) Two

years ago, the Mexican Peso was 12.50:1 against the USD. From them to now, there

has been significant dollar revaluation, like with most of the other

currencies around the world. This week the US dollar was quoted around 18.50

pesos after crossing the 19:1 mark last February. Other countries’ currencies

devaluation look like this: Russia, (86 per cent), Brazil (52 per cent),

Canada (18 per cent), Euro (20 per cent), South Korea (19 per cent), British

Pound (17 per cent). Mexico

currency devaluing by over 30 per cent is detrimental, but it could be worse.

In the worst case scenario, producers are buying more costly imported grain

than before (even when grain prices are lower in price than in the country of

origin). Since the price of a country's currency affects the price of their

products on world markets, the currency's exchange rate can have a big effect

on national exports and costs of imports. On

the other hand, Mexican pork exporters are earning more margins by putting

their product overseas. With the rise of the dollar, Mexico has enjoyed a surge

in exports, especially to the US. Why

Mexico is taking such a hit doesn't really make sense, as Mexico will enjoy 4

per cent GNP growth in 2016, nearly double that of the US. In a backhanded

way, the fall of the peso has stimulated economic growth by lowering the cost

of Mexican-produced products in the world's largest consumer nation, the

United States. There

have been at least a half dozen reasons for the peso and other currencies to

remain weak against the dollar, as the world’s economic conditions remain

fluid. Mexico’s

pork industry is projecting to expand a little bit further on international

markets with a clear focus in Asia. With 1.4 million tons of pork production

projected for 2016 (USDA projection), Mexico is still far to from

self-sufficient. It is estimated that the consumption of pork in Mexico would

increase 3.3 per cent during 2016, to stand at 2.2 million tons (carcass).

Since 2012, Mexico has expanded pork exports about 30 per cent (2012, 70,000

tons – 2015, 100,000 tons). Having

said that, Mexico’s pork imports is about 1 million tons a year -for a value

of more than $1,785 million US dollars- representing 14 per cent of imports

of pork (meat and by-products) worldwide. The main supplier, prominently, is

the US, which accounts for 84 per cent of sales -over $1,500 million US

dollars. It is followed by Canada with $250 million value. Between both, they

add around 98 per cent of the volume and value of pork imports from Mexico. We

were visiting several pig producers and packing plants in Spain over the last

two weeks. My feeling is that Europe’s packing plants, especially those from

Spain, are focusing right now to target markets like Mexico and Colombia. The

recently confirmed opening of the Mexican market to fresh pork from Spain is

being seen by the European Commission (EC) as the first step in a process

which will deliver similar export breakthroughs for other EU member states. “The

market is opening for fresh pork from Spain and we expect the go-ahead for

fresh pork from France. Work is also ongoing for exports from Germany,

Romania, Italy and Poland,” mentioned a European Commissioner Representative

recently. How much pork trade can be expected? Personally, I don’t think too

much, and here are my reasons: 1.

There is some potential in this

market, but European exporters should be ready to face fierce competition

with its North American counterparts in terms of price, due mainly to

significantly higher freight costs. 2.

Mexico’s main pork import are

hams. Ham is a relatively low value pork product in North America, while hams

in Europe, mostly in Spain, are costly. I am not sure if Spain could afford

to ship hams to Mexico to compete with those very cheap American ones. Now,

if they (Spaniards) are thinking to add some value on them, it would be a

different story. In that case we would be talking about cured or cooked hams;

areas where Spain has a lot of expertise. 3.

Mexico is quite a large pork

importer, taking around 1 million tons last year, but, as I already

mentioned, most comes from the US (84 per cent) and Canada (14 per cent).

There is, however, some room for sending offal to this country. Mexico is

getting around 200,000 tons of offal/year. There might be more chances for

the EU’s products to compete in that market, although currently the US and

Canada dominate again. <ブラジル> 8月の豚肉輸出量は30.7%の増加、第1位輸出先はロシア Brazilian Pork Exports Up 30.7 per

cent in August 13

October 2016 BRAZIL

- The Brazilian Animal Protein Association (ABPA) has revealed that Brazilian

pork exports grew 30.7 per cent in August, compared to the same period last

year. Around

478,900 tons were exported between January and August this year. In

August, Brazilian pork exports also gained $138.3 million, 19.8 per cent higher

than the figure reached in the first eight months of 2015. The

main destination of exports were to Russia (159,300 between January and

August), 4 per cent more than recorded in the same period last year. Second

was Hong Kong with 111,100 tons, 54 per cent more than in 2015. "One

of the highlights this year is Chile, which has stepped up its imports at

levels that exceed 200 per cent. Other major markets such as Uruguay,

Argentina and Singapore also showed significant growth," says Rui

Eduardo Vargas Saldanha , technical vice president of ABPA. <イスラエル・ブラジル> ブラジルからの牛精液輸入を解禁 Israel Opens Market to Brazilian

Beef Semen 07

October 2016 BRAZIL

- The Israeli government has now opened its market to frozen bovine semen

from Brazil. The

market opening is the result of negotiations between the Brazilian

agriculture ministry and the Israeli Ministry of Agriculture. <加・墨> 墨産豚肉の輸入解禁:墨の豚コレラフリーを承認 Canada Opens Market to Mexican

Pork 12

October 2016 MEXICO

- The Canadian government has opened its market to Mexican pork after

recognising Mexico as a country free of classical swine fever (CSF). Mexico

has requested recognition of its health status by the Canadian authorities

since 2009. Canada

is considered a leader in pork products, meaning the achievement is of the highest

importance to Mexico. <ブラジル> 9月エジプトが19,000トン輸入し、牛肉輸出が増加 Brazilian Beef Exports Climbing 11

October 2016 BRAZIL

- Brazil's fresh beef exports are performing well in Egypt, as the country

purchased almost 19,000 tons from Brazil in September and ranked ahead of

China. Egypt

was the main destination for Brazilian exports of fresh beef in September.

The Arab country imported almost 19,000 tons in the month and placed ahead of

China, Hong Kong, Russia and Iran, according to data from the Association of

Brazilian Beef Exporters (Abiec). In

terms of revenues, however, China ranked first with purchases worth USD 68.5

million, with Egypt coming in second with USD 63.2 million. According

to Abiec, Brazil exported overall 93,000 tons of fresh beef last month, an

increase of 13 per cent over August. Shipments generated USD 388 million, up

11 per cent in the same comparison. <アルゼンチン> 飼料コスト安で2017年のブロイラー生産量は3%増加 Argentina's Poultry Industry

Expected to Benefit from Lower Feed Costs 29

September 2016 US

- Argentina's broiler production is expected to rise in 2017 by 3 per cent

from 2016 levels, according to the latest report from the US Department of

Agriculture's Foreign Agricultural Service (FAS). However,

expected production levels for 2016 were revised down in the report because

of lower production during the first half of the year. The

temporary exit of Cresta roja (the second largest producer for Argentina,

which declared bankruptcy in December 2015) from December 2015 until March

2016 made a dent in total broiler meat production for Argentina. Production

is expected to accelerate as Cresta Roja’s reinsertion in the market will

increase the country’s production levels during the second half of the year. The

expected production increase in 2017 is driven by stronger exports as a

result of the strong work Argentina is doing in order to open new markets,

FAS said. The domestic market has practically reached its ceiling and there

is little room for further expansion in domestic consumption. Moreover,

cattle herd expansion is expected to lead to a recovery in per capita

consumption of beef around 53.5 kg. While broiler meat consumption has risen

tremendously over the past decade because of its price competiveness, beef is

Argentines’ preferred meat choice. Production

costs were higher this year due to various policy and economic effects, but

FAS predicted costs will moderate as economic forecasts point to lower

inflation for 2017. More

importantly, feed costs are expected to decline as Argentine corn production is

forecast to increase by 30 per cent for the 2016/2017 season. This

development, along with higher corn production in other key producing

countries, is expected to put downward pressure on corn prices – the main

component of feed rations for the Argentine poultry sector. <ブラジル> 8月の豚・ブロイラー生産コストが下落 Brazilian Production Costs for

Broilers Fell in August 20

September 2016 BRAZIL

- Production costs for pigs and broilers fell for the second month in a row

in August, according to Brazil's agricultural research institute Embrapa. The

production cost index for pigs fell by 0.46 per cent, whilst the index for

broilers fell by 2.65 per cent. The

reduction in spending on animal feed, the most important raw material in

terms of production costs, was primarily responsible for the fall in costs. The

two indices reached record highs in June after Brazil struggled with a low

harvest of maize. <米・ブラジル> 米への非加熱牛肉の初輸出はJBS(4工場)、マルフリッグ(6)、ミネルバ(2)の3社工場から CME: US to Receive First Beef

Exports from Brazil 22

September 2016 US

- Media has reported that several beef producing facilities in Brazil have

been approved to export fresh beef to the US, according to the latest CME

Daily Livestock Report from Steiner Consulting Group. While

we have heard this report from several sources, we have yet to be able to

confirm it with USDA’s Food Safety Inspection Service as it is not updated on

their website at the time of publishing this DLR nor could we get hold of

anyone on the phone. According

to reports, three main international beef producing companies who have plants

in Brazil; JBS, Marfrig, and Minerva, have all had individual Brazil units

(plants) approved for export to the US. JBS

has 4 units approved, and reported the first batch of fresh beef will be

shipped to the US this weekend. Marfrig has 6 units approved for export and

said it has already shipped its first container of fresh beef to the US, and

Minerva had 2 units approved for exporting. To

recap, on August 1st, the USDA announced the reopening of fresh beef trade

with Brazil. At the time of announcement no specific plant in Brazil had

approval, but the announcement jump-started the plant specific approval

process. While

this market is now open and operating, we do not expect a major influx of

Brazilian beef into the US in the short run, mainly due to Tariff Rate Quotas

(TRQ’s) and Brazil’s foothold in other major markets. To

review, TRQ’s are assigned to countries exporting product to the US, who do

not have a free trade agreement with us. The total TRQ for beef from

countries without a free trade agreement or specific quota with the US

(defined as “Other Countries”) is 64,805 metric tons, and is used on a

first-come-first-served basis. Brazil

falls into this “Other” category. Once the quota is reached, any beef

exported to the US from “Other” countries, over the maximum amount, is

subject to a 26.4 per cent ad valorem tax. Last

year, 68 per cent of the 64,805 mt (142 million pounds product weight) quota

was filled, primarily by Nicaragua, Honduras, Costa Rica, and Ireland. This

TRQ, along with the market share Brazil holds in Chinese and Russian beef

imports, leads us to believe that relatively small levels of beef will be

imported from Brazil at least for the first couple years. According

to USDA’s Global Agricultural Information Network (GAIN), the recent report

on Brazil’s 2016 Annual Livestock situation compiled by USDA staff in

country, notes they expect Brazil to fill about 80 per cent of the 64,805 mt

quota in 2017. Note,

the graph shows that even if Brazil filled 80 per cent of the quota, it would

pale in comparison to the volume of beef we import from our main

international sources. Brazil

hosts an impressive cattle and beef industry. According to the GAIN report,

Brazilian total beef cow inventory numbers were at 54 million head in 2015

and 55 million head in 2016. That is compared to the US beef cow herd at 29

million head in 2015 and 30 million head in 2016. In

Brazil, beef production, on a carcass weight equivalent (cwe), totalled

9,425,000 mt (20.8 billion pounds) in 2015 and is forecast at 9,620,000 mt

cwe (21.2 billion pounds) in 2016, Almost 20 per cent of their production

goes to the export markets. This

is compared to US beef production which totalled 23.7 billion pounds cwe in

2015 and is estimated at 24.8 billion pounds cwe in 2017. Brazilian

cattle are generally smaller framed than in the US. Additionally, cattle in

Brazil are largely finished on grass based pasture systems. The

report describes the expected increase in Brazilian beef production into 2017

is underpinned by higher exports, mostly to Asian markets, along with a small

increased in domestic demand due to a recovering economy. However, the report

cautions that cattle producers and packers remain concerned with the price

uncertainty of feed costs, along with the volatility of the exchange rate, as

main factors that could affect margins.

<ブラジル・韓国> 2国間豚肉貿易交渉、近々サンタカタリーナ州産豚肉が韓国輸入解禁に Brazilian-South Korea Pork Export

Negotiations Near End 12

September 2016 BRAZIL

- After years of hard work, Brazilian pork should soon be entering the South

Korean market. Approval

of pork from Santa Catarina by South Korean officials is expected to be

completed in early 2017. Negotiations

for Brazilian pork to enter the South Korean market have been going on for a

decade. <墨・ブラジル> 養鶏業者がブラジルからの無税輸入枠30万トンは国内の養鶏の根幹を壊すと非難 Mexican Poultry Farmers Unhappy

with Brazilian Imports 07

September 2016 MEXICO

- Mexican poultry farmers are concerned about tariff-free imports of poultry

meat from Brazil, suggesting they are undermining the domestic poultry

industry. The chairman

of the board of the National Union of Poultry Farmers, Cesar Quesada

Macías, said that the tariff-free quota of 300 thousand tons of chicken meat

is hurting Mexican poultry farmers, but also is not benefiting consumers in

terms of lower prices. "The

figures worry us, especially since we see a clear upward trend and thus a

free displacement of the national product. US legs and thighs are imported,

and now Brazilian chicken breasts," said Mr Quesada Macías. The

Union suggested that the quota is having a detrimental impact on domestic

employment, production levels and tax revenue, and urged the Ministry of

Economy to remove the quota. Mr Quesada

Macías added that when the quota was implemented, H7N3 highly pathogenic

avian influenza was present in the industry, but he said the crisis has

passed and the Mexican industry is now recovering. <ブラジル> 飼料価格高くても、ブロイラー生産量は2017年も3%増加の見通し Brazil Broiler Production Forecast

to Increase Despite High Feed Prices 06

September 2016 BRAZIL

- Brazil's broiler production is forecast to increase by 3 per cent in 2017,

to 14 million metric tons, according to the latest forecast from the US

Department of Agriculture's Foreign Agricultural Service (FAS). This

increase is mostly driven by higher world demand for the Brazilian product,

especially after the impact of the avian influenza in several countries and

continued increasing broiler exports to China. In addition, domestic demand

for boilers should improve in 2017 as the Brazilian economy is projected to

grow and inflation is likely to be under control. Feed

prices remain as the main constraint for production, due to the lower corn

crop and the volatility of the Brazilian currency. The

second Brazilian corn crop suffered from a longer dry spell which caused a

price surge in corn of more than 88 per cent this year, and prompted the

government to reduce the import tariff for corn from non-Mercosul suppliers,

such as the United States. In addition, the federal government began sales of

corn from public stocks. However, large

packers benefit from lower-priced corn imports and subsidised government bids

from public corn stocks. Independent producers are being more affected

by the shortage of corn than those integrated producers. In general, broiler

producers intensified the use of wheat as an alternative to reduce

high-priced corn. In

addition, competition from beef prices is expected to be more intense, as the

gap between beef and chicken prices narrow, although broilers remain as the

most affordable animal protein in the country. Domestic

consumption of broiler meat in Brazil is expected to rise by 2 per cent, as

economists are beginning to see signs of recovery in the Brazilian economy. <ブラジル> 国の基幹産業の牛肉生産は引続き伸長 Brazil's Beef Sector Continues to

Grow 05

September 2016 BRAZIL

- The livestock production chain generated BRL 483.5 billion (USD 148.47

billion) last year, according to an annual report by the Association of

Brazilian Beef Exporters (Abiec). That's

an increase of 27 per cent over the previous year's levels. According to

Abiec, since the first survey of the series in 2010, there was an increase of

44.7 per cent. The

association adds that livestock's Gross Domestic Product (GDP) accounts for

30 per cent of the GDP of the Brazilian agricultural sector, which, in its

turn, accounts for 21.5 per cent of the country's GDP. In this respect,

livestock's share in Brazil's economy is 6.8 per cent. Within

foreign trade, Brazilian beef exports totalled USD 5.9 billion in 2015, which

accounted for 3 per cent of all of Brazil's foreign sales last year. "In

contrast to the negative wave impacting the majority of the sectors of the

Brazilian economy, agribusiness continues to grow, and beef's industrial

system is one of the most dynamic of the sector," said Abiec's

president, Antônio Jorge Camardelli, in a statement. <世界> ラテンアメリカ最大のレストラン・チェーンのアルシーが2025年までにケージフリー卵に切換え:メキシコ、南米、スペインでチェーン展開 Latin American Restaurant Chain

Alsea Switches to Cage-Free Eggs 30

August 2016 GLOBAL

- Alsea, the largest restaurant operator in Latin America, announced it will

switch to a 100 per cent cage-free eggs throughout its entire supply chain in

Mexico, Latin America and Spain by 2025. Alsea

operates Burger King, Domino’s, Starbucks, VIPs, Chili’s, California Pizza

Kitchen, PF Chang’s, El Porton, Foster’s Hollywood, Pei Wei, Italianni’s and

Cheesecake Factory. This

policy applies to the three thousand units that Alsea operates in Mexico,

Argentina, Chile, Colombia, Brazil and Spain. The

chain made the decision after working with animal welfare organisation Humane

Society International. Alfonso

Tinoco, director of Responsible Consumption at Alsea, stated: “Today’s

announcement proves that Alsea is committed to farm animal welfare, which is

increasingly important to our customers. We are convinced that collaboration

with different key players will make a difference to improve animal

wellness." Most

egg-laying hens in Mexico are housed in battery cages, but a growing number

of companies in Mexico have pledged to switch to a cage-free supply chain,

including Grupo Toks, Sodexo, Eurest, Subway, Grupo Bimbo, and Unilever,

joining more than 200 companies that have done so already in the United

States. <仏・ブラジル> ブルータン病フランスでは発生続き、ブラジルでは動物園の鹿が Bluetongue Outbreaks: French

Outbreaks Continue, Brazilian Zoo Hit 25

August 2016 GLOBAL

- A number of Bluetongue outbreaks have been reported in the last few months,

as outbreaks continue to be detected in France. In

total, France has reported seven new outbreaks of the disease to the World

Organisation for Animal Health since the start of July. Eight cases of the

disease were found in cattle across these outbreaks, which were mainly

detected through surveillance efforts. The

outbreaks, of serotype 8, were mainly detected in southern and central

France. Movement

controls, screening, disinfection and vaccination measures are all in

operation as well as surveillance to try and halt the spread of the disease.

Locations

of two of the outbreaks in Haute-Loire and Saône-et-Loire In

Brazil, two outbreaks were reported recently in a zoo in Parana

province. A deer from the indigenous fauna (Mazama nana), aged

two years, was found dead and haemorrhagic lesions were identified during the

necropsy. Another

deer, which presented clinical signs and pathological injuries consistent

with bluetongue, died three days after the start of its clinical disease.

|