|

アメリカ食肉ニュース |

|

<米> 牛・豚肉の3月の輸出これまでの最高を記録 US Beef Exports Remain Strong 08

May 2017 US

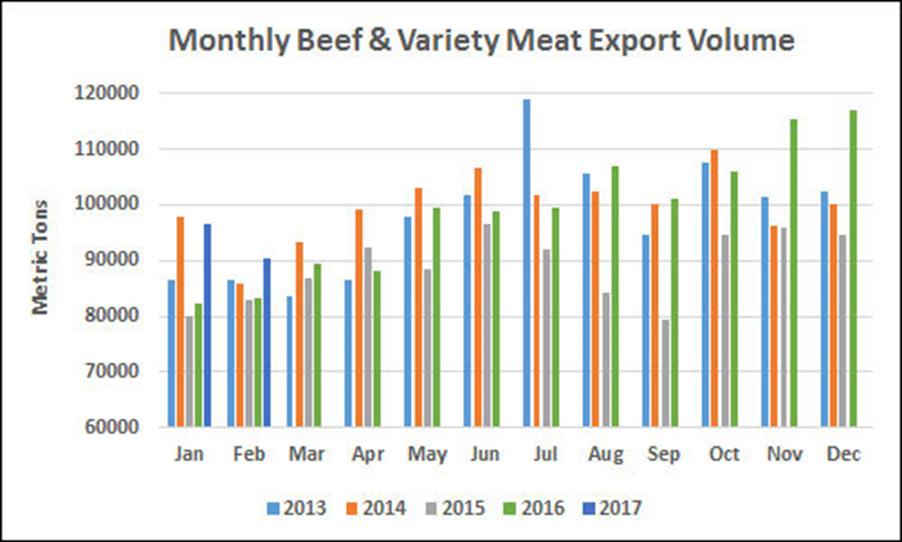

- US pork and beef exports capped a strong first quarter with excellent March

results that included a new record volume for pork, according to statistics released

by USDA and compiled by USMEF. Beef

exports totaled 105,310 mt in March, up 18 per cent year-over-year, with

value increasing 22 per cent to $588.2 million. First-quarter beef exports

were up 15 per cent in volume (292,215 mt) and 19 per cent in value ($1.61

billion). March

exports accounted for 12.5 per cent of total beef production and just under

10 per cent for muscle cuts only, each up slightly from last year. For the

first quarter, the percentage of total beef production exported was down slightly

from a year ago (12.4 per cent vs. 12.5 per cent) despite an increase for

muscle cuts (9.8 per cent vs. 9.4 per cent). Export value per head of fed

slaughter averaged $270.14 in March, up 11 per cent from a year ago, while

the first-quarter average increased 10 per cent to $267.71 per head. “Entering

2017 with record-large pork production and an uptick in beef slaughter, we

knew this ‘wall of US meat’ presented a challenge for our industry,” said

USMEF President and CEO Philip Seng. “So the fact that first-quarter export

volumes are higher than a year ago is not surprising, but it’s important to

look beyond that – to the higher percentage of production being exported and

the strong return on those exports. The US is not just moving more meat

internationally because we have more available. Our products are commanding

solid prices and winning back market share in many key destinations, even

with a strong US dollar and many trade barriers still in place. But our

competitors are working every day to reverse this trend, so we must

aggressively expand and defend our international customer base.”

Beef exports move higher in Asian and North

American markets March

beef exports to Japan increased 41 per cent in volume (28,135 mt) and 39 per cent

in value ($167.7 million). This capped a very strong first quarter in which

exports jumped 41 per cent (to 74,411 mt) and 42 per cent (to $427.3

million), respectively. This included a 55 per cent increase in chilled beef

volume to 33,366 mt, as US beef captured its highest-ever market share in

Japan’s high-value chilled sector. Coming

off a record performance in 2016, beef exports to South Korea posted a very

strong first quarter, with volume up 23 per cent to 42,551 mt and value

increasing 30 per cent to $267.5 million. With US beef continuing to gain

momentum in Korea’s retail and restaurant sectors, first-quarter chilled beef

exports were up 78 per cent to 8,508 mt. Other

first-quarter highlights (compared to year-ago levels) for US beef included: ·

Exports to Mexico posted a solid

increase in volume (57,057 mt, up 17 per cent), while value increased 3 per

cent to $226.8 million. An important destination for shoulder clods, rounds

and other beef end cuts, muscle cut exports to Mexico expanded at an even

faster pace, climbing 23 per cent in volume (30,015 mt) and 11 per cent in

value ($175.1 million). ·

Despite a recent slump in the

value of the Canadian dollar, beef exports to Canada have rebounded in 2017,

with solid increases in both volume (29,909 mt, up 14 per cent) and value

($190.5 million, up 19 per cent). ·

In Taiwan, where US beef captures

more than two-thirds per cent of the chilled beef market, exports increased

28 per cent in volume to 9,746 mt and 29 per cent in value to $85.7 million.

This included a 10 per cent increase in chilled beef volume to 3,650 mt. ·

Beef exports to South America were

down 2 per cent in volume (4,919 mt) but increased 16 per cent in value ($23

million), bolstered by a strong performance in Colombia and a recent rebound

in Peru. This week USDA also confirmed the arrival of the first US beef

shipments to Brazil since a BSE-related suspension was imposed more than 13

years ago. The first significant export volumes for Brazil will likely appear

in the May USDA data, which will be available in early July. ·

March exports to South Africa

(1,107 mt) were the highest since the market opened last year, making it the

month’s 10th largest volume destination for US beef. For the first quarter,

South Africa ranked 11th at 1,971 mt. Export value was $1.5 million, with

most of the volume being beef livers. TheCattleSite

News Desk <米> 3月の牛肉輸出がこれまで最高に CME: Largest Monthly Beef Export

Volume Witnessed in March 08

May 2017 US

- US red meat and poultry exports were explosive in March, with both export

volume and revenue up in double digits compared to year ago levels, reports

Steiner Consulting Group, DLR Division, Inc. Below

is a brief summary of the highlights for each species. Keep in mind that the

export volume data is in metric ton, product weight basis. USDA/ERS issued

its calculations on a carcass weight basis, which will allow us to better

compare with the monthly production numbers and implied domestic availability. US

meat supplies have expanded rapidly but a significant portion of that growth

went to feed the rest of the world. It is good news for US producers and

something that domestic buyers need to consider in their planning decisions.

The spike in fed cattle values this spring is a reminder of the risks of

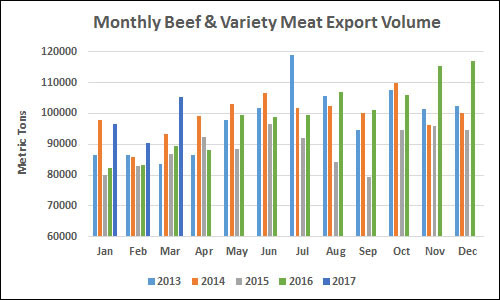

staying short bought going into the biggest grilling weekend of the year. Beef:

Exports of fresh, frozen or cooked beef and veal in March were 77,743 MT,

15,407 MT (+24.7 per cent) higher than a year ago. This was the largest

monthly beef export volume since June 2014. We think this is evidence that it

was a combination of both domestic and export demand which pushed beef

packers to ramp up slaughter during the first quarter. Beef export revenue

(excluding variety meats) was $510.8 million, almost $100 million (+24.2 per

cent) higher than last year. The value of beef shipped in March was not much

different than a year ago, implying that it was the increase in availability

rather than a cheaper price that drove exports. The two biggest contributors

to the growth in beef exports were Japan and S. Korea. Lower slaughter and

higher prices for Australian/New Zealand beef supported US beef exports to

these markets. Beef and veal exports to Japan in March were 23,222 MT, 43 per

cent higher than a year ago. Exports to South Korea at 13,052 MT were 27 per

cent higher than last year.

Pork: Weekly

export data suggested that pork exports in March would be large and indeed

they were. Total shipments of fresh, frozen and cooked pork for the month

were 176,574 MT, 22,671 MT (+15 per cent) higher than a year ago. This was

another all time record monthly volume, surpassing the record amount that was

shipped in November 2016. We will wait for the carcass weight data but it is

likely that the percentage of pork exports relative to national production

was the largest ever as well. Even more encouraging is that the value of pork

exported increased by more than volume shipped, evidence of excellent demand

for US pork. Export revenue in March was $483.4 million, $78.7 million (+19

per cent) higher than a year ago. This was only for pork meat products. The value

of pork variety meat in March was $79.7 million, a whopping $22.2 million

(+39 per cent) higher than last year. The combined value of pork and pork

variety meat exports in March increased by more than $100 million. FI hog

slaughter in March was 10.6 million head and the $100 million increase in

export value contributed about $10 per head of hog processed. Some of this

went into higher packer margins but some of it also helped bolster the price

the packer paid for hogs during that period. Net hog prices in March averaged

around $71/cwt, substantially more than earlier expected. We think this was

in part due to the very robust pork export demand.

Broilers:

Exports of fresh/frozen broiler meat in March were 269,744 MT, 29,485 MT (+11

per cent) higher than a year ago. One of the biggest growth markets in March

was Cuba, with exports there up 12,517 MT (+58 per cent).

TheCattleSite

News Desk <米> カーギル社がコロラド州の残りのフィードロットを売却 Cargill to Sell Remaining Cattle

Feed Yards in Colorado, Kansas 01

May 2017 US

- Cargill has reached an agreement to sell its beef cattle feed yards at

Leoti, Kansas, and Yuma, Colorado, to Omaha-based Green Plains Inc., a

vertically integrated ethanol producer with existing feed yards at Kismet,

Kansas, and Hereford, Texas. The transaction will be finalized once a

definitive agreement and regulatory review are complete. Green

Plains will supply cattle to Cargill through a new multiyear agreement. The

approximately 90 people currently employed at Cargill’s Colorado and Kansas

feed yards will be offered positions with Green Plains. The feed yards being

sold have a capacity of approximately 155,000 cattle at any point in time. “Selling

our two remaining feed yards aligns with our protein growth focus by allowing

us to redeploy working capital away from cattle feeding operations to other

investments,” said John Keating, president of Cargill’s Wichita-based protein

business operations and supply chain. “By

partnering with Green Plains in a multiyear supply agreement, the Yuma and

Leoti yards will continue to supply cattle to our beef processing facilities

at Fort Morgan, Coloradoi, and Dodge City, Kansas, ensuring consistent

high-quality beef products for our customers.” Over

the past two years, Cargill has announced approximately $560 million in

acquisitions and capital investments to grow its North American protein

business. “We

are committed to being the leading protein provider that nourishes people,

animals and the planet in a safe, responsible and sustainable way while

exceeding the expectations of our customers,” added Mr Keating. “We

have great positive growth momentum and are confident it will continue to

accelerate as we continue to help our customers’ and suppliers’ businesses,

communities and colleagues thrive,” he concluded. TheCattleSite

News Desk <米> トランプ政権がナフタ脱退を決定、米国農業会連合はこれを歓迎 Trump Administration Improves

NAFTA; Decision Pleases Farm Bureau 01

May 2017 US

- The Trump administration has decided to pursue renegotiation over its withdrawal

from the North American Free Trade Agreement (NAFTA). The

American Farm Bureau Federation has thanked the Trump administration this

decision. AFBF President Zippy Duvall expressed his gratitude last week. In

his letter, Mr Duvall wrote: "Thank you for your recent decision to

choose the path of renegotiation for the North American Free Trade Agreement,

rather than withdrawal. Your leadership in reaching out to President Enrique

Peña Nieto of Mexico and Prime Minister Justin Trudeau of Canada began an

important step to finding a path forward for updating this important

agreement. "There

are compelling reasons to update and reform NAFTA from agriculture’s

perspective, including improvements on biotechnology, sanitary and

phytosanitary measures, and geographic indicators. As you know, overall,

NAFTA has been overwhelmingly beneficial for farmers, ranchers and associated

businesses all across the United States, Canada and Mexico for decades.

Walking away from those gains would have been a severe blow to the

agricultural sector and we appreciate the path that will allow for reform and

enhancement, rather than abandonment of past achievements. "The

NAFTA modernization effort should recognize and build upon the strong gains

achieved by US agriculture through tariff elimination, harmonization—or

recognition of equivalency—of numerous regulatory issues, and development of

integrated supply chains that have arisen due to the agreement. With NAFTA,

US farmers and ranchers across the nation have benefited from an increase in

annual exports to Mexico and Canada, which have gone from $8.9 billion in

1993 to $38 billion in 2016. We strongly caution against any actions that

would lead to a re-imposition of tariffs or other barriers to agricultural

trade with our NAFTA partners. "Trade

is critical to the livelihood of the US agricultural sector because it spurs

economic growth for our farmers, ranchers and their rural communities.

Agriculture supports jobs in the food and agricultural industries and beyond.

The fact is, 95 per cent of the world’s consumers live outside of the United

States and over 20 per cent of US farm income is based on exports. "Expanding

opportunities for US crop and livestock producers to access international

markets will boost farm income in the United States. Just as important as

expansion, we need your engagement on behalf of agriculture to protect our

current access to foreign markets, which amounts to $134 billion annually. "Existing

trade agreements have proved successful in tearing down tariff and non-tariff

trade barriers that hinder US farmers’ and ranchers’ competitiveness and

prevent us from taking advantage of consumer demand for high-quality US food

and agricultural products throughout the world. "Trade

agreements also provide the highest standard of trade rules, allowing the

United States to lead in setting the foundation to establish market-driven

and science-based terms of trade and dispute resolution that will directly

benefit the US food and agriculture industry. If we surrender the lead, we

will fall behind as our competitors aggressively work to establish

alternative trade agreements that give their agricultural interests an

advantage over our own. "There

are numerous areas in agriculture alone where the agreement can be

modernized, ranging from the handling of wheat to dairy issues, from animal

health certifications to transparency on agricultural biotechnology. We look

forward to working with the administration in developing the full list of

topics for discussion. "As

farm income continues to fall to its lowest level since 2009, we urge your

immediate attention both to securing and to maintaining solid and fair trade

agreements that bring the benefits of agricultural trade to our struggling

farm economy." TheCattleSite

News Desk <米> 冷凍牛肉在庫数量が減少 CME: USDA Report Highlights

Decline in Frozen Beef Inventories 26

April 2017 US

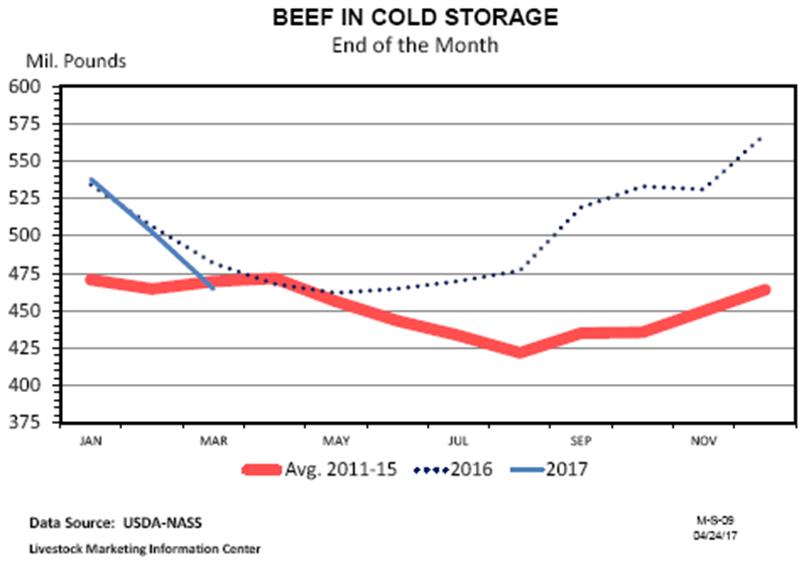

- The highlight of the USDA-NASS (National Agriculture Statistic Service)

"Cold Storage" report released 24 April was the decline in frozen

beef inventories, reports Steiner Consulting Group, DLR Division, Inc. Total

beef in cold storage declined 38 million pounds from the start of the month.

Frozen beef inventories in March 2003 registered a similar decline, but no

other March going back to the 1970s shows a decline as big as this March.

Frozen boneless beef inventories were reduced by 40 million pounds this

March, setting a record for a decline during this month. In March 2003, boneless

beef inventories were reduced 35 million pounds. Compared to a year earlier,

frozen beef stocks were down 4 per cent, with boneless product stocks down 5

per cent.

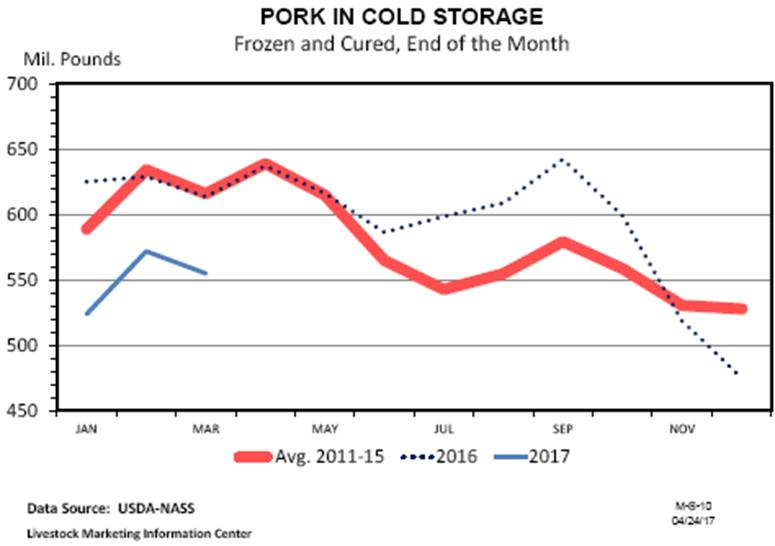

Frozen

pork inventory at the end of March was down 10 per cent from a year earlier,

a 17 million pound reduction over the course of the month. The decline was

similar to trends in March during 2015 and 2016. Pork belly stocks at the end

of March increased by 4 million pounds to 20.5 million pounds, but this was

still down 68 per cent from a year earlier. Frozen ham inventories at the end

of March were down 6 per cent from a year ago, but boneless ham stocks were

up 4 per cent. Bone-in ham stocks during March declined 21 million pounds,

the biggest March decline in at least 20 years.

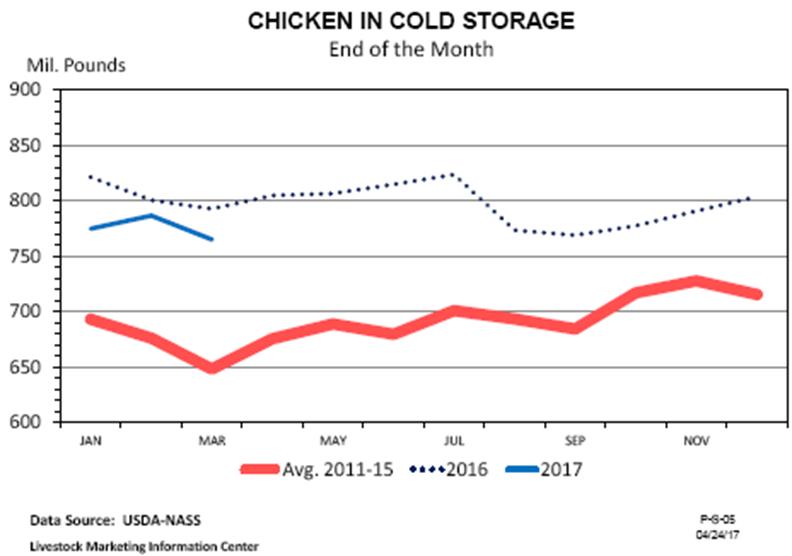

End

of March frozen chicken inventory was down 3 per cent from twelve months

earlier. Frozen chicken inventories declined 21 million pounds during March

with most of the decline accounted for by breast and wing product. Leg

quarter freezer holdings were close to unchanged over the course of the

month. Wholesale breast meat prices, basis the NE US market, averaged

$1.26 in March, up 17 cents from February, encouraging the out-movement of

product from freezers. Last year, breast meat prices were unchanged from

February to March and frozen breast product inventories increased two million

pounds. Frozen chicken inventories are still high relative to historical

norms, which will be a factor limiting industry production expansion

prospects.

TheCattleSite

News Desk <米> 牛枝肉重量の減少がより顕著に CME: Decline in Cattle Weights

More Significant in 2017 24

April 2017 US

- Cattle and hog weights have been trending in opposite directions in the

last few weeks. Some of this is seasonal but it also may reflect some of the short-term

supply issues in both markets, reports Steiner Consulting Group, DLR

Division, Inc. USDA

reported that for the week ending 8 April the average dressed carcass, this

is both fed and non-fed cattle, was 802 pounds. This is 20 pounds lighter

(-2.4 per cent) than a year ago and 22 pounds lighter than the five year

average.

Cattle

weights normally decline into the spring but the decline this year has been

more significant than usual. The five year average carcass for all cattle at

the start of the year was around 810 pounds per carcass and by the end of

April the five year average stands at 794 pounds, a 2 per cent decline. This

year carcass weights in early January stood at an average 837 pounds and

since then have declined 4.2 per cent, more than double the five year average

rate. The decline in fed cattle carcass weights has been even more dramatic

and has been the primary contributor for the weight reduction. The

average fed steer carcass weight for the latest reported week was 852 pounds,

28 pounds (-3.2 per cent) lower than a year ago and now about 6 pounds less

than the five year average. The five year average decline for steer weights

between early January and the end of April is around 3.4 per cent. So

far we are down 5.8 per cent for the year and it is very likely we will see

further declines in weights through the end of this month. At this point it

looks possible that steer weights may eventually get as low as 840-845 by

early-May before starting their seasonal upswing. Heifer

weights have declined just as sharply this year. Keep in mind that heifers

are smaller than steers. An increase in the percentage of heifers in the

slaughter mix (keep an eye on this in the Cattle on Feed report) will

also tend to lower overall cattle carcass weights. The average weight of

heifers in the latest report was pegged at 792 pounds, 26 pounds (-3.2 per

cent) lower than last year. The

implication of the lower weights is both direct and indirect. Lower weights

will subtract from beef production. While fed cattle slaughter for the week

of 8 April was around 6 per cent higher than the previous year, fed beef

production for the week likely increased by less than 3 per cent from the

previous year. And

with robust exports and less imports coming in, the amount of beef available

to the domestic user likely was less than a year ago. The indirect

implication of the fed cattle weights has to do with the supply conditions in

the feedyards. The

sharp decline in weights indicates that feedlots are much more current than a

year ago and also more current than normal. A current yard does wonders for

the testicular fortitude of a feedlot operator. TheCattleSite

News Desk <米> 牛肉の国内・輸出需要が上昇中で、肥育日数が減少 CME: Beef Demand from Domestic,

Export Interests on the Upswing 10

May 2017 US

- Beef demand from both domestic and export interests has been on the upswing

since late last year and cattle feeders have not been shy about exploiting

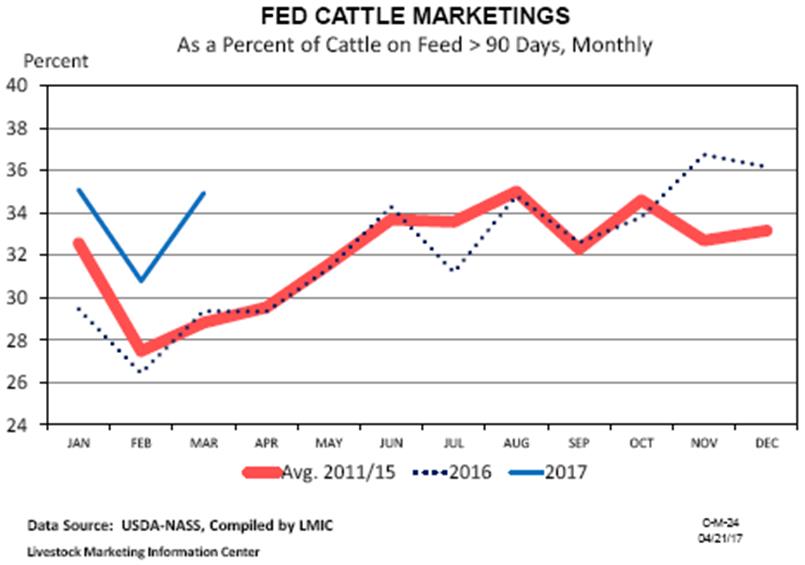

the situation, reports Steiner Consulting Group, DLR Division, Inc. Feedlot

marketing rates, as defined by monthly feedlot marketing volumes relative to

feedlot inventories on hand longer than 90 days moved above the five year

average last November. The accelerated marketing pace has remained intact

ever since, leading to bigger drawdowns in market-ready slaughter cattle

inventories (see following graph).

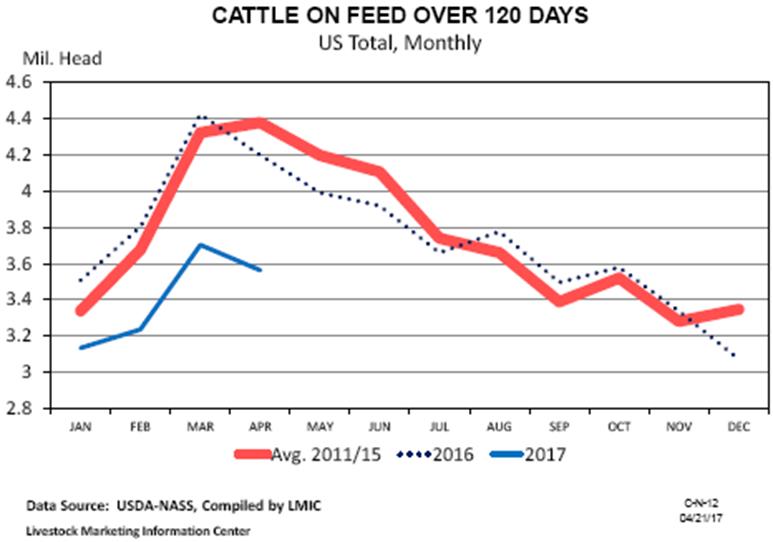

Feedlot

inventories of cattle on feed over 120 days (in feedlots with 1000+head

capacities sampled by USDA-National Agriculture Statistics Service (NASS) on

1 April were at the lowest levels in ten years. Actual

daily slaughter data for steers and heifers during the first two-thirds of

April, which is a good indicator of feedlot marketings during a month was up

2 per cent from last year. A

preliminary bead on April placements using weekly feeder cattle auction data

from USDA-Agriculture Marketing Service suggests a 2 per cent gain from last

year, although total feeder cattle receipts (including direct and

video/internet markets) points higher by maybe as much as 10 per cent. An

adjustment also needs to be made for one less work day this April than in

April 2016. Combining these numbers with an allowance for normal other

disappearance from feedlots during April gives a projected 1 May feedlot

inventory close to unchanged from a year earlier. This

exercise translates into April feedlot marketing rates that are as impressive

as prior months. In March, feedlot marketings as a per cent of cattle on feed

longer than 120 days was 55 per cent. The

prior high during the last ten years was in 2011 at 49 per cent. The

prospective marketing rate for April would be 52 per cent. The

prior peak marketing rate during the past ten years was 49 per cent in 2014.

Under this scenario, inventories of cattle on feed over 120 days declines by

1 per cent from the prior month and is down 11 per cent from a year earlier. Feedlot

inventories on feed longer than 90 days would be down 4 per cent from a year

earlier but up 170,000 head from a month earlier. Over the course of

2007-2016, 90 day feedlot inventories averaged a 45,000 head decline during

April. The

1 May 90-day cattle inventory change from a year ago of 4 per cent compares

with a 6 per cent decline on 1 April.

The

trend that could possibly be starting to surface in 90 day feedlot

inventories would flow through to similar developments for 120 day feedlot

inventories (i.e. slaughter-ready cattle) by late spring and summer. This

is a normal seasonal trend for the feedlot industry. The discount between the

spot choice cattle price and live cattle futures values should work to

encourage beef demand to accommodate the increasing supply of cattle. TheCattleSite News Desk <米> 牛肉輸出20%増、輸入17%減少 CME: Beef Export Tonnage Up 20%,

Imports Down 17% 11

April 2017 US

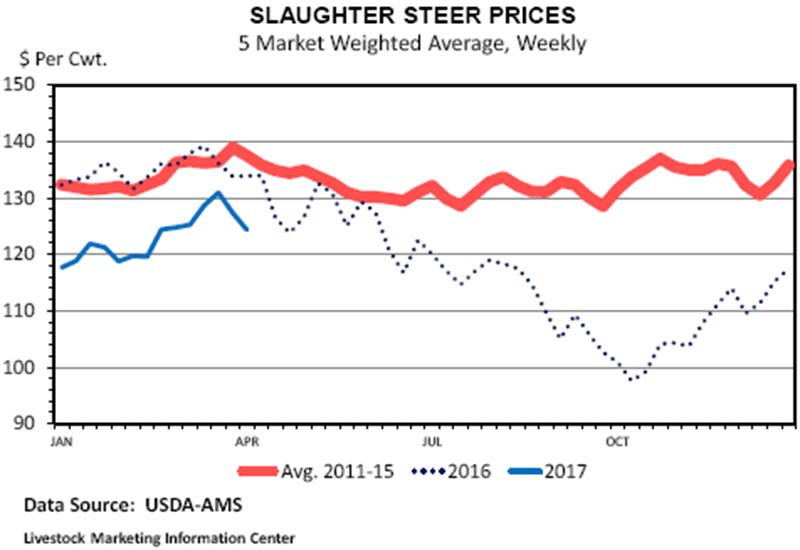

- To explain cattle prices during the first quarter of this year in terms of

fundamental market forces, we need to look at both seasonal (e.g. key changes

compared to the fourth quarter of 2016) and also year-over-year market supply

and demand aspects, write Steiner Consulting Group, DLR Division, Inc. From

January into late March of this year cattle prices generally increased, which

is a rather normal seasonal occurrence. Still, cattle prices for the first quarter

were the lowest for the first three months of any year since 2011. Two

key seasonal factors came together to raise fed cattle prices during the

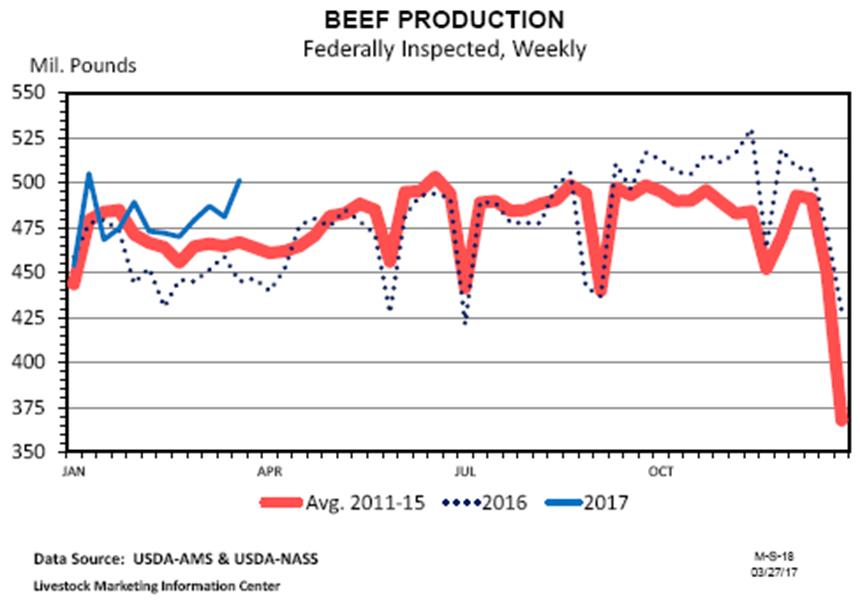

first quarter of this year: 1.

Seasonally smaller beef production

(data are reported by USDA’s National Agricultural Statistics Service).

Comparing 2017’s first quarter commercial beef production with the fourth

quarter of 2016 the drop was a rather normal 4.9 per cent. That same

comparison for a year ago (first quarter of 2016 versus 2015’s fourth

quarter) the decline was only 2.9 per cent. As a baseline, the prior 10-year

average was down 4.5 per cent. 2.

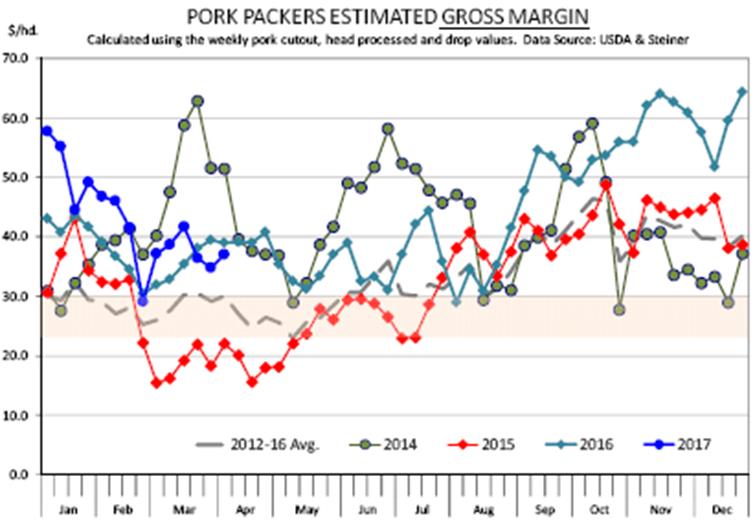

Seasonally lower packer gross

margins. From setting record high monthly levels in much of 2016, the

calculated margin, that is the live-to-cutout price spread (including the

byproduct value), declined significantly quarter-over-quarter. That margin

returned to historical levels in early 2017. On

a year-over-year basis, the change in US net trade balance was a key market

factor. That is, US beef exports were higher year-over-year and imports

dropped. The exact numbers were not available at the time this article was

written. Actual data compiled and released by the USDA’s Foreign Agriculture

Service were available through February. For the January-February timeframe,

compared to a year earlier, beef export tonnage increased 20 per cent, while

imports fell by 17 per cent. Projected

US commercial cattle slaughter for the first quarter was 7.7 million head,

the largest for the quarter since 2012’s. That was a 7.3 per cent increase

compared to January-March of 2016. Compared to a year ago, average dressed

weight was down 1.1 per cent. So, US beef production was 6.1 per cent above a

year earlier. Importantly, due to a year-over-year increase in beef export

tonnage and a decline in imports, US per capita beef disappearance (based on

preliminary data) only increased about 1.2 per cent for the first quarter. Fed

steers, using the 5-market average price reported by USDA’s Market News

Division of the Agricultural Marketing Service (USDA-AMS) averaged $122.97

per cwt. in this year’s first quarter. That was, down 8.8 per cent from a

year ago. However, compared to the depressed levels of the 2016’s fourth

quarter, of 2016, fed cattle prices during January-March averaged were over $15.00

per cwt. higher (up 14.2 per cent).

Yearling

and calf prices were supported by higher fed cattle prices and the associated

rebound, finally, of cattle feeding returns back into the black. For the

first quarter of 2017, the Livestock Marketing Information Center (LMIC)

calculations put estimated cattle feeding returns at the highest average for

any calendar year since the last quarter of 2003. In

the Southern Plains, for 2017’s first quarter, USDA-AMS reports showed that

steers weighing 700-to 800-pounds and 500-to 600-pounds averaged $132.88 per

cwt. and $157.38, respectively. Yearling and calf prices were below a year

ago (down $27.18 per cwt. for 700-to 800-pound steers and dropping $38.35 for

500-to 600-pound steer calves). As with fed cattle, yearling and calf prices

increased compared to late 2016’s, rising quarter-over-quarter by $3.81 (up

3.0 per cent) for steers weighing 700-to 800-pounds and up $18.94 per cwt.

(increasing 13.7 per cent) for 500-to 600-pound animals. TheCattleSite

News Desk <米> 2月も牛肉・豚肉とも輸出は好調 Continued Strong Pace for US Beef

Exports in February 11

April 2017 US

- February results for US pork and beef exports were well above year-ago

levels, with pork exports posting the strongest February volume on record,

according to statistics released by USDA and compiled by USMEF. Beef

exports totaled 90,417 mt in February, up 9 per cent year-over-year, with

value up 16 per cent to $508.5 million. Through February, beef exports were

up 13 per cent in volume (186,905 mt) and 17 per cent in value ($1.02 billion). February

exports accounted for 12.6 per cent of total beef production and 10.1 per

cent for muscle cuts only, which was steady with last year. January-February

ratios were also fairly steady at 12.4 per cent and 9.8 per cent,

respectively. Export value per head of fed slaughter averaged $276.96 in

February, up 13 per cent from a year ago, while the January-February average

was up 10 per cent to $266.34 per head. “With

trade deficits being a hot topic of conversation, especially with countries

such as Mexico, China and Japan, it’s important to highlight the sectors in

which US products are competitive throughout the world and exports are

thriving,” said USMEF President and CEO Philip Seng. “The red meat sector is

certainly in that category, as exports have helped fuel growth in the US

industry and, in turn, larger US production has opened further export

opportunities and generated positive returns for the entire supply chain.” Chilled

beef to Japan, Korea and Taiwan continues to drive export growth Japan

continued to solidify its position as the leading volume and value market for

US beef, with February exports climbing 48 per cent from a year ago in volume

(23,789 mt) and 55 per cent in value ($134.3 million). Through February,

exports to Japan were up 41 per cent in volume (46,276 mt) and 44 per cent in

value ($259.6 million). This included a 60 per cent increase in chilled beef

volume to 19,404 mt. Japanese import data showed that US beef overtook

Australian beef in the first two months of the year, with US market share

climbing to 45.6 per cent while Australia’s dropped to 44 per cent. Strong

momentum continued for US beef in Korea, where February exports increased 11

per cent to 13,093 mt valued at $86 million (up 26 per cent). This pushed the

two-month totals up 23 per cent in volume (28,287 mt) and 31 per cent in

value ($177.6 million). Chilled exports through February were up 95 per cent

to 5,384 mt. In

Taiwan, February exports jumped 33 per cent from a year ago to 2,886 mt,

while value increased 26 per cent to $25.3 million. Through February, exports

were up 28 per cent in volume (6,477 mt) and 25 per cent in value ($55.1

million). US beef holds 70 per cent of the chilled beef market in Taiwan, the

highest of any Asian market. Through February, chilled exports to Taiwan

increased 12 per cent to 2,479 mt.

Other

highlights for US beef included: ·

Exports within North America are off

to a solid start in 2017, with January-February exports to Mexico increasing

14 per cent from a year ago in volume (36,235 mt) and 3 per cent in value

($147.4 million). Exports to Canada are showing signs of a rebound, with

volume up 11 per cent to 19,446 mt and value up 18 per cent to $123.5

million. ·

Beef exports to two key South

American markets increased significantly in value through February, with

exports to Chile up 22 per cent year-over-year to $8.9 million and exports to

Peru up 68 per cent to $4.3 million. The increase in Chile was achieved

despite a 16 per cent decline in volume (1,417 mt) while volume to Peru was

up 16 per cent to 1,130 mt. ·

A rebound in the Philippines and

continued growth in Vietnam pushed January-February beef exports to the ASEAN

region up 33 per cent in volume (4,774 mt) and 19 per cent in value ($27.3

million). Exports to Indonesia, which set a value record of $39.4 million

last year, are off to a slow start in 2017 with value through February down

48 per cent to $3.5 million. ·

Strong growth to most Asian

markets helped offset a slowdown to Hong Kong, where January-February volume

was down 21 per cent to 16,131 mt, valued at $104.7 million (down 12 per

cent). TheCattleSite

News Desk <米> 豚屠畜頭数は昨年比6.8%のアップ CME: Hog Slaughter During W14 Up

6.8% Compared to Previous Year 11

April 2017 US

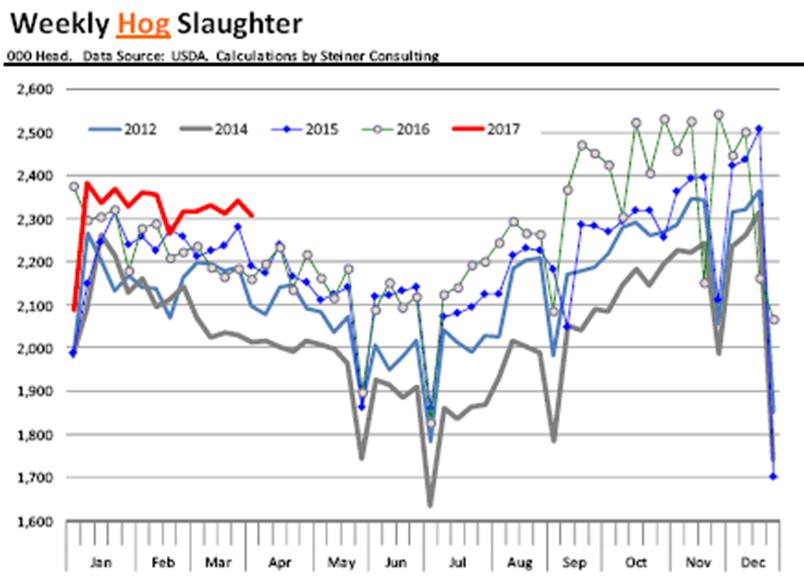

- Hog slaughter for week ending 8 April was 2.301 million head, 6.8 per cent

higher than the same week a year ago, according to Steiner Consulting Group,

DLR Division, Inc. This

is the sixth consecutive week that hog slaughter has surpassed 2.3 million

head and since the start of March hog slaughter has averaged almost 6 per

cent above year ago and slightly above the levels indicated by the 1 March

Hog Inventory survey.

Pork

production last week was 489.7 million pounds, 6.2 per cent higher than a

year ago. In the last four reported weeks, pork production was a total 1.973 billion

pounds, almost 120 million pounds (+6.4 per cent) more than the previous

year. While

pork exports were excellent in the first three months of the year, it has not

been enough in our view to absorb the bulk of this increase. More pork has

had to go through domestic channels, which in turn has kept prices in check

even as demand generally starts to improve into the spring. Also

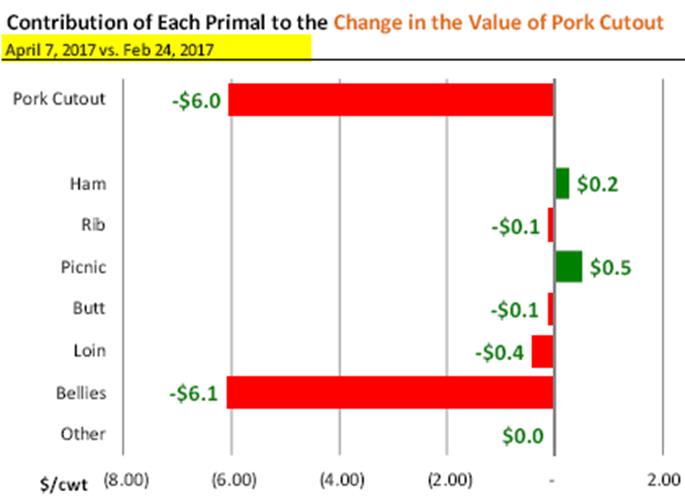

we think the sharp spike in the value of pork bellies earlier in the year

negatively impacted retail features for the spring and we are now seeing that

playing out. The following chart illustrates the effect that the change in

the value of various primal has on the overall value of the cutout.

On

Friday USDA quoted the value of pork cutout (a weighted average price of all

pork cuts sold) at $75.28/cwt, $6/cwt or 7.4 per cent lower than where prices

were at the end of February. What accounts for that decline? All of it is due

to lower pork belly prices. The

value of the belly primal on Friday was quoted at $122.72/cwt, $38/cwt (-24

per cent) since late February. Since the belly primal accounts for about 16

per cent of the total carcass, the decline in belly prices has subtracted a

little over $6/cwt from the cutout value. Interestingly,

prices for other items have been fairly steady since then and also relatively

steady compared to a year ago. Indeed, the comparisons to a year ago are

quite telling considering the large supplies coming to market . The

loin primal on Friday was $75.47/cwt, 2 per cent lower than a year ago while

the ham primal at $55.74/cwt is actually 2 per cent higher than what it was

last year. Also positive for the pork market so far has been the performance

of pork trimmings and picnics. Both

lean and fat pork trim prices have been above year ago levels to this point,

an indication of still very robust demand for hot dogs, sausages and other

such items. The

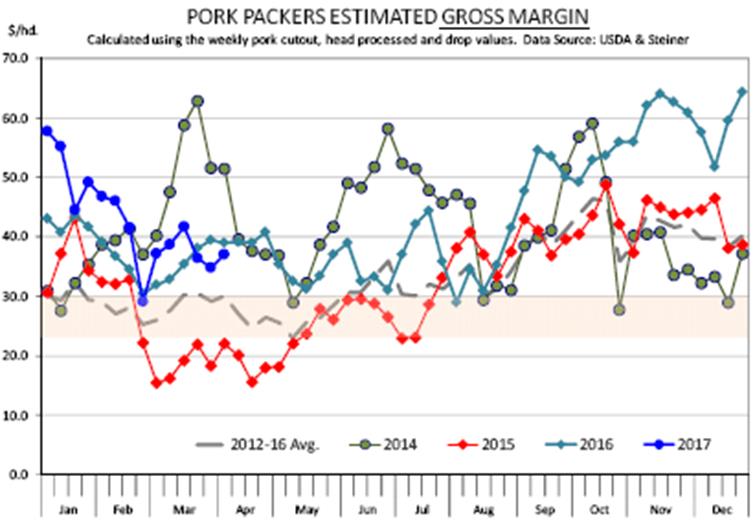

erosion in the value of the pork cutout since late February has negatively

impacted packer margins but, in our view, at $37/cwt they still remain in

positive territory. Discussion of margins always goes to the assumptions

about operating costs but the gross margin calculations show packer margins

at this point are almost as good as they were last year and above what we see

as needed to break even (between $25-$30 per head). As

a result, packers continue to push as many hogs through as they can, with

slaughter last Tuesday at 449,000 head. Slaughter should be near full

capacity during this week but we expect a smaller slaughter next Monday

because of Easter celebrations.

Last

year Easter Sunday was on 27 March and the following Monday hog slaughter was

298,000 head, down from around 434,000 that would have been a normal level.

We suspect a shortfall of a similar amount again next Monday but most of it

likely will be made up on Saturday. The net effect of the holiday will likely

be limited in terms of the weekly slaughter.

ThePigSite

News Desk <米> 牛肉輸出20%増、輸入17%減少 CME: Beef Export Tonnage Up 20%,

Imports Down 17% 11

April 2017 US

- To explain cattle prices during the first quarter of this year in terms of

fundamental market forces, we need to look at both seasonal (e.g. key changes

compared to the fourth quarter of 2016) and also year-over-year market supply

and demand aspects, write Steiner Consulting Group, DLR Division, Inc. From

January into late March of this year cattle prices generally increased, which

is a rather normal seasonal occurrence. Still, cattle prices for the first

quarter were the lowest for the first three months of any year since 2011. Two

key seasonal factors came together to raise fed cattle prices during the

first quarter of this year: 3.

Seasonally smaller beef production

(data are reported by USDA’s National Agricultural Statistics Service). Comparing

2017’s first quarter commercial beef production with the fourth quarter of

2016 the drop was a rather normal 4.9 per cent. That same comparison for a

year ago (first quarter of 2016 versus 2015’s fourth quarter) the decline was

only 2.9 per cent. As a baseline, the prior 10-year average was down 4.5 per

cent. 4.

Seasonally lower packer gross

margins. From setting record high monthly levels in much of 2016, the

calculated margin, that is the live-to-cutout price spread (including the

byproduct value), declined significantly quarter-over-quarter. That margin

returned to historical levels in early 2017. On

a year-over-year basis, the change in US net trade balance was a key market

factor. That is, US beef exports were higher year-over-year and imports

dropped. The exact numbers were not available at the time this article was

written. Actual data compiled and released by the USDA’s Foreign Agriculture

Service were available through February. For the January-February timeframe,

compared to a year earlier, beef export tonnage increased 20 per cent, while

imports fell by 17 per cent. Projected

US commercial cattle slaughter for the first quarter was 7.7 million head,

the largest for the quarter since 2012’s. That was a 7.3 per cent increase

compared to January-March of 2016. Compared to a year ago, average dressed

weight was down 1.1 per cent. So, US beef production was 6.1 per cent above a

year earlier. Importantly, due to a year-over-year increase in beef export

tonnage and a decline in imports, US per capita beef disappearance (based on

preliminary data) only increased about 1.2 per cent for the first quarter. Fed

steers, using the 5-market average price reported by USDA’s Market News

Division of the Agricultural Marketing Service (USDA-AMS) averaged $122.97

per cwt. in this year’s first quarter. That was, down 8.8 per cent from a

year ago. However, compared to the depressed levels of the 2016’s fourth

quarter, of 2016, fed cattle prices during January-March averaged were over

$15.00 per cwt. higher (up 14.2 per cent).

Yearling

and calf prices were supported by higher fed cattle prices and the associated

rebound, finally, of cattle feeding returns back into the black. For the first

quarter of 2017, the Livestock Marketing Information Center (LMIC)

calculations put estimated cattle feeding returns at the highest average for

any calendar year since the last quarter of 2003. In

the Southern Plains, for 2017’s first quarter, USDA-AMS reports showed that

steers weighing 700-to 800-pounds and 500-to 600-pounds averaged $132.88 per

cwt. and $157.38, respectively. Yearling and calf prices were below a year

ago (down $27.18 per cwt. for 700-to 800-pound steers and dropping $38.35 for

500-to 600-pound steer calves). As with fed cattle, yearling and calf prices

increased compared to late 2016’s, rising quarter-over-quarter by $3.81 (up

3.0 per cent) for steers weighing 700-to 800-pounds and up $18.94 per cwt.

(increasing 13.7 per cent) for 500-to 600-pound animals. TheCattleSite

News Desk <米> 2月も牛肉・豚肉とも輸出は好調 Continued Strong Pace for US Beef

Exports in February 11

April 2017 US

- February results for US pork and beef exports were well above year-ago

levels, with pork exports posting the strongest February volume on record,

according to statistics released by USDA and compiled by USMEF. Beef

exports totaled 90,417 mt in February, up 9 per cent year-over-year, with

value up 16 per cent to $508.5 million. Through February, beef exports were

up 13 per cent in volume (186,905 mt) and 17 per cent in value ($1.02

billion). February

exports accounted for 12.6 per cent of total beef production and 10.1 per

cent for muscle cuts only, which was steady with last year. January-February

ratios were also fairly steady at 12.4 per cent and 9.8 per cent,

respectively. Export value per head of fed slaughter averaged $276.96 in

February, up 13 per cent from a year ago, while the January-February average

was up 10 per cent to $266.34 per head. “With

trade deficits being a hot topic of conversation, especially with countries

such as Mexico, China and Japan, it’s important to highlight the sectors in

which US products are competitive throughout the world and exports are

thriving,” said USMEF President and CEO Philip Seng. “The red meat sector is

certainly in that category, as exports have helped fuel growth in the US

industry and, in turn, larger US production has opened further export

opportunities and generated positive returns for the entire supply chain.” Chilled

beef to Japan, Korea and Taiwan continues to drive export growth Japan

continued to solidify its position as the leading volume and value market for

US beef, with February exports climbing 48 per cent from a year ago in volume

(23,789 mt) and 55 per cent in value ($134.3 million). Through February,

exports to Japan were up 41 per cent in volume (46,276 mt) and 44 per cent in

value ($259.6 million). This included a 60 per cent increase in chilled beef

volume to 19,404 mt. Japanese import data showed that US beef overtook

Australian beef in the first two months of the year, with US market share

climbing to 45.6 per cent while Australia’s dropped to 44 per cent. Strong

momentum continued for US beef in Korea, where February exports increased 11

per cent to 13,093 mt valued at $86 million (up 26 per cent). This pushed the

two-month totals up 23 per cent in volume (28,287 mt) and 31 per cent in

value ($177.6 million). Chilled exports through February were up 95 per cent

to 5,384 mt. In

Taiwan, February exports jumped 33 per cent from a year ago to 2,886 mt,

while value increased 26 per cent to $25.3 million. Through February, exports

were up 28 per cent in volume (6,477 mt) and 25 per cent in value ($55.1

million). US beef holds 70 per cent of the chilled beef market in Taiwan, the

highest of any Asian market. Through February, chilled exports to Taiwan

increased 12 per cent to 2,479 mt.

Other

highlights for US beef included: ·

Exports within North America are

off to a solid start in 2017, with January-February exports to Mexico increasing

14 per cent from a year ago in volume (36,235 mt) and 3 per cent in value

($147.4 million). Exports to Canada are showing signs of a rebound, with

volume up 11 per cent to 19,446 mt and value up 18 per cent to $123.5

million. ·

Beef exports to two key South

American markets increased significantly in value through February, with

exports to Chile up 22 per cent year-over-year to $8.9 million and exports to

Peru up 68 per cent to $4.3 million. The increase in Chile was achieved

despite a 16 per cent decline in volume (1,417 mt) while volume to Peru was

up 16 per cent to 1,130 mt. ·

A rebound in the Philippines and

continued growth in Vietnam pushed January-February beef exports to the ASEAN

region up 33 per cent in volume (4,774 mt) and 19 per cent in value ($27.3

million). Exports to Indonesia, which set a value record of $39.4 million

last year, are off to a slow start in 2017 with value through February down

48 per cent to $3.5 million. ·

Strong growth to most Asian

markets helped offset a slowdown to Hong Kong, where January-February volume

was down 21 per cent to 16,131 mt, valued at $104.7 million (down 12 per

cent). TheCattleSite

News Desk <米> 豚屠畜頭数は昨年比6.8%のアップ CME: Hog Slaughter During W14 Up

6.8% Compared to Previous Year 11

April 2017 US

- Hog slaughter for week ending 8 April was 2.301 million head, 6.8 per cent

higher than the same week a year ago, according to Steiner Consulting Group,

DLR Division, Inc. This

is the sixth consecutive week that hog slaughter has surpassed 2.3 million

head and since the start of March hog slaughter has averaged almost 6 per

cent above year ago and slightly above the levels indicated by the 1 March

Hog Inventory survey.

Pork

production last week was 489.7 million pounds, 6.2 per cent higher than a

year ago. In the last four reported weeks, pork production was a total 1.973

billion pounds, almost 120 million pounds (+6.4 per cent) more than the

previous year. While

pork exports were excellent in the first three months of the year, it has not

been enough in our view to absorb the bulk of this increase. More pork has

had to go through domestic channels, which in turn has kept prices in check

even as demand generally starts to improve into the spring. Also

we think the sharp spike in the value of pork bellies earlier in the year

negatively impacted retail features for the spring and we are now seeing that

playing out. The following chart illustrates the effect that the change in

the value of various primal has on the overall value of the cutout.

On

Friday USDA quoted the value of pork cutout (a weighted average price of all

pork cuts sold) at $75.28/cwt, $6/cwt or 7.4 per cent lower than where prices

were at the end of February. What accounts for that decline? All of it is due

to lower pork belly prices. The

value of the belly primal on Friday was quoted at $122.72/cwt, $38/cwt (-24

per cent) since late February. Since the belly primal accounts for about 16

per cent of the total carcass, the decline in belly prices has subtracted a

little over $6/cwt from the cutout value. Interestingly,

prices for other items have been fairly steady since then and also relatively

steady compared to a year ago. Indeed, the comparisons to a year ago are

quite telling considering the large supplies coming to market . The

loin primal on Friday was $75.47/cwt, 2 per cent lower than a year ago while

the ham primal at $55.74/cwt is actually 2 per cent higher than what it was

last year. Also positive for the pork market so far has been the performance

of pork trimmings and picnics. Both

lean and fat pork trim prices have been above year ago levels to this point,

an indication of still very robust demand for hot dogs, sausages and other

such items. The

erosion in the value of the pork cutout since late February has negatively

impacted packer margins but, in our view, at $37/cwt they still remain in

positive territory. Discussion of margins always goes to the assumptions

about operating costs but the gross margin calculations show packer margins

at this point are almost as good as they were last year and above what we see

as needed to break even (between $25-$30 per head). As

a result, packers continue to push as many hogs through as they can, with

slaughter last Tuesday at 449,000 head. Slaughter should be near full

capacity during this week but we expect a smaller slaughter next Monday

because of Easter celebrations.

Last

year Easter Sunday was on 27 March and the following Monday hog slaughter was

298,000 head, down from around 434,000 that would have been a normal level.

We suspect a shortfall of a similar amount again next Monday but most of it

likely will be made up on Saturday. The net effect of the holiday will likely

be limited in terms of the weekly slaughter.

ThePigSite

News Desk <米・タイ> タイ向け牛肉輸出アクセスが拡大:屠畜日4月1日以降から対象 US Beef Gains Expanded Access to

Thailand 11

April 2017 THAILAND

- Bone-in and boneless beef from cattle of any age are now eligible for

Thailand, as long as the slaughter date is on or after 1 April 2017. For

product derived from cattle slaughtered on or after this date, all USDA

Agricultural Marketing Service (AMS) Export Verification (EV) Programme

requirements have been removed. “Thailand

enforced its boneless conditions with exceptional rigor,” explained Joel

Haggard, USMEF senior vice president for the Asia Pacific. “We

can remember entire shipments of premium items being rejected based on the

finding of a single millimeter-long chip. "That’s

hopefully behind us now, with the new rules allowing boneless and bone-in

cuts. "Although

it is likely to remain a relatively small market for US beef, more exporters

will now be interested in serving Thailand, where there are a number of

foodservice and retail operations that want to feature American beef.” Exporters

should note that beef offal and offal products remain ineligible for

Thailand, and USMEF is seeking clarification on which items (for example,

skirts and diaphragms) will be classified as offal by Thailand’s Department

of Livestock Development. For

cattle slaughtered before 1 April, the boneless-only requirement is still in

effect, as are all other EV Programme requirements. TheCattleSite

News Desk <米・タイ> タイ向け牛肉輸出アクセスが拡大:屠畜日4月1日以降から対象 US Beef Gains Expanded Access to

Thailand 11

April 2017 THAILAND

- Bone-in and boneless beef from cattle of any age are now eligible for

Thailand, as long as the slaughter date is on or after 1 April 2017. For

product derived from cattle slaughtered on or after this date, all USDA

Agricultural Marketing Service (AMS) Export Verification (EV) Programme

requirements have been removed. “Thailand

enforced its boneless conditions with exceptional rigor,” explained Joel

Haggard, USMEF senior vice president for the Asia Pacific. “We

can remember entire shipments of premium items being rejected based on the

finding of a single millimeter-long chip. "That’s

hopefully behind us now, with the new rules allowing boneless and bone-in

cuts. "Although

it is likely to remain a relatively small market for US beef, more exporters

will now be interested in serving Thailand, where there are a number of

foodservice and retail operations that want to feature American beef.” Exporters

should note that beef offal and offal products remain ineligible for

Thailand, and USMEF is seeking clarification on which items (for example,

skirts and diaphragms) will be classified as offal by Thailand’s Department

of Livestock Development. For

cattle slaughtered before 1 April, the boneless-only requirement is still in

effect, as are all other EV Programme requirements. TheCattleSite

News Desk <米> 1-3月期の牛肉生産量・価格ともに急上昇 CME: Beef Production During Q1

Expected to Rise 29

March 2017 US

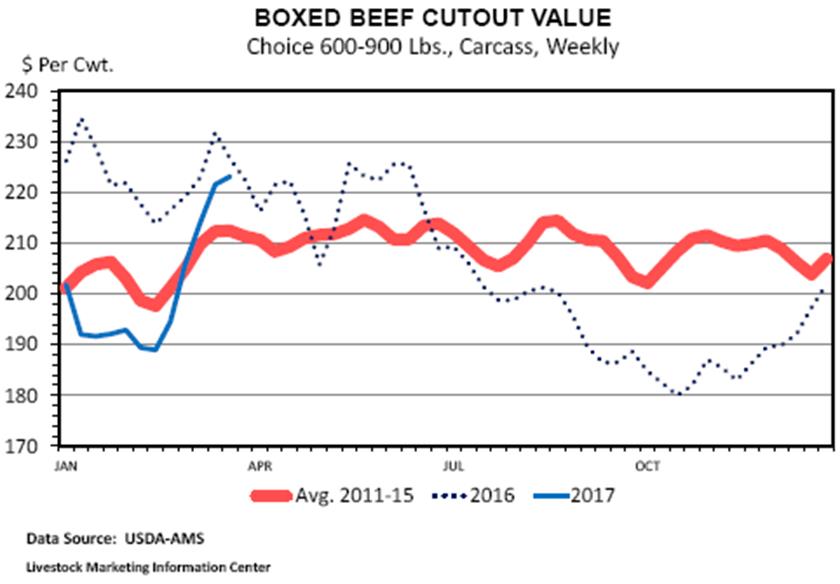

- Choice grade carcass beef values have taken off like a rocket during the

last month, writes Steiner Consulting Group, DLR Division, Inc. Last

week, the Choice beef cutout value averaged $2.23 per pound. A year earlier,

Choice beef prices averaged $2.27 for the same week, but note the volatility

depicted last year in the graphic. If, and it’s a big if, Choice product

prices hold steady this week, this will represent the first year-over-year

increase in the Choice beef cutout since the week of 3 July 2015.

Beef

production this quarter is expected to be up 4-5 per cent from the first

quarter of 2016. An increase in beef exports along with less imported beef

create a situation where beef availability in the US is actually down from a

year ago, however, which is a price-supportive factor in the marketplace.

The

Livestock Marketing Information Center is expecting per capita beef

consumption this quarter to be down 0.4 per cent from a year ago. The Choice

beef cutout value during the first quarter of 2016 was $2.23 per pound. So

far this quarter it has averaged $2.01, about a 10 per cent decline from a

year ago. This

would be consistent with traditional price quantity relationships where a 5

per cent change in the quantity of a product leads to percentage change in

prices of twice the magnitude in the opposite direction (known as a price

flexibility in economic jargon). The

recent price-quantity relationships indicate that the market has not been

that sensitive, that is up until the last few weeks. The bounce in beef value

back to what was seen a year ago brings some consistency back to the

relationship between availability (i.e. per capita consumption) that is

expected to be down from a year ago this quarter and current prices that are

on track to finish the quarter slightly above 2016’s. The

intensity of the price rally for beef during the last month is a notable

contrast to distinct downtrend last year, that finally bottomed-out last

October. Cattle marketings to slaughter plants started out 2016 increasing by

3 per cent from the first quarter of 2015 and finished 2016 with a 9 per cent

from the last quarter of 2015. Beef

cutout values in the final quarter of 2016 were down 10 per cent

year-over-year, a modest decline relative to the increase in cattle

marketings. The trend in reduced US beef imports and expanding exports was

one factor limiting the beef price decline to only 10 per cent. Currently,

the outlook for cattle slaughter in the upcoming quarter (April-June) shows a

5 per cent increase relative to the spring quarter of 2016. Per capita

beef supplies, integrating the effects of beef import and exports, should be

up 2 per cent from last year. These

beef quantities suggest that the Choice beef cutout value in the upcoming

quarter will probably be slightly less than the $2.19 average value posted

for the spring quarter of 2016, unless consumer demand for beef improves in

order to pay for more supply at a higher price. TheCattleSite

News Desk <米> 牛業界がトランプ大統領に要望;4月の習近平との対談時に米産牛肉の輸入再開を Beef Industry Urges President Trump

to Help Get US Beef Back into China 29

March 2017 US

- On Monday, the National Cattlemen’s Beef Association today sent a coalition

letter to President Donald Trump, urging him to raise the restoration of US

beef access to China when he meets with Chinese President Xi Jinping in

April. Leaders from the US Meat Export Federation and the North American Meat

Institute also signed the letter. American

beef producers have been denied access to China – a $2.6 billion import

market - since 2003. Last fall China announced that it had lifted its ban on

imports of US beef, but attempts since then to negotiate the technical terms

of access have been unsuccessful. “We

believe that access to the large and growing Chinese beef market is essential

to the future health of the US beef industry,” read the letter, which

was signed by NCBA’s CEO, Kendal Frazier. “We understand that you have many

important issues to discuss with President Xi, but we strongly encourage you

to take this important opportunity to convey the urgent need for China to

reopen its market to US beef.” In

2016, American beef producers sold $6.3 billion worth of US beef to customers

around the world, with three of the industry's top foreign markets located in

Asia. You

can view the letter sent to President Trump by clicking here. TheCattleSite

News Desk <米> 2月の商用牛屠畜頭数が3.5%増加 CME: Total Commercial Cattle

Slaughter in February Up 3.5% 27

March 2017 US

- USDA issued its monthly production statistics for beef and pork, reports

Steiner Consulting Group, DLR Division, Inc. The

numbers give us one more piece of data to build the demand picture for red

meat in February. It is always important to look at these supply numbers in

the broader context of supply flows through the economy rather than as

individual data points. Also

important is to recognize that calendar differences often will tend to skew

the numbers so one should look past the headline and understand what was the

true availability in the domestic market. Below are some of the highlights

and implications for beef. Total

commercial cattle slaughter in February was 2.369 million head, 3.5 per cent

higher than the previous year. But there was one less slaughter day last

month. Average slaughter last month was 118,460 head/day, 8.7 per cent higher

than in February 2016.

Steer

slaughter in February averaged 60,070 head/day, 9 per cent more than last

year while heifer slaughter at 31,730 head was 7.8 per cent higher. While the

increase in heifer slaughter slowed down slightly last month, in the last six

months the number of heifers coming to market has averaged about 12 per cent

above the previous year. Cow

slaughter also was higher last month, averaging 22,765 head/slaughter day or

7.6 per cent more than the same period a year ago. Larger slaughter numbers

bolstered overall beef production but output did not increase by the same

degree due to lighter carcass weights. Total

beef production for the month was 1.934 billion pounds, 48.7 million pounds

more than in February 2016. Average daily beef output last month was 96.7

million pounds, about 7.7 per cent higher than what it was a year ago. But

more beef produced does not always mean that there is more beef available for

the US domestic consumer. To

come up with that number, we need to adjust for the supply of beef trading in

and out of the US and adjust for the starting and ending cold stocks. Trade

data is not yet available but we estimate that US beef imports were down

about 11 per cent last month while exports were up 15 per cent. The

shift in trade flows reduced domestic availability by about 52 million

pounds, more than offsettng the production increase. End users appear to have

countered that by relying on their cold storage stocks. According

to our calculations (which will be revised when trade data comes out) total

disappearance in February was 1.978 billion pounds, just 0.3 per cent less

than a year ago. Adjusting for 21.92 slaughter days in a month, disappearance

was 5.3 per cent higher than last year or 4.4 per cent on a per capita basis. TheCattleSite

News Desk <米> ジョージア州でローパソ鳥フル発生 Bird Flu Discovered in Georgia 29

March 2017 US

- A flock of chickens at a commercial poultry breeding operation located in

Chattooga County, Georgia, has tested positive for H7, presumptive low

pathogenic avian influenza (LPAI). This

is the first confirmation of avian influenza in domestic poultry in Georgia.

The Georgia Department of Agriculture notes that avian influenza does not

pose a risk to the food supply, and no affected animals entered the food

chain. The risk of human infection with avian influenza during poultry

outbreaks is very low. The

virus was identified during routine pre-sale screening for the commercial

facility and was confirmed as H7 avian influenza by the USDA National

Veterinary Services Laboratory (NVSL) in Ames, Iowa. As a precaution the

affected flock has been depopulated. Officials are testing and monitoring

other flocks within the surveillance area and no other flocks have tested

positive or experienced any clinical signs. The

announcement follows similar confirmations from Alabama, Kentucky and

Tennessee in recent weeks. The Georgia case is considered a presumptive low

pathogenic avian influenza because the flock did not show any signs of

illness. While LPAI is different from HPAI, control measures are under way as

a precautionary measure. Wild birds are the source of the virus. Avian

influenza virus strains often occur naturally in wild birds, and can infect

wild migratory birds without causing illness. “Poultry

is the top sector of our number one industry, agriculture, and we are

committed to protecting the livelihoods of the many farm families that are

dependent on it,” said Georgia Commissioner of Agriculture Gary W. Black. “In

order to successfully do that, it is imperative that we continue our efforts

of extensive biosecurity.” The

state has already made an official order on the subject of poultry as a

preventative measure to stop the spreading of the disease. Owners

of poultry flocks are encouraged to closely observe their birds and report a

sudden increase in the number of sick birds or bird deaths to the state

veterinarian’s office at 855- 491-1432. More information can also be obtained

at www.ga-ai.org. ThePoultrySite News Desk <米・加> 北米自由貿易協定の再協議で、米の食品加工業者は加産製品のストップを懸念 NAFTA Renegotiation Could

Jeopardies US Food Processors Access to Canadian Products 29

March 2017 US

& CANADA - The Research Lead with Agri-Food Economic Systems says US food

processors need to be sensitive to the potential impact on them of reduced access

to imported Canadian products under a renegotiation of the North American

Free Trade Agreement, Bruce Cochrane writes. Agri-Food

Economic Systems has released an Independent Agri-Food Policy Note which

looks at the prospects for the US agri-food industry under a NAFTA

renegotiation. Dr

Al Mussell, the Research Lead with Agri-Food Economic Systems, observes the

US food processing industry has benefitted from imports of Canadian bulk

products, primarily grain, and intermediate imports such as ground grain and

livestock. Dr Al Mussell-Agri-Food Economic Systems I

think the reality is the US wouldn't be able to support its food processing

industries at the level they've been able to had they not had access to

Canadian products. Just

one example we went through in the policy note is oats. The

US imports oats out of particularly Manitoba, probably elsewhere in western

Canada directly down into breakfast cereal manufacturing plants in the United

States. The

US is not a large oat producer of its own. Whether

or not it could sustain those kinds of industries, understanding that oats is

a big part of what goes into breakfast cereal is perhaps an open question,

but probably pretty difficult for them without access to Canada. The

same thing on pork products, other red meat products. We

know that the US imports a significant volume of Canadian cattle and hogs for

processing in their plants and these products, they turn around and export

back to Canada as well as elsewhere as ready to eat products. That's

value added that's added in the US. Dr.

Mussell says, depending on how the NAFTA renegotiation proceeds, US food

processors can't assume they'll continue to have the same kind of access to

Canadian products that they've had in the past. ThePigSite

News Desk <米> 牛畜産業者は米通商代表部に、各国の貿易障壁の撤廃を要求 Beef Producers Want USTR That

Breaks Down Barriers 20

March 2017 US

- Last week (14 March), the US Senate Finance Committee held a hearing

regarding the nomination of Robert Lighthizer to head the Office of United

States Trade Representative. According

to the Committee, Mr Lighthizer previously worked for foreign governments,

thereby making him ineligible to be appointed as the United States Trade

Representative, pursuant to the Lobbying Disclosure Act. However,

according to the Committee, "Mr Lighthizer has an understanding about

the impact of unfair trade on America’s manufacturers and workers that could

be a valuable asset for our country. "The

country needs a USTR that will stand up for our rights on behalf of American

workers and businesses at the WTO, and that will partner with Customs and

Border Protection, the Department of Commerce, and the full range of agencies

responsible for trade enforcement to crack down on trade cheats hurting

workers and businesses here at home." In

response to the Finance Committee's hearing, Craig Uden, president of

the National Cattlemen’s Beef Association, released a statement saying,

"In order for America’s ranching families to remain competitive, we need

a government that prioritises market access and tears down barriers to trade

in leading global markets. "The

role of the US Trade Representative has become critically more important in

recent years, especially as our competitors seek to secure economic

advantages through trade agreements with our top export markets, such as

Japan. "Likewise,

we need a trade representative who understands the importance of abiding by

rules-based trade, who is willing to rigorously enforce agreements with our

trading partners, and who will work with the US beef industry to address our

many unresolved barriers to trade. "We

look forward to learning more about Mr Lighthizer’s views on these important

issues during the confirmation process." National

Pork Producers Council Ken Maschoff also issued a statement regarding the

hearing. Mr Mascoff said, "NPPC commends Robert Lighthizer,

nominee for ambassador of the Office of the US Trade Representative, for

telling the Senate Finance Committee that he places high importance on

agricultural trade, and we look forward to working with him and the rest of

the president’s trade team to preserve and expand foreign market access for

US pork. "Access

to international markets is the No. 1 priority of US pork producers. We are a

vibrant industry, with five new packing plants coming on stream in the next

couple of years, and the United States has been the top global exporter of

pork, on average, the past 10 years. All of this is because of trade deals. "It

wasn’t until 1995 – after the Uruguay Round and the NAFTA – that our industry

became a net exporter, and 20 US free trade agreements later, we are now an

export juggernaut. The flip side of that, however, is we now are very

dependent on export markets, with 25 per cent of our production being

exported. Given global income growth and demographics, we know the future

health of our industry is tied inextricably to preserving and expanding

international market access. "At

our recent annual meeting, producer after producer expressed concern about

the financial bloodbath they would experience if we have a disruption in pork

exports to Mexico. Further, producers expressed concern about losing market

share in the Asia-Pacific region as the EU and other nations close trade agreements

with Japan and other countries in the region. "His

statement on agricultural trade gives us confidence that as USTR ambassador,

Bob Lighthizer will work to create export opportunities for America’s farmers

and ranchers." TheCattleSite

News Desk <米> 牛部分肉価格が黒字に CME: Boxed Beef Prices Show Packer

Margins Back in Black 17

March 2017 US

- The rally in boxed beef prices has once again pushed implied packer margins

back in the black although the extent of beef packer profits is always a

point of debate and varies depending on the assumptions you make on operating

costs, etc, according to Steiner Consulting Group, DLR Division, Inc. The

comprehensive beef cutout value for the week ending March 10 was quoted by

USDA at $207.87/cwt, a 4 per cent jump from the previous week and now 9 per

cent higher than it was four weeks ago. More

than half of the increase is due to higher prices for steak cuts but also a

sharp recovery in the value of 50CL beef trim (ground beef, hot dog demand)

The average calculated feedlot price for last week is around $200/cwt on a

dressed basis. The

way we calculated that number is by adding up the sales of all cattle traded

on a negotiated basis, both on a live and dressed basis, and converting all

to the same dressed value. The value of the drop credit for last week was

quoted at $11.91/cwt on a live basis or $162 head. Drop

credit values have shown steady improvement in recent months and the increase

has added an extra $12.4/head to the packer margin compared to the same

period a year ago. Adding up the revenue side (cutout value + drop credit)

and subtracting the cost side (cost of cattle) yields a gross margin of

around $225 head. Estimates

as to what the packer needs to get to cover operating costs vary, some using

$150/head and others thinking it is close to $200/head. We really don’t want

to be in the guessing game and have no particular insight here. Still,

it appears to us that the latest numbers do indicate that a) packer margins

by most measures are back in the black, and b) they are currently running

substantially higher than last year when the gross margin was almost half of

what it is today. The

improvement in packer margins should make packers more willing buyers than a

year ago at a time when feedlot supplies are considerably more current. But

that is not the only thing that’s positive in the current market. One

of the insights included in the USDA beef comprehensive cutout report is

the volume of beef that has already been sold for future delivery. As

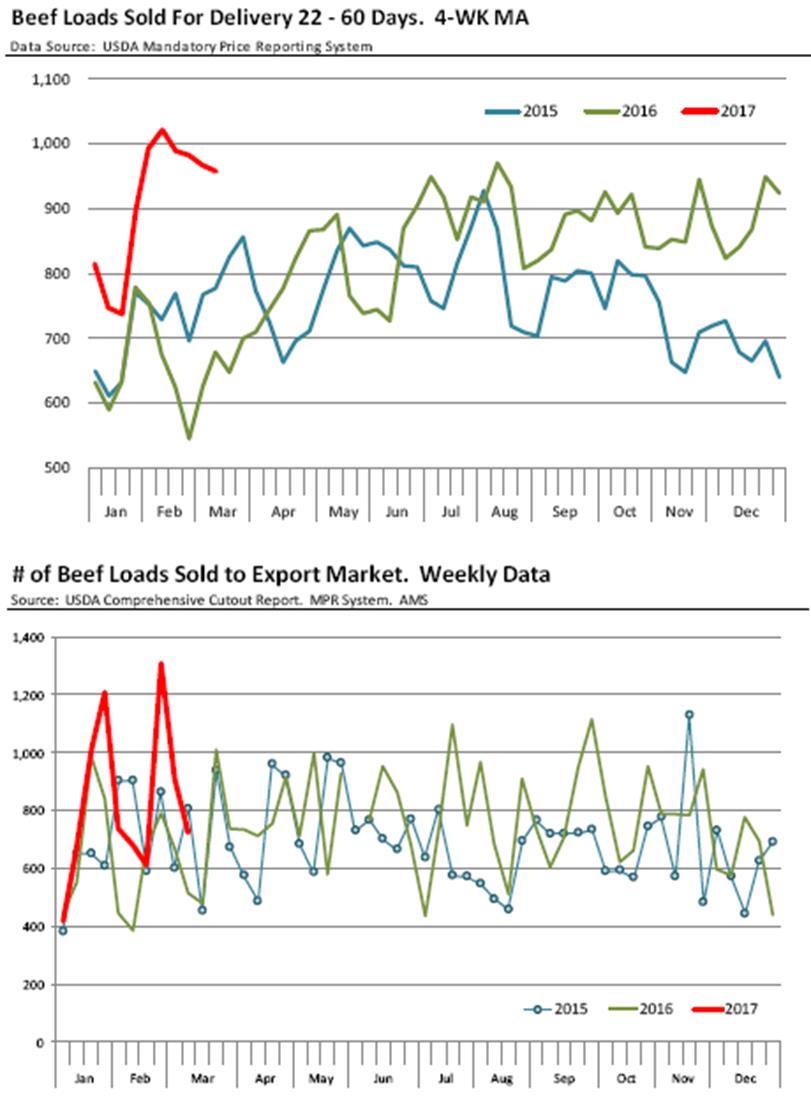

the top chart shows, the volume of forward sales improved significantly in

the last quarter of last year and it continues to run well above year-ago

levels so far in the first quarter.

The

report showed that for the week ending 10 March packers had sold 908 loads

for delivery between early April and mid-May. During the same week last year

sales for this time period were around 633 loads. But because week to week

volumes move around a lot, a four-week moving average makes more sense. At

this time the four-week moving average is at 956 loads/week, 41 per cent

higher than the same period last year. Sales for time periods past 60 days

are also running about 17 per cent higher than last year. In other words,

packers have been more successful in selling beef forward, something you want

to see if you expect an increase in cattle supplies/availability. Also

interesting/important is that packers are selling more beef into export

markets. We see these higher sales in the weekly export data and they are

also reflected in the comprehensive cutout report.

For

the last four weeks, packers sold an average of 889 loads/week for export,

about 34 per cent more than they did for the same period last year. Export

sales are volatile but so far this year the pace of shipments has been quite

robust, helping clean up spot supplies and contributing to the overall

improvement in fed cattle prices. TheCattleSite

News Desk <米> アラバマ州でハイパソ鳥フル発生か Alabama Officials Investigate

Avian Flu Detections 17

March 2017 US

- Alabama agriculture officials are investigating suspected avian flu

outbreaks at three locations in the northern part of the state, close to

where H7N9 outbreaks — one highly pathogenic and one low pathogenic — were

recently reported on two Tennessee farms. State

officials in Alabama were already on high alert for avian flu, because parts

of the state were in the control zone that had been placed around the

Tennessee outbreak area. Alabama authorities have not said what avian flu

strain is suspected, but they noted that samples are on their way the US

Department of Agriculture (USDA) National Veterinary Services Laboratory in

Ames, Iowa, for further testing. Alabama's

Department of Agriculture and Industries (ADAI) announced a stop movement for

certain poultry. Tony

Frazier, DVM, Alabama's state veterinarian, said in a statement, "With

three investigations of avian influenza in north Alabama on three separate

premises we feel that the stop movement order is the most effective way to

implement biosecurity for all poultry in our state." Farm,

backyard flock, flea market involved One

of the suspected outbreaks involves a commercial breeder operation in

Lauderdale County, located in the far northwestern corner of the state where

birds haven't shown significant mortality. Another is a backyard flock in

Madison County near Huntsville. Both counties are on the Tennessee border. Officials

said the third location is the TaCo-Bet Trade Day flea market in Scottsboro,

Alabama, in Jackson County, about 40 miles east of Huntsville. As part of

Alabama's highly pathogenic avian flu preparedness response plan, poultry

technicians from the USDA collected samples from birds on the premises on 12

March, which indicated suspected avian influenza. Amy

Belcher, spokeswoman for the ADAI, said there are no epidemiologic

connections between the outbreak locations in Tennessee and in Alabama,

Reuters reported today. Ray Hilburn, associate director of the Alabama

Poultry and Egg Association, told the news service that infected birds have

been culled, but he didn't say how many. The

ADAI said it and the USDA's Animal and Plant Health Inspection Service are

working together closely on a joint incident response. According

to the Alabama Cooperative Extension System, the state is the nation's second

largest broiler producer, part of its $15 billion poultry and egg industry. ThePoultrySite

News Desk <デンマーク・米・ブラジル> デニッシュクラウン社が米のプラムローズ社をブラジルのJBS社に売却 Danish Crown Sells Plumrose USA 15

March 2017 DENMARK

- Danish Crown has signed an agreement to sell its American subsidiary

Plumrose USA to Brazilian-based JBS, which is the world’s largest

meat-processing company. The sale is based on the 4WD strategy, under which

Danish Crown has decided to focus its business on Northern Europe and Asia. Group

CEO Jais Valeur, Danish Crown, said: "The focus of Danish Crown’s 4WD

strategy is to lead our home markets in Northern Europe, to further grow our

positions in Asia and to expand our leading position in casings globally. "We

have therefore decided to sell Plumrose USA. I am certain that JBS, with its

wide presence and access to raw materials in North America, is a perfect

match for Plumrose USA and will help fortify its business for the benefit of

many loyal customers. "Plumrose

USA is an excellent company, which has made significant progress in recent

years, and I would like to take this opportunity to thank the Plumrose USA

management and employees for their committed efforts." For

more than 80 years, Plumrose USA has been a supplier of quality products to

consumers across the USA. In 1932, the company started production of sliced

cooked ham, and over the years it has developed into a company offering a

wide selection of products including premium bacons, packaged deli meats,

quality deli counter hams, cooked ribs and canned hams. CEO

Andre Nogueira, JBS USA Food Company, said: "Plumrose USA is a highly

respected business with an outstanding professional team, a strong portfolio

of branded cooked and prepared foods, and first-class, well-invested assets

in strategic geographic locations that complement our current business

structure. "We

are excited to welcome the more than 1,200 dedicated team members of Plumrose

USA to JBS and look forward to building on the legacy of high-quality

products and outstanding service established by Danish Crown." Four

months ago, Danish Crown launched its ambitious 4WD strategy with the

predominant aim of growing its four home markets in Denmark, Sweden, Poland

and the UK. The

strategy includes plans to expand exports to Asia in general, and to

establish a production facility in China based on Danish pork. Also, Danish

Crown is focused on achieving global leadership in selected categories. Mr Valeur

said: "Selling Plumrose USA is a step forward in achieving the long-term

goals of the 4WD strategy. We have strengthened our financial capacity quite

substantially. "This

gives us extensive room for manoeuvre and for taking part in what I would

call a necessary consolidation of the food sector in our four home

markets." In

the most recent financial year, Plumrose USA posted revenue of DKK 3.4

billion. The company manages five plants and two distribution centres with

1,200 employees across the USA. JBS pays DKK 1.6 billion to acquire Plumrose

USA. The

sale of Plumrose USA to JBS is contingent on approval by the US competition

authorities. ThePigSite

News Desk <加・米> 加の牛飼養頭数は昨年比0.2%増:ようやく減少に歯止めがかかるか? 輸出先の米にとっても関心事 CME: Total Canadian Cattle