|

���I���@���V�A�ł͎����E�R���������̂ɁA�{�R�X�g�͉��̍����̂��H�@�\�A���ォ��̈�Ől����̂����߂��B���x���̒Ⴂ�J���Z�p�������B Russia Hog Market 08

May 2017 RUSSIA

- Pig price currently is currently 110 Roubles per live kg ($1,92). For good

farmers, pigs continue to be very profitable, but for many not! according to

Simon Grey, General Manager Russia, CIS, and Europe. Some

are even losing money (incredible though it seems). I was asked a week or so

ago, �gwhy when Russia has low grain cost (wheat at 8900 Roubles ($156) per

metric tonne), low labour cost (about $500 per month) and low energy cost

(petrol $0.56 per litre at the pump) why are costs of production so high�h? Russia

wants to continue to grow its pig industry and become a net exporter. For me

this is a very sensible ambition. Russia has a massive land bank and can

produce a lot more grain. There is a lot of land to build farms on and of

course use for slurry disposal - as a valuable organic fertilizer that can

increase crop yields. There are today a lot of skilled pig farmers who can

get globally competitive production results. One

major obstacle to this happening is a high (average) cost of production. When

you want to trade a global commodity like pig meat, you need to be globally

competitive on cost. In any commodity market the lowest cost producers have

the advantage. Having

grown up within the European pig industry and also having worked for the

world�fs largest pig producer it is very easy to see where the extra costs

are: 1,

The first is excessive legislation, most of which comes from the USSR. In

soviet times, everyone had to have a job. State farms were created to feed

and occupy people, not to be profitable. There

is some modern legislation that seems to originate from the EU. As far as I

can see, the EU is steadily legislating its pig farmers out of business, with

more and more rules that simply add to cost of production and ultimately only

put up the cost of pork for the consumer!! This

excess legislation is the cause for many high costs. Just last week I was at

a farm that was set up in Soviet times. There were over 400 people working

with 7000 sows! The total salary cost per pig produced was considerably

higher than either Europe or North America. The

administration costs, directors, accountant�fs lawyer�fs etc. was in excess of

$9.00 per pig sold. I would be targeting $1per pig, even taking into account

the excess administration in Russia a maximum of $2! Excess

legislation adds to the cost of everything. Farms are expensive to build

(despite low cost labour and building materials). The process of getting

permissions is expensive and slow. Getting bank loans is administrative and

complicated. 2,

The �gI want�h culture. Having spent a lot of time in Russia over the past 12

years I observe many spoilt children, especially boys, spoiled by their

mothers! They learn from an early age that they can get whatever they want.

This behaviour follows some into their working lives. Spoilt children never

learn the real value of something. When

designing farms, �eI want�f adds to the cost. When deciding on feed ingredients

or medicines or other supplies, I want�f adds to cost. When deciding on how

many people and salaries �eI want�f also adds to cost. 3,

Inability to take decisions. This is caused by the �gpunishment culture�h that

comes from Soviet times. Mistakes were punished, success ignored. Still today

if something goes wrong on a Russian farm, it seems to me that 99% of the

effort is put into finding who was responsible, rather than sorting the

problem. Fear

of punishment means many managers daily focus is avoiding mistakes and trying

to find someone to blame for anything. I have been on farms many time and

asked manager for a simple production report. Many time I have been told,

sorry I can�ft, the data in-putter is on holiday today and only she can print

reports. My response, but you are the manager, surely you have access to information

and can run the management program? Answer, no its not my job! The

inability to make a decision means its easier to change nothing, than risk

changing something. Therefore, nothing changes, production stays the same and

inevitably costs rise and rise! Taking

decisions is very easy. Good decisions increase profitability (more sales or

lower cost or both). Bad decisions reduce profitability (less sales or higher

cost or both). Managers by definition, are employed to manage, this requires

taking decisions on a daily basis! A calculator is usually all you need to

decide is a decision is good or bad. 4,

Subsidies and protected market. Both have an important place in helping to

establish business, but only as a catalyst (the business has to be profitable

without the support, otherwise it is a rally bad idea to subsidise). Ultimately

however subsidies do nothing to help companies become globally competitive.

They do help to keep inefficient and poorly business profitable! 5,

�eRussians like suffering�f is something I am often told. This is something

that has made Russia what it is today (we need only look at how Russia dealt

with the German invasion in the 2nd world war. The ability of Russian people

to put up with poor work and living conditions, low salaries, poor quality

food, bad service, is incredible! I hear so many times �gits Russia�h. Accepting

what has always been and nothing will change stops real development. In

Russia is see some very clever business owners that want to get on and create

excellent globally competitive business. I see many very clever young

managers who understand the problems of high cost and who get very frustrated

being desk bound filling in forms, rather than being on farms producing more

pigs. I also see many skilled production workers on farms who are more than

willing to do more and earn more money. Russia

could easily double (and maybe triple) its pig production and not hire a

single person! Will

all this happen? Time will tell. ���I���@�ؓ�����F��^150�����A�w���b3�����ȏ�̓������Ŗׂ��� Russia Hog Market 23

March 2017 RUSSIA

- Simon Grey, General Manager Russia, CIS, and Europe, writes, "Despite

lent, when many Russians stop eating meat, the pig price remains good at 105 Roubles

($1.82) per kg live weight. With production cost for good producers around 65

Roubles ($1.12) per kg, profitability remains high. Interestingly, the price

of lean meat and fat remains very similar. Producers killing really heavy

pigs are very happy!" All

of the talk within the industry continues to be developing an export market,

and of course, the control of ASF, although there have been no recent

outbreaks on large commercial farms. The majority of outbreaks over the

summer have been linked to domestic pigs and farm workers in contact with

them or the meat from infected domestic pigs. Big commercial farms are having

more and more control, but this is not the problem. The majority of Russian

farms already have excellent biosecurity. The

solution, at least on paper, is simple. Make it illegal to keep domestic

pigs, or at least have the same rules for domestic pigs as there are for

commercial farms as this would effectively make it impossible or un-economic

to keep pigs at home. The next issue would be policing it! Belgorod Oblast

has sort of done this. Despite having the largest population of pigs in

Russia, there have been no outbreaks of ASF on commercial farms. Outdated grading system. Many

Russians still talk about the carcass classification system. Although some

plants do their own thing, the classification system is still used. There are

discounts for lower classed pigs. First

Category: pigs from 70kg to 100kg live weight and with no more than 2cm of

backfat Second

Category: pigs from 70kg to 150kg live weight with no less than 1cm of

backfat and no more than 3cm of backfat. Third

Category: pigs to 150 kg live weight with over 3cm of backfat. 1.

Having a national grading system

makes little sense. Slaughter plants should set their own prices and

encourage farmers to produce the most profitable pigs for that plant by

paying a premium for pigs which make them the most profit. Taking into

account the excellent margins and the high cost of fat in Russia today, the

heavier the pig, the more the profit! 2.

Having the highest class pigs in a

weight range that is totally uneconomic to produce also makes no sense.

Slaughtering pigs at less than 100kg is crazy. Light pigs cost more to

produce (per kg) and give lower margin. Even with a premium price, it would

make no sense to produce light pigs. 3.

Wide bands for backfat also make

no sense. I do not believe a 125kg pig with 3cm backfat is so much more

valuable than a 125kg pig with 3.1cm of backfat. Once again, when the price

of lean and fat are virtually the same, the 2 carcasses will be worth the

same money when cut down and sold. Carcass

classification systems should be designed to maximise profitability within a

system. For on farm production, the math is easy. Bigger pigs = lower cost of

production. For the slaughter plant, the bigger the pig the lower the cost. The

issue is only understanding what carcass gives the most profit or

understanding how to maximise profit from heavier pigs with inventive

butchery. With neck having the highest value in the shops, the more cuts that

look like neck and that can be sold for a higher price, the greater the

profit through the whole chain. The

last issue that a classification system should encourage is tastier meat! As

an industry looking to make more profit, we need to sell more meat and at a

higher price. There is nothing like a bad taste experience to put people off

eating pig meat. My

own wife is proof of this. We are a family that live from pig farming. Coming

from the UK, where pigs are not castrated, every now and again we would get

pork that had boar taint. The risk of this meant that if we were ever

entertaining guests, my wife would never risk serving pork just in case it

was tainted. It always made me cross that we spent money earned from the pig

industry to pay for another meat, because of the risk of a poor tasting

product. Russia

is targeting Asia for exports of pig meat. Asians like darker meat with

intramuscular fat. The highest value cut in Russia is neck. Maybe it is time

for better classification systems to encourage maximum profit. ���x�����[�V���@UAE�����Ɍ{���E�����̗A�o���v�� Belarus Plans to Launch Poultry,

Beef Exports to UAE in 2017 08

March 2017 BELARUS

- The Belarusian Agriculture and Food Ministry plans to launch the export of

poultry and beef to the UAE in 2017, BelTA learned from head of the Foreign

Economic Activity Department of the Agriculture and Food Ministry Aleksei

Bogdanov. �gDuring

the meeting with the UAE Minister of Climate Change and Environment last week

we agreed on an inspection of Belarusian companies in the first half of the

year for possible supplies of poultry and beef to the Arab market. Usually

the certification of companies takes some 4-5 months, so we hope to launch

our exports in late 2017,�h he explained. BelTA

reports that Mr Bogdanov noted that the preliminary work had been conducted to

prepare for the visit of UAE inspectors to Belarus. �gThe

Department of Veterinary Inspection has sent the necessary documents to the

UAE Ministry of Climate Change and Environment. Belarusian companies have

Halal certificates and are ready to fulfill additional requirements of the

UAE,�h he stressed. In

December 2016 Belarus' Agriculture and Food Ministry hosted a seminar for

Belarusian meat factories on the production of meat under Halal requirements

for the UAE market. The seminar was initiated by the UAE company RACS. �gAt

present the Agriculture and Food Ministry is working on the list of meat

processing companies and poultry farms ready to meet the Halal standards of

the UAE and other countries of the Persian Gulf,�h Mr Bogdanov said. Mr

Bogdanov added that last week 14 Belarusian companies took part in the

international exhibition Gulfood 2017 in Dubai, the UAE. �gThe

Agriculture and Food Ministry organized a national stand with the total area

of 100 square meters to feature meat, milk, bakery and confectionery

products. The participation in the exhibition is important for export

diversification as it gathers together traders and processers from around the

world, including Southeast Asia, Africa and the countries of the Persian

Gulf,�h he said. Gulfood

is one of the world's biggest food expos, which annually attracts a big

number of international participants. ThePoultrySite News Desk ���A�����j�A���@�ˊO�ł̋��̓j�{�͈�@�ƌ��� Armenia Decides Slaughtering of

Cattle Outside Butcheries Illegal 10

March 2017 ARMENIA

- The Armenian government has adopted a decision wherein the slaughter of

cattle outside butcheries illegal, agriculture minister Ignaty Arakelyan said

at a Cabinet session. According

to ARKA News Agency, the minister said the

decision will be made mandatory step by step. He

said beginning from 1 May 2017, the government will be buying meat from

slaughterhouses only. The

decision will become mandatory for meat products producing and exporting

companies from 1 November 2017. According

to him, starting from 1 April 2018, all public catering facilities in Yerevan

will have to buy meat exclusively from slaughterhouses. Prime

Minister Karen Karapetyan added that the implementation of this decision

should not create obstacles for business. TheCattleSite

News Desk ���I���@�{�Y�ő��`�F���L�]�{�E�O���[�v���ɐB�؏�̐V�݂\ Cherkizovo Launches New Sow Farm

in Lipetsk Region 27

February 2017 RUSSIA

- Cherkizovo Group, the largest vertically integrated meat and feed producer

in Russia, has launched a new sow farm in the Lipetsk region. Igor Babaev,

founder of Cherkizovo Group, and Oleg Korolev, head of administration of the

Lipetsk region, both attended the opening. This

new facility will supply sows to Cherkizovo�fs pork production facilities

located in the Lipetsk and Voronezh regions. The sow farm�fs weekly capacity

is 11,600 sows of simultaneous placement and 7,000 weaned piglets. Once fully

operational, the facility will boost production in the Group�fs pork segment

by 350,000 heads per annum. Total investment into the project amounted to RUB

1.3 billion. The

facility has been constructed according to the highest biosafety standards

and state-of-the-art equipment, including a covered heated disinfectant

barrier, has been installed at the site. The entire production process is

fully isolated and both animals and feed are moved within the facility via

special transfer points. Staff can move around inside the sow farm via

walkways, without exiting the facility. In

addition to opening the new sow farm, Igor Babaev and Oleg Korolev also

visited the Dankov meat processing plant, which is now fully operational

following the 2015 renovation to increase its annual production capacity to

124,000 tonnes. A total of RUB 1.5 billion was invested into the facility. Igor

Babaev, founder of Cherkizovo Group, commented: �gThe opening of this new sow

farm not only further strengthens our vertically integrated business model,

but also boosts the local economy. The new facility will help increase

Cherkizovo�fs production in the Lipetsk region by 50 per cent and this will

inevitably create new jobs for the region. Cherkizovo is the largest investor

in the Lipetsk region and we look forward to maintaining our strong

relationship in the region going forward.�h ThePigSite

News Desk ���I�E�ٷ�݁��@�ٷ�݂���̓��E�����i�̗A���F Import of Kyrgyzstan's Dairy, Meat

Products to Russia Confirmed 07

February 2017 KYRGYZSTAN

- Kazakhstan did not put any barriers for the transit of dairy and meat

products of Kyrgyzstan to Russia, reports KyrTAG news agency. Oleg

Pankratov, Vice Prime Minister of Kyrgyzstan said: "Kyrgyzstan is ready

to provide security of exported products. Only Kazakhstan expressed concern

and is not ready to recognize the real situation. "Taking

in account that Russia is the main sales market of Kyrgyzstan, there is a question

of goods transit through Kazakhstan to Russia. "In

December 2016 President of Kazakhstan Nursultan Nazarbayev said that transit

would be provided. In January we received a letter from the Deputy Minister

of Agriculture of Kazakhstan spelling out the rules of the transit." Source:

KazTAG ���I�ƭ��ް���ށ��@���N�g�p�~�����o���R�ŁANZ����̋����A�����~�GNZ�͔ے� Russia Bans Imports of New Zealand

Beef 07

February 2017 RUSSIA

- Russia has banned the import of beef and beef byproducts originating in New

Zealand, Russia's Interfax news agency has reported. Russia's

state agriculture agency Rosselkhoznadzor claimed that traces of ractopamine

had been found in samples of beef on three separate occasions. The

drug, which is used to build muscle mass in cattle, is banned within Russia. The

ban could also be extended to cover fish and butter from New Zealand after

samples were found to have high levels of bacteria, Rosselkhoznadzor chief

Sergei Dankvert told Interfax. A

spokesperson for New Zealand's Ministry for Primary Industries (MPI) told the

NZ Farmer news outlet that officials had not received prior

notification about the ban. He

also stressed that ractopamine was not licensed for use in New Zealand

cattle. Source:

The Moscow Times ���I���@�ؓ����v7�����i24.9�����^1�l������j�ŁA���Y���g�咆�F1��������40-70�h���̗��v Russia Hog Market 09

February 2017 RUSSIA

- The pig price this week in Russia is averaging 98 Roubles ($1.66) per live

kg., writes Simon Grey, General Manager of Genesus Russia. Producers

continue to make good profits in the range of $40 to $70 per pig. Russian pig

producers continue to build new farms and expand Pork

consumption increased during 2016 by 7 per cent to 24.9kg per person. With

companies beginning to export into Asia the future remains bright. There

are some peculiarities within the Russian market, and some anomalies which

make no sense! 1.

Majority of pigs produced and

slaughtered and sold by large integrated producers, there is a limited �efree

market�f. Large producers set their own prices. 2.

Russian pig businesses target and

measure their production in tonnes of pig meat sold. 3.

In Russia today the value of a 1/2

carcass and the value of pig fat are both in the 130 to 140 Roubles per kg range

($2.21 to $2.38). 4.

The highest value cut on meat in

Russia is Neck (Russians like fat). 5.

The cull sow price is relatively

high in comparison to slaughter price (74 per cent ), meaning cull sow value

is about 6000 Roubles ($100) higher than that of a standard slaughter pig.

Farms producing their own gilts and paying a royalty to a breeding company

make a profit selling a cull sow and replacing it with a gilt. The

anomaly is that the Russian grading system penalises fatter (and therefore

larger) carcasses and many new plants built by the large integrators are

using lean meat per cent as the only measure of carcass value! When

talking with producers over the past few weeks, most think that less fat is

the major market driver. I have heard several smaller, independent producers

say that who they sell to want leaner pigs and are considering reducing

slaughter weights to comply to slaughter plant demand. Genesus

recently took part in a major sire line trial. We were very clear winners in

terms of slaughter weight (9kg and 7kg higher slaughter weight in same time

vs the competitors). We were then told that according to Autofom

measurements, the weight of primal�fs was lower than competitors. This is of

course impossible! It

is important that slaughter plants understand the major drivers of

profitability for their business. What is the most profitable pig to kill,

weight, lean per cent, backfat, meat quality (pH, colour, tenderness,

intramuscular fat). Also, you need to consider the value of all of the other

parts of the pig. There is an old English saying: �gyou can use every bit of

the pig except the squeak�h. Blood, intestine, offal, ears, bones, skin, ears

etc. all have potential value. In

the USA, several years ago, Smithfield Foods looked properly at what is the major

driver for profitability. Their finding after doing very thorough analysis

was that carcass weight was the single most important factor related to

profitability. They discovered also that back fat / lean per cent cost had

almost no impact and that it actually cost more to measure than it was worth.

Today, 50 per cent of plants in North America have stopped any form of

grading for backfat and the remaining 50 per cent have for now changed the

emphasis in their contracts from lean to weight. We

are beginning to see the same trend in Europe, especially Spain which is by

far Europe�fs most progressive industry, and most similar to North America in

structure. Spain, a major exporter of pork, in reaction to sanctions with

Russia has been developing export markets to Asia. Asia requires pork with

better meat eating qualities. Colour and intramuscular fat are important. As

a result some plants are now asking for minimum levels of back fat to be 2cm!

Even in Germany, the country where farmers are paid for lean meat and

Pietrain has been the only choice of sire for many years, plants are

beginning to look for alternative and tastier meat. Even fat obsessed

European consumers seem to at last be getting tired of dry tasteless pale

pork! In

North America and Europe there is a bigger difference in the price of fat Vs

½ carcass. There are still consumer preferences in many places for lean (it

is assumed to be healthier). In these markets it is becoming clear that

carcass weight is the major driver of profitability. In

Russia, where consumers prefer fatter pork and the price of fat is high,

carcass weight HAS TO BE the major driver of profitability. It seems to me

that if plants turned off their expensive grading machines and spent time

properly evaluating which is the most profitable pig it will become clear. It

seems that a country where targets and results are set and measured in tonnes

of pig meat already knew the answer. I have said many times before, with

regards the pig industry, Russia has absolutely nothing in common with Europe

and everything in common with North America! It seems European influence and

technology may have pushed the Russian market in the wrong direction? To

grow the pig industry, Russia needs to increase local consumption, remember

that Russians like fat pork! Russia needs to develop the Asian export market

where good meat eating quality is vital. At

the core of the Genesus breeding program is more tonnes of pig meat sold from

a pig business. ·

More pigs sold per sow per year

and faster growth rates giving heavier carcass weight. ·

Genesus has put more time and

effort than any other breeding company into maximising meat eating quality. More

tonnes of better meat = maximum profit! ���L���M�X�^�����@�h�u��̗��R��1��1������A�J�U�t�X�^���o�R�̃��V�A�����H���E�~���N�̓��H�E��H�ł̗A�����֎~�i�S���͋��j Kyrgyzstani Milk, Meat Exporters

Barred from Transporting Goods to Russia 09

January 2017 KYRGYZSTAN

- Kyrgyzstan is no longer allowed to transport its goods to Russia by road

through the territory of Kazakhstan, Advisor to the Director of the

Veterinary and Phytosanitary Safety Inspectorate Tolonbek Yrsaliyev told

Tazabek on 6 January. The

ban on transport of Kyrgyz goods subject to veterinary control via Kazakhstan

to Russia came into effect from 1 January 2017. "The

Ministry of Agriculture of Kazakhstan represented by the Deputy Minister

Gulmira Isayeva sent a letter on 31 December 2016 informing about introducing

a ban on road and air transport of goods subject to veterinary control via

Kazakhstan based on the decision of the Customs Union as of 2010," said

Mr Yrsaliyev. 15

Kyrgyz producers that are allowed to export their goods to Russia are no

longer allowed to transport their products to Russia via Kazakhstan by road

and by air. They can only carry out transport of goods via Kazakhstan by

rail. Source:

AKI Press ���G�X�g�j�A���@2016�N��3�l��������ؓ��A�������i���㏸ Milk, Pork Purchase Prices on Rise

in Estonia 28

December 2016 ESTONIA

- Purchase prices in the livestock sector have started to increase in Estonia

this year, with the average purchase price of pigs being seven and milk

purchase price being 2.5 per cent higher than one year ago, it appears from a

third-quarter survey carried out by the Ministry of Rural Affairs. "Signs

of adaptation can be seen in the livestock sector," said Deputy

Secretary General for Agricultural and Rural Life Policies Marko Goran in a

press release. "The

low ebb of the milk market that has continued for a long time has had a

negative effect on the purchase price of milk and cattle numbers. Yet the

productivity of cattle has grown despite the difficult situation and milk

output has stabilized on the level of recent years." In

the first nine months of the year, approximately 7,000 tons more milk was

produced in Estonia than during the same period in 2015. The average purchase

price in September was 233 euros per ton, a 2.5 per cent increase year over

year, reports News.Err. ThePigSite

News Desk ���I���@�̗��ꂪ���t���̑Ō� Russian Layers Hit by Latest Bird

Flu Outbreak 09

December 2016 RUSSIA

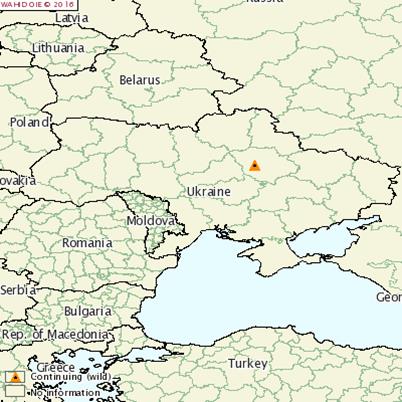

- The latest country to report a case of highly pathogenic avian influenza is

Russia, with a laying hen farm affected. The

outbreak hit the Astrakhanskaya Oblast in the west of the country,

killing over 5000 birds.

���I���@�`�F���L�]�{�Ђ��{�����i��EU�ւ̗A�o�����擾 Russian Poultry Producer

Cherkizovo to Export to EU 09

November 2016 RUSSIA

- Russian meat processor Cherkizovo Group has been given permission to export

poultry products to the EU from its Vasilyevskaya poultry production

facility. The

EU Export Compliance Certificate confirms Vasilyevskaya�fs compliance to the strict

veterinary and sanitary requirements of the EU. This certificate is also

recognised by many countries outside the EU, such as Serbia, Macedonia,

Georgia and South Africa. Andrei

Terekhin, Head of the Export Department of Cherkizovo Group, commented:

�gReceiving the EU Export Compliance Certificate is a direct result of our

ongoing investment into the quality and biosafety our products and marks a

significant step in our ongoing journey to expand into new markets. "The

European market is one of our priorities and we are already in active

negotiations with potential partners on dispatching a pilot batch of poultry

products. With this certification, Cherkizovo Group is now well-positioned to

capture growth opportunities in the broad European market.�h ���I���@�ؓ��s���͍D���F���̉��i��1.61�h���^kg�A���Y�җ��v��1���i120kg�j������50�h�� Russia Hog Market Report 04

November 2016 RUSSIA

- The current pig price in Russia is 102 Roubles ($1.61) per kg live. This

means good producers are making in the region of $50 for a 120kg pig, writes

Simon Grey, General Manager Russia, CIS, and Europe. There

were predictions of over supply this autumn, with very low prices that were

expected to be below the cost of production for all but the very best

producers. Several outbreaks of African Swine Fever in large farms in the

past few weeks has led to over 100,000 pigs being destroyed and burnt. Maybe

this has been enough to reduce numbers of pigs going to market. Certainly,

the current �econspiracy theory�f that are so loved in Russia is that African

Swine Fever is being used to control the pig price. We

know historically that the aftermath of any major disease outbreak is higher

market prices on the back of lower production. However, failing to contain

ASF has potential catastrophic effects on the Russian pig industry, which is

looking for further growth and the development of export markets. With

a lot being done to develop pig production in the far east of Russia,

primarily to supply China and Asia, it will be interesting to see if the

movements of pigs from western to eastern Russia are banned. The Ural

Mountains form an excellent physical barrier for any natural movement of the

disease. With proper management, there is no reason for the virus to move

east. One

interesting figure is the price for cull sows. This is currently 91 Roubles

($1.44) per kg, only 10 per cent less than for a market pig. Russia, like

many Eastern European countries, has a great tradition of making all sorts of

dried and smoked sausage, for which sow meat can be used. For

a 120kg market pig, total sales price is 12,244 Roubles ($196.27), and for a

200kg cull sow, 18,2000 Roubles ($263.16). The vast majority of Russian

companies produce their own F1 replacement gilts. Even with a gilt royalty

that will average around $30, a cull sow is worth more than a replacement

gilt. Russian

producers make a profit when they replace a sow with a home-produced gilt!

Like producers globally, there is still a net cost of buying an F1. This

is a big bonus for Russian producers. It means there is no reason ever to not

have enough gilts. This is important for many reasons. 1.

Having enough gilts on the farm

means that you should never miss breeding targets. Number of sows / gilts

bred weekly is the number one target for all pig producers. It has the

biggest influence on number of pigs sold (if you breed nothing, you get

nothing). 2.

When I analyse production figures,

the most effective pig farms in terms of pigs per crate and kg per m2 have

replacement rates of around 55 per cent to 56 per cent. This is a function of

never missing breeding target and always having barns full of pigs. 3.

For maximum sow productivity, it

is important to maximize the number of parity 3 and 4 sows in the herd. The

only way to do this is by entering enough gilts every week. 4.

Getting genetic progress means

replacing existing sows and boars. Keeping the same animals means it is

impossible to get genetic progress. For most farmers, replacement gilts are a

net cost to the business. The decision to take is one of genetic progress Vs

cost of replacements. If you are making profit each time you replace a sow

with a gilt then the only issue becomes one of genetic progress. 5.

Currently, there is a very good

case to replace any sow that misbehaves immediately. Once again, for most

producers, the cost of a sow that returns must be balanced with the net cost

of replacing her. If you actually make a profit replacing her, then the issue

becomes only one of maximizing output from a farm. Maximising

output from a farm means having every single sow space full with a productive

sow or gilt (except required for emptying and washing farrowing). ���I���@���Ɨ{�؏�ŃA�t���J�ؔM������ Commercial Russian Pig Farm

Reports ASF 01

November 2016 RUSSIA

- A new African Swine Fever (ASF) outbreak has been reported on a commercial

pig farm in Russia. The

farm in Krasnyansky, Voronezhskaya, reported that of the 43,884 pigs

susceptible to the outbreak, 150 cases were reported. Over

18,000 pigs died or were destroyed as a result of the outbreak.

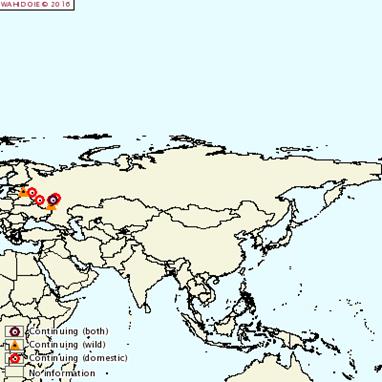

���E�N���C�i���@�V���ɃA�t���J�ؔM������ New ASF Cases Reported in Ukraine. 25

October 2016 UKRAINE

- Another three outbreaks of African Swine Fever (ASF) have been reported in

Ukraine. One

outbreak has affected two pigs at a backyard unit in Kalcheva, Odessa. The

unit is located close to Moldova and Romania.

Two

further outbreaks were discovered at pig farms in Berezanka and

Kalynivka, both in Nikolayev. In

total, five cases were reported.

���E�N���C�i���@�{�����Y���MHP���P�]9������6%�̔̔��ʑ��� Leading Ukrainian Poultry Company

MHP Targets Further Export Growth 19

October 2016 UKRAINE

- Ukrainian poultry producer MHP has reported an increase in poultry sales

volume of 6 per cent during 2016 in its latest financial results, compared

with the first nine months of 2015. The

company said the increase was driven by a massive increase in export volumes

- chicken meat exports rose 70 per cent in the third quarter of 2016 compared

with the same period last year. In the first nine months of 2016, the share

of the company's total poultry sales going to exports was approximately 34

per cent. MHP

said it is continuing to pursue further expansion of exports, in the

countries of the Middle East, the EU, Asia and Africa. In

the EU, the company has a joint venture in the Netherlands to run a

processing plant, which is a key part of its plans for expansion. MHP said

the plant has been gradually increasing its capacity and it is

expected to reach full production capacity by the end of the year. In

a speech at the recent General Assembly of AVEC, the association

representing the poultry meat industry in the EU, the organisation's

president said that Ukraine can now produce poultry at a lower cost than key

exporting countries Brazil and Argentina. President Paul Lopez added that for

the European poultry industry, Ukraine "represents a clear threat at the

gates of Europe". The

EU is a net poultry exporter in terms of quantity, but imports a lot of high-value

poultry products from third countries - 25 per cent of the breast meat

consumed in the EU is currently imported from third countries, according

to AVEC. ���I���@�\�z�ʂ�A�I��WTO�̃��[���ᔽ����ɔ��� Russia

Appeals WTO Ruling on EU Pork Import Ban 05

October 2016 GLOBAL

- As was widely anticipated, Russia has appealed against the World Trade

Organisation (WTO)�fs judgement that its ban on imports of EU pig meat

products was against WTO rules. Appeals

can take up to three months to complete. If the original judgement is upheld,

Russia will have to remove the ban within a �ereasonable period of time�f or

face retaliatory measures. The

Russian import ban was imposed in early 2014, in response to outbreaks of

African Swine Fever (ASF) in Poland and the Baltic States. Although the

disease has not spread beyond these countries, the Russian ban affected the

whole EU. A

number of other importers have restricted shipments from the infected

countries but Russia is the only major buyer to have extended the ban to the

rest of the EU. The

ban covers not just fresh/frozen pork, which is further restricted by the

wider political ban imposed later in 2014, but also other uncooked pig meat

products, including offals and fats. The

latter, in particular, had a significant impact on the EU pig market, due to

the lack of alternative buyers. The value of EU fat exports fell by €237

million between 2013 and 2015, a loss of nearly one euro for every pig

slaughtered. �����g�r�A���@�H�����H�̃t�H�G�o�[�Ђ����Y�̔��� Latvian Meat Processor Eyes

Expanded Output, Higher Sales 16

September 2016 LATVIA

- Latvia�fs meat processor Forevers is aiming to increase its revenues by up

to 5 per cent in 2016, the company announced following the release of its

improved sales results for last year. To enable this, Forevers is currently

implementing a number of investments to raise its output capacity. For

2015, Forevers reported sales of some €30.1 million, an increase of 8 per

cent compared with a year earlier, as well as a net profit of about €1.43

million, according to the information obtained by local news agency LETA. With

the aim to further expand its sales, the company is carrying out an

investment worth €12.8 million under which it plans to modernise and raise

the output capacity of its meat processing facility by 2018. The

expansion is to allow Forevers to increase its foreign sales which currently

represent a minor share of the company�fs revenues. The Latvian firm sells as

much as 99.2 per cent of its output in the domestic market, and only about

0.8 per cent of its output is intended for export sales to other European

Union member states. The

meat processor�fs facilities are operated by a workforce of some 239

employees, according to data from Forevers. The company�fs product range

comprises of various pork, poultry and beef meat products, such as sausages,

hams, pates, cutlets and others. Set

up in 1996, Forevers owns a meat processing facility in the country�fs capital

Riga, and owns branches in Jekabpils and Saldus, both in Latvia. The company

is enabled to process about 79 tonnes of meat per day. Earlier this month,

Forevers said in a statement that it reached its new record monthly output

level last August, with some 1,452 tonnes of processed meat. Forevers

is owned by Latvian businessman Andrejs Ždans who also serves as the company�fs

chief executive. ���I���@�ؓ��s��̌����F 1.

�A�t���J�ؔM�̖��� 2.

15%���Y�ʑ����ɂ�鉿�i�̉��� 3.

WTO�ɂ��I��EU����̋֗A��@�ْ�ɑ���I�̑Ή� 4.

��s��8�N�Z���̕ԍς�3�N�ォ��J�n��5�N�ԕԍςɂ�������炸�A�L���b�V�����v�����剻�B Russia Hog Market Report 19

September 2016 RUSSIA

- Current prices in Russia are around 104 Roubles ($1.59) per live kg. This

means good producers continue to be making $50 to $70 per pig profit. Despite

this, there is a degree of nervousness in the market, writes Simon Grey,

General Manager Russia, CIS, and Europe. ·

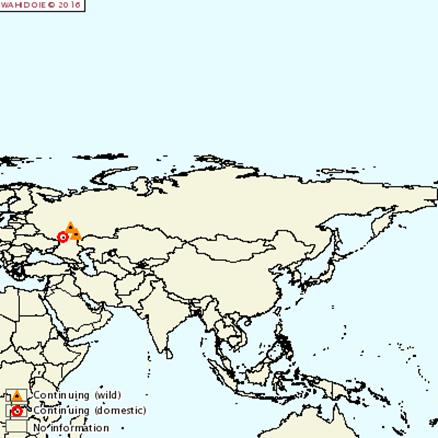

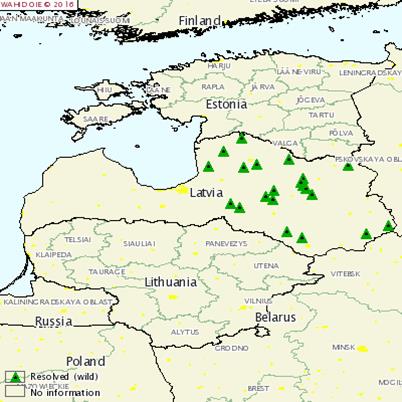

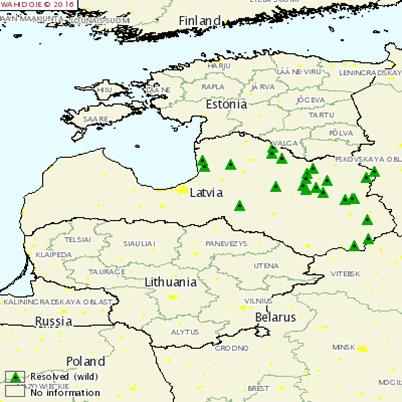

African Swine Fever is having its

normal summer rampage in Western Russia. Outbreaks are primarily in wild pigs

and domestic herds, but some large commercial herds have also been infected

and subsequently destroyed. ·

Russia is expecting a 15%

increasing production this year. This is expected to create market surplus in

Russia in the autumn, resulting in considerably lower prices. ·

The WTO has found that the trade

ban on pigs and pigmeat from EU to be illegal and should be lifted. However,

Russia has 60 days to appeal the decision and for sure will! ·

Russia�fs banking system requires

loans for pig farms to be repaid within 8 years. In the first 3 years (the

so-called investment phase), there are no repayments. Then, all the capital

needs to be repaid over the next 5 years. Although capital repayments are not

an actual cost of production, they are a huge demander of cash! With

the average capital cost of a new farm (from green field to point of first

sale) being about $9000 per sow. 80% borrowed from the bank is $7,200 per

sow. $7,200

/ 5 years = $1,440 per year to repay, or $57.60 per pig assuming 25 pigs sold

per sow per year!! What does this mean for the future? All

of the major Russian producers are either building new farms or plan to build

new farms. More good quality production is needed in Russia. These companies

are all profitable and have a track record of achieving results, and they can

get the finance required to grow. The 80:20 rule will apply. 80% of

production in the hands of the top 20 producers! Domestic

production continues to fall, encouraged by a will to stop ASF. On the back

of very high pig prices over the past 10 years, there are a number of old and

inefficient farms with very high production costs that will be forced to

close. New farms will replace both. At

some point in the future, Russia will open its borders for the importation of

pig meat. All

of the above means more competition, which means lower pig prices. For the

first time ever in Russia, cost of production and exporting pig meat will

become very important. Genetics Role In Sales and Cost Russia

exporting means China and Asia. Genetically, this means one thing. You need

to use a Duroc boar. Only the Duroc will consistently give large volumes of

carcasses with the meat quality required in Asia. Meat quality means high pH,

good water retention, darker colour and good amounts of intra muscular fat. From

a cost of production point-of-view, genetics and more importantly genetic

progress is also vital. Many people understand the value of changing genetic

suppliers and the initial benefit for production and reducing cost. However,

understanding the value of Annual Genetic Progress is another issue.

Remaining competitive requires year on year genetic improvement. Today, the

main economic cost drivers remain: more pigs, faster growth rate and less

feed used. More

pigs and less feed are very obvious benefits. For some, faster growth is more

difficult to understand. Faster

growth means more kg can be produced on the same farm in the same time,

either by growing pigs to heavier weights or putting more pigs through the

same buildings. More kg = higher income. The second advantage of more kg is

lower fixed costs. In pig production, we have only 1 real variable cost. That

is finisher feed. Every extra kg we produce needs only food. The cost of the

farm, labour, finance, utilities the sow etc�c. all remain the same. More kg =

higher income and lower fixed costs per kg! Secondary

drivers are earlier maturing gilts. Breeding gilts at 210 days of age rather

than 240 saves 30 days-worth of feed. Lower sow and pig mortality, higher sow

cull value also reduce cost. Lastly, pigs that are easier to look after (less

labour) is also a factor. The

annual Genetic improvement (more pigs, faster growth, less food) achieved by

Genesus is Russia is worth 240 Roubles ($3.68) / slaughter pig per year,

every year! Russia�fs

main competitor for export markets will be the USA, Canada and Brazil. These,

of course, happen to be the world�fs lowest cost producers. In a commodity

market, the lowest cost producer always has the advantage. These

countries understand the value of genetics and genetic improvement. North

Americans buy F1�fs or GP�fs for own internal multiplication. This way, they

get known improvement and good return on investment (spending $1 to get $2

back is good business). North Americans do not try to run �edo it yourself

breeding programs�f that do not deliver progress because they are actually more

expensive. ���I���@�V���ɃA�t���J�ؔM��8������ Russia Reports More ASF Outbreaks

in Pigs 05

September 2016 RUSSIA

- Eight new outbreaks of African Swine Fever (ASF) have been reported in

western Russia. The

outbreaks were reported in backyard units and on larger farms in the areas

of Krasnodarskiy, Saratovskaya, Vologradskaya, Ryazanskaya

and Voronezhskaya. In

total, of the 31,441 pigs susceptible, 235 cases were reported which led to

144 deaths and for 342 pigs to be destroyed.

���I���@���E�f�Ջ@�\�����V�A��EU����̓E�ؓ��̋֗A�[�u����@�ƍْ� Weekly Overview: WTO Rules Against

Russia's Embargo on EU Pigs, Pork 31

August 2016 ANALYSIS

- In the news this week, the World Trade Organisation (WTO) has declared that

Russia's ban on the import of pig and pork products from the EU is illegal

and in breach of WTO rules and should be lifted. Russia

originally placed the import ban on the EU in 2014 following concerns over

the spread of African Swine Fever (ASF), saying that the EU was not doing

enough to stop the spread. At

the time, ASF outbreaks were only being reported in a few countries, close to

the border with Belarus. The

WTO Panel has therefore found that the EU-wide import ban violates the rules of the

WTO Agreement on the Application of Sanitary and Phytosanitary Measures (the

SPS Agreement). Individual

bans placed on imports from Poland, Lithuania, and Estonia also received the

same criticism from the panel. Despite

the WTO's findings, most of the products involved in this trade ban

still cannot be exported to Russia due to Russia's politically motivated

trade ban on EU agriculture products. Copa

and Cogeca also noted that: "Russian authorities are likely to appeal

against the ruling in the next 60 days which means that farmers may not see

the benefits of it before 2018.�h Also

this week, there have been an array of advancements in pig health.

Firstly, a new vaccine has been developed for Porcine

Epidemic Diarrhoea (PED) in Canada. The

vaccine has been developed by scientists at the University of Saskatchewan

and has demonstrated the ability to protect up to 100 per cent of piglets. Scientists

at The Pirbright Institute in the UK have been busy developing a new

inexpensive test for diagnosing Foot and Mouth Disease (FMD). The

scientists used a truncated bovine integrin ��v��6 in their diagnostic tests

which all FMD virus types would bind to. The

researchers have been able to create large amounts of bovine integrin ��v��6 in

the lab using a rapid technique called �etransient cell transfection�f. This

could make diagnosis of FMD strains cheaper and easier, as only one integrin

would be needed to identify all strains of the FMD virus, compared to the

many antibodies that were needed previously. In

other news, a further case of swine dysentery has been detected in

Yorkshire, UK. It is the second case to be reported in Yorkshire

in a few weeks. AHDB

Pork is advising producers to increase vigilance for the development of

clinical signs of disease within their herd. ���I���@82���̃A�t���J�ؔM������ Russia

Detects 82 New ASF Cases in Pigs 10

August 2016 RUSSIA

- Thirteen new outbreaks of African Swine Fever (ASF) have been reported in

the south west of the country. Twelve

of the outbreaks were on pig farms and one outbreak affected wild boar. In

total, of the 18,605 pigs susceptible, 82 cases were reported and nearly

4,000 pigs have died or been destroyed as a result.

���I�EEU���@�v�[�`���哝�̂�������������̗A���֎~�߂̉����ɏ��� Putin Signs Extension for Russian

Food Import Ban 05

July 2016 RUSSIA

- Russia's President Vladimir Putin has reportedly signed a decree to extend

the ban on various agri-food imports from Western countries as part of

sanctions resulting from the crisis in Ukraine. According

to Russia's TASS news

agency, Mr Putin signed the decree last week, extending the ban

until the end of 2017. The

ban covers a number of products including beef, pork, fruits and

vegetables, meat, poultry, fish, cheese, milk, and most types of dairy

products from the United States, European Union, Canada, Australia and

Norway. Previous reports suggested that a number of

meat and vegetables intended for use in baby foods are exempt from the new

decree. ���I���@�A�t���J�ؔM�������13���� Thirteen More ASF Outbreaks

Reported Across Russia 21

June 2016 RUSSIA

- There have been 13 new outbreaks of African Swine Fever (ASF) reported

across western Russia in both wild boar and farmed pigs. In

total, 33 cases were reported in backyard farmed pigs and eight in wild boar.

���E�N���C�i���@�����[�}�j�A�����߂��ŐV���ɃA�t���J�ؔM������ New Ukrainian ASF Outbreak Hits

Farm Close to Romanian Boarder 10

June 2016 UKRAINE

- A new outbreak of African Swine Fever (ASF) has been reported on a pig farm

close to the boarder with Romania. The

outbreak, in Dovzhok, Novoselytskiy, Chernovtsy, resulted in 55 cases of

the 700 pigs susceptible. All

the quarantine measures have been implemented on the farm following the

outbreak and a stamping-out of all susceptible animals is going to be held.

���I���@���X�N���n��̌{����������72���ɑ��� Moscow Closer to Self-Sufficiency

in Poultry Meat 09

June 2016 RUSSIA

- Moscow Region�fs self-sufficiency in poultry meat is expected to reach 72

per cent in 2016, said Moscow Region�fs Minister of Agriculture and Food,

Dmitry Stepanenko, during his visit to �gMosselprom�h, Cherkizovo Group�fs

poultry production cluster. Given

the already high satisfaction of demand in the region, it is essential to develop

technologically advanced facilities producing value added products, he added. �gMosselprom�h,

Cherkizovo Group�fs poultry production cluster, is one of the fastest growing

poultry facilities in the region. Minister�fs visit coincided with the launch

of 24 new poultry houses which are expected to boost company�fs annual

production volume by 12 thousand tonnes. Investment in the new infrastructure

at �gMosselprom�h reached almost 650 million roubles. The

Minister commented: �gThe facility is technologically advanced. Broiler

growing takes only 35 days compared to three months in a typical farm

enterprise. Such high turnover helps increase production volume. Once full

self-sufficiency is reached, the challenge of finding new channels of

distribution comes up. Currently a number of poultry production companies are

exploring opportunities to enter new markets abroad. I view this as the next

key area of development for poultry companies in the Greater Moscow Area.�h A

number of Cherkizovo poultry farms had already received licenses to export

their products to UAE and Egypt. The company expects its exports to account

for 20 per cent of total revenue within the next two years. On

top of that, Cherkizovo�fs poultry facilities in the Moscow region are already

equipped to produce ready-to-cook products such as nuggets, varieties of

cutlets, hot dogs and healthy products on top of traditional chilled poultry

meat. Meanwhile,

in the Kashira district of the Moscow Region the company is planning to build

a modern fully-automated meat processing plant with a yearly output of 30

thousand tonnes of finished sausage products. Cherkizovo�fs total investment

in the region�fs production assets in 2015 was just under 1 billion roubles. Moscow

region remains the company�fs top investment priority with its geographical

proximity to the largest market in the country. The Group�fs current strategy

consists of creating modern technologically advanced production facilities

enabling to increase the volume of value-added products and provide the region�fs

population with delicious domestically manufactured products of the highest

safety standards. ���I���@�܂��܂��A�t���J�ؔM�������� More ASF Reported in Russian Pigs 07

June 2016 RUSSIA

- A further outbreak of African Swine Fever (ASF) has been reported in

Russia. The

outbreak was reported in village pigs in Novouglaynka, Usmansky,

Lipetskaya. In

total, of the six pigs susceptible, there were five cases. All

pigs in the unit died or were destroyed as a result.

�����V�A���@�I�_���Ȃ��d�t�E�Ă���̋֗A�[�u��2017�N���܂ʼn��� Russia Prepares to Extend Agri-Food Embargo Until

End of 2017 02

June 2016 RUSSIA

- The Russian Agriculture Ministry has prepared a draft decree to extend its

embargo on food products from a number of countries including the EU and US

until the end of 2017. The

sanctions were imposed in August 2014 in retaliation for Western sanctions

resulting from the crisis in Ukraine. The

restrictions cover a range of products, including meats, fish, dairy products

and fruit and vegetables, causing problems for these markets in many

countries. Other products were subsequently added to the list, such as

lactose-free milk and salmon and trout hatchlings. However,

some EU reports indicate that food producers are

compensating for the loss of the Russian market by exporting more to other

third countries. According

to Russia's Tass News

Agency, which reported the move, Agriculture Minister

Alexander Tkachev said the embargo's extension would be "good news for

domestic agricultural producers." The

draft will have to be approved by President Vladimir Putin before the

extension goes ahead. "The

embargo is currently effective until the end of August. I think these

documents will be approved unless some miraculous changes occur in the

geopolitics," Deputy Prime Minister Arkady Dvorkovich told Tass. A

further report from Tass said

that poultry meat, beef and vegetables intended for use in baby food

manufacturing have been removed from the new embargo decree, which will allow

certain volumes of these foods through into Russia. The

EU's sanctions against Russia are set to run until 31 July 2016, but a recent

statement released by the office of German

Foreign Minister Frank-Walter Steinmeier hinted that an easing of the

sanctions might be on the cards. "Sanctions

are not an end in themselves but need to serve to provide an incentive for

the political behaviour we would like to see," he said. "In

the current situation this means that a demand for all or nothing will not

bring us any closer to our goal. If substantial progress is made, the gradual

reduction of sanctions must also be an option." - See more at: http://www.thebeefsite.com/news/49742/russia-prepares-to-extend-agrifood-embargo-until-end-of-2017/#sthash.LrTGFRV5.dpuf ���E�N���C�i���@�V���ȃA�t���J�ؔM������ New ASF Outbreak Reported on

Ukrainian Pig Farm 18

May 2016 UKRAINE

- A new outbreak of African Swine Fever (ASF) has been reported on a backyard

pig farm in Hyrchychna village. In

total, seven cases were reported out of the 14 susceptible pigs.

���x�����[�V���@�A�t���J�ؔM�ŃN���~�A����̓ؓ��A�����~ Belarus Bans Pork and Pig Products

From Crimea 08 February 2016 BELARUS - Belarus has banned

pork from Crimea following an outbreak of African Swine Fever. The temporary ban was

imposed on 3 February by the Belarus Department of Veterinary and Food

Supervision, Ministry of Agriculture, reports Depo. The ban includes live

pigs, boar semen, pork (including from wild boar) and products such as

leather, horn and hoof and intestinal raw materials and bristle. In addition, a ban is

also imposed on feed and feed additives of animal origin. ���E�N���C�i���@�A�t���J�ؔM����ɔ��� ASF

Detected in Ukrainian Wild Boar 01 February 2016 UKRAINE - Another

outbreak of African Swine Fever (ASF) has been reported in a wild boar found in

the Poltava region. The wild boar was found

dead in the hunting grounds near Yenki village, Khorlovskiy.

�����g�A�j�A���@�쐶�ɃA�t���J�ؔM��5�������@�@ Five ASF Outbreaks Reported in

Lithuania 28 January 2016 LITHUANIA - Five new

outbreaks of African Swine Fever (ASF) have been reported in Lithuania. In total, seven cases

were reported in wild boar in the Panevezys and Utena regions.

���A�����j�A���@�����u������ Armenia Latest Country to Report Foot and Mouth

Disease 26 January 2016 GLOBAL - The latest report of Foot and Mouth

disease around the world comes from Armenia. A farm in Armavir province with 1219 cattle and 362

swine was the location of the serotype A outbreak. One of the cattle and two pigs were infected, and

both the pigs died. The rest of the herd has not been destroyed. The official report identifies the source of the

outbreak as 'airborne spread'. Movement controls, disinfection, quarantine and

surveillance are all being used to control the disease.

- See more at:

http://www.thebeefsite.com/news/49185/armenia-latest-country-to-report-foot-and-mouth-disease/#sthash.N3gXyfnu.dpuf �����V�A�E�u���W�����@�u���W������̓ؓ��A����27���������@�F�d�t����̗A����~�ɔ��� Russia

Drives Growth in Brazil's Pork Exports 25 January 2016 BRAZIL - There was a

strong growth in the volume of pork exported from Brazil during 2015 – up 13

per cent on 2014. There was a drop in

exports to Russia in the first quarter of the year. Russian exports were

behind expectations during this period, exacerbated by difficulties in the

Russian economy, largely driven by the weakening price of crude oil. However, Russia did

return to the buying table in the rest of 2015 and there was a large peak in

exports during the second half, a year on from the Russian import ban of

Western foods, imposed over the situation in Ukraine. Brazilian pork became

extremely competitive on the global market due to the weakening of the real

against the dollar, attributed to the recessive Brazilian economy. Whilst

this helped increase the volume of pork exported to a range of markets, the

effect on value was very dependent on the currency involved. In domestic currency,

the value of exports was 16 per cent up on the year, as prices rose modestly.

However, in US dollar terms, value was 19 per cent lower than 2014, as prices

fell by 28 per cent.

The 2016 outlook is that exports are forecast to continue to grow. Brazil is looking to explore exporting to other markets, including Japan, China and Mexico, in 2016 to avoid an over reliance on Russia. This export development will be fundamental in 2016 as production is set to grow. There is an expectation

that domestic consumption will also increase due to high beef prices but this

will still be behind growth in production. Whilst the weakness of the real

has proved beneficial for the global competitiveness of Brazilian pork, it

has caused an increase in the cost of imported vitamins and medicines for

pigs and therefore started to squeeze producers�f margins. However, this hasn�ft

overly deterred producers who are still looking to capitalise on the growing

export market, low feed prices and sustainable domestic and export prices. ���I���@�ׂ���{�r�W�l�X�@�F���C���e�O���[�_�[�͑������ Russia

Hog Market Report 20 January 2016 The new year starts

with a pig price of 96 Roubles per kg live ($1.28) meaning the majority of

producers are making money, with some of the large integrators still making a

lot of money, writes Simon Grey, Genesus. What does 2016 have in

store for Russian pig producers. This will I think have a lot to do with the

structure and ownership of each individual business. Fully integrated

business that grow crops to feed pigs have a very low cash cost of production

(even if on paper they lose money, if you put grain into pigs at cost of

production then 96 Roubles sales price means you still have a business with

very good cash flow)!! Russia has done its

federal budget for 2016 based upon a $50 per barrel oil price. At least for

the first part of the year there will be less money in the federal budget

than expected. Therefor any money for direct subsidy will not be there,

unless there are further devaluations of the rouble. For oil as with all

commodities the rules of supply and demand applies. With low price, even if

production is not cut, then bankruptcy�fs will cut production. No company, no

matter how wealthy, can produce at a loss for ever!! The issue as always is

only one of time! For pig producers in

Russia expect some changes. Some are easy to predict and others not so. 1. Backyard production

will continue to reduce, reducing production. 2. Producers with very high

cost (old farms and poor production, or those who have borrowed far too much

money) will go bankrupt also reducing production. 3. The modern and

efficient producers will continue to grow. However, there are a limited

number of new farms currently under construction and a limited number started

last year. There will be increased production, but little in 2016 from new

farms. Most new farms will be being stocked at the earliest in the 2nd half

of 2016. This means extra production hitting the market in the 2nd half of

2017. These factors would mean little change to supply and there is little to

say there will be much change in consumer demand. No particular reasons in

the market for major changes in pig price. 4. Less predictable is the

situation with imports and exports. Russia currently has the lowest level of

imports in recent history. Ant further devaluation in the Rouble would reduce

imports further. 5. Sanctions from EU and

USA in place until at least June. The only sanctions that may have had any

affect are those on banks (oil price much more significant). In general

sanctions will benefit the Russian economy which is changing to be less oil

dependent (this takes time). With current pig price in Europe it is likely

the EU will lose about 1 million sows. The EU with all its environmental and

animal welfare legislation along with high cost of labour make pig production

costs very high. Even if sanctions are lifted the devaluation of the rouble

makes imports from the EU expensive and by the second half of the year

reduction in inventory will start to affect the number of pigs hitting the

market. 6. The biggest unknown for

me and the one that would have the biggest impact on the market is China.

Certainly there is a lot of general talk about increased trade with China.

This did reduce in 2015, but whether this is a genuine reduction or simply

Russia exporting less in general to compensate for sanctions is not clear.

Certainly there are well publicised communication between major Russian

producers and the Chinese. China has a 4,000 km border with Russia and vast

areas of farm land capable of producing low cost crops and pig meat. It is an

obvious supplier of considerable quantities of food to China. Watch this

space. One thing has and never

will change in pig production. The best time to start is when prices are low.

This is because low prices absolutely guarantee high prices between 1 and 2

years after the bottom of the market. When few people are building it�fs a

great time also to be negotiating with suppliers! With 19 of the 20 top

producers in Russia linked to government there are signs of maybe some delays

to expansion, but certainly no talk of it stopping. Predicting the future

is not so hard. Empires fall, boom follows bust, conflicts end. Low pig price

follows high pig price. The problem with the future is getting the timing

correct. Russian producers need to learn and adapt to managing the pig cycle. ���E�N���C�i�E�d�t���@�E�N���C�i���d�t����̋����A�������ցF�a�r�d����� Ukraine Lifts Ban on Imports of EU Beef,

Veal 20 January 2016 EUROPEAN UNION - Ukraine has lifted its longstanding beef trade

restrictions relating to BSE in cattle.Exports of bone-in beef and beef from

all EU Member States to Ukraine are now allowed as Ukraine has recognised the

EU single system of control on BSE, and the official sanitary status of EU

Member States based on the BSE risk category of the World Animal Health

Organisation (OIE) for imports. This trade-facilitating measure follows

closely the entry into force (1st January 2016) of the Deep and Comprehensive

Free Trade Agreement between Ukraine and the EU. The European Commission is

looking forward to Ukraine agreeing to the required health certificate

quickly so that real trade can start soon. The European Commission has been

constantly requesting Ukraine to follow the OIE key recommendations

concerning BSE and remove the associated trade barrier. The first step to be

in line with OIE standards was made by Ukraine early 2015 by removing the ban

on imports of safe EU boneless beef from some Member States (France, Denmark

and Poland). EU-Ukraine discussions led to a �eroadmap�f of joint actions

aiming to fully remove remaining barrier on boneless beef from the other EU

Member States and bone-in beef from the entire EU. Ukrainian concerns related

mainly to the robustness of the EU control system across all Member States,

and to the reliability of traceability control systems in several Member

States. As part of this road map proposed by Ukraine, Ukrainian inspectors

visited the Netherlands as an example of BSE negligible risk country on 10-12

November 2015 and Poland as an example of BSE controlled risk country on 7-10

December 2015. EU Commission experts participated in both audits. Following

the positive outcome of these audits, Ukraine has announced the authorisation

of exports of boneless and bone-in beef and veal from the whole EU and that

Ukraine will follow OIE standards in the setting of Ukrainian animal health

and public health standards. The European Commission and the EU Delegation in

Kiev say they will continue working together with the Ukrainian authorities

to eliminate unnecessary trade restrictions and to further facilitate trade.

- See more at:

http://www.thebeefsite.com/news/49165/ukraine-lifts-ban-on-imports-of-eu-beef-veal/#sthash.tIQxtZoZ.dpuf ���G�X�g�j�A���@�A�t���J�ؔM�X��76���������@ Estonia

Reports 76 More ASF Outbreaks 15 January 2016 ESTONIA - Estonia has

reported 76 new outbreaks of African Swine Fever (ASF) in wild boar. In total, 135 wild boar

were found dead across the country.

�����g�A�j�A���@�A�t���J�ؔM���X��6���� Lithuania

Reports Six New ASF Outbreaks 15 January 2016 LITHUANIA - Lithuania

has reported six new outbreaks of African Swine Fever (ASF) in wild boar. In total, six wild boar

were confirmed with ASF after been hunted or found dead.

���|�[�����h���@���������t�߂ŃA�t���J�ؔM���V���ɔ��� Poland Reports New ASF Outbreaks 12 January 2016 POLAND - Two new

outbreaks of African Swine Fever (ASF) have been reported in wild boar. In total, two cases

were reported in the Podlaskie province, close to the boarder with

Belarus.

���E�N���C�i�E���V�A���@���V�A�̃E�N���C�i����̐H�i�A���֎~�[�u�ɑ��A�Ƀ��V�A����̐H���A�����~ Ukraine Bans Russian Meat Imports in Retaliation 12 January 2016 UKRAINE - The Ukrainian government has

decided to ban imports of food products, including meat, from Russia. The

move is a response to the embargo placed by Moscow on Ukrainian food imports,

according to Kiev, reports Jaroslaw Adamowski for TheCattleSite."Ukraine

exits the free trade area with Russia, raises duties on all goods and puts a

trade embargo on all food products manufactured in the Russian Federation, as

well as on car building and engineering products," said Ukrainian Prime

Arseniy Yatsenyuk, according to a statement released by the country�fs

government. "We are taking countermeasures. We didn�ft start this war,

meanwhile the aggressor will be punished.�h The ban came into force on 10

January, and it is expected to remain in place until at least August 5,

according to the Ukrainian government. On 1 January, the Deep and

Comprehensive Free Trade Area (DCFTA) which forms part of the Association

Agreement inked by Ukraine and the European Union in June 2014, entered into

force. The free trade zone agreement has triggered opposition from Moscow

which aims to disengage Kiev from its alignment with the EU. Meanwhile,

Ukrainian Minister of Agrarian Policy and Food Oleksiy Pavlenko said that the

majority of products which are exported from Russia to Ukraine are made by

local subsidiaries of major international groups. According to Pavlenko, the

embargo placed by Kiev on Russian imports could encourage these companies to

expand their manufacturing capacities in the Ukrainian market. In 2014, Ukraine

exported about $54.2 billion worth of products, of which 32.3 per cent were

agricultural products. The EU remained the country's main trade partner, with

31.5 per cent of the total, followed by Russia which held a 18.2 per cent

stake, according to data from the World Trade Organization (WTO). The latest

decision marks another tit-for-tat move in Ukraine�fs troubled economic

relations in Russia. Ten years ago, Kiev decided to ban Russian animal

product imports after Moscow placed an embargo on imports of such products

from Ukraine on January 20, 2006. - See more at:

http://www.thebeefsite.com/news/49130/ukraine-bans-russian-meat-imports-in-retaliation/#sthash.3L5sAKlg.dpuf �����g�r�A���@�A�t���J�ؔM�����64������ More

ASF Reported in Latvian Wild Boar 07 January 2016 LATVIA - A further 46

new outbreaks of African Swine Fever (ASF) have been reported in wild boar. In total, 64 cases were

reported across the country.

���I�E�ā��@�ĎY�Ⓚ�{��35����s�@�A���ō��������G�J�U�t�X�^�������q���ؖ����ł͖��� Russian Authorities Seize 35 Tonnes of

Illegal US Poultry 26 March 2015 RUSSIA - Russian veterinary authorities in the Tver and Pskov regions have

detained a train with seven containers of frozen poultry quarters that were

illegally being imported from the US.The 35 tonnes of poultry meat that was

certified from a US plant had certification papers from a plant in

Kazakhstan. The meat had a veterinary certificate for export of US poultry

meat and poultry meat products to Kazakhstan as well as Latvian certificates.

The meat was seized because of the discrepancies in the paper work and

concern over advanced issuing of veterinary certificates. - See more at: http://www.themeatsite.com/meatnews/27168/russian-authorities-seize-35-tonnes-of-illegal-us-poultry#sthash.pxVLu9ln.dpuf �����g�A�j�A���@��Q���ɃA�t���J�ؔM�E�C���X Lithuania Reports Two

More Wild Boar with ASF 25 February 2015 LITHUANIA - Two wild boars at different locations

tested positive for the African swine fever (ASF) virus in mid-February. According to the latest Follow-up report - number

33 - dated 20 February from the Lithuanian veterinary authority to the World

Organisation for Animal Health (OIE), two more wild boar have tested positive

for the ASF virus, both in the north-east of the country in regions that

border Latvia. The first was a female, found dead on 17 February

at Bheresai Nyreport in the Zarasai district municipality in Utena county. The other animal was also a female, hunted on 18

February in Kupiskis district municipality, which is in the county of

Panevezys. It subsequently tested positive for the ASF virus. - See more at: http://www.themeatsite.com/meatnews/26931/lithuania-reports-two-more-wild-boar-with-asf/#sthash.L7BPwg3i.dpuf ���I���@�Y�f�a�^���̂��郉���}���̃N���~�A�ւ̗A����j�~ Anthrax Alert Blocks Import of Lamb Carcases 12 February 2015 RUSSIA - Russian state inspectors from Rosselkhoznadzor in the Republic

of Crimea and Sevastopol have seized a shipment of potentially dangerous lamb

from being imported into the country.Vehicles, which had 96 lamb carcases of

lamb on board, weighing 1.62 tonnes, were heading to the Crimea Agro Lan in

the Zaporozhye region of Ukraine. The meat was being shipped to a private

business in Simferopol. However, an inspection of the documents found that in

the veterinary and accompanying documents there was no reference to tests for

anthrax. A physical inspection of the carcases found blurred carcase stamp

prints, so that it was impossible to determine the origin of the meat.

Because of the breeches of the regulations and requirements of the current

legislation of the Russian Federation and the Customs Union, and also because

the inspectors felt there was an obvious danger from the meat to the health

of consumers, the carcases were refused entry and returned to Ukraine. - See

more at: http://www.themeatsite.com/meatnews/26838/anthrax-alert-blocks-import-of-lamb-carcases#sthash.smPeG2i9.dpuf ���I���@�`�F���L�]�{�E�O���[�v��2014�N���オ�����F�{��22���A�ؓ�8���A���H���V���A����40�����ꂼ�ꑝ�� Cherkizovo Group Sees

Sales Rise in 2014 30 January 2015 RUSSIA - Russian meat

and feed producer, Cherkizovo Group, saw pig, poultry and meat sales rise

over the last year. Poultry Division Sales volume in the Poultry

division in 2014 increased by 22 per cent year-on-year to 416,622

tonnes of sellable weight compared to 342,637 tonnes in 2013 including 58,417

tonnes produced by LISCO Broiler following the company's acquisition by

Cherkizovo in March. Prices in ruble terms

increased by 18 per cent year on year from 77.12 RUB/kg in 2013 to 90.70

RUB/kg in 2014. Compared to the price of

98.43 RUB/kg in the third quarter of 2014, the price in the fourth quarter of

2014 increased by two per cent to 100.86 RUB/kg. Prices for poultry in

dollar terms decreased by two per cent year-on-year from $2.42/kg

in 2013 to $2.36/kg in 2014. Compared to the price of

$ 2.72/kg in the third quarter of 2014, the price in the fourth quarter of

2014 decreased by 22 per cent to $ 2.13/kg. Dollar-denominated price has

significantly decreased due to ruble devaluation in the fourth quarter. Pork Division Sales volume in the Pork

division increased by eight per cent year-on-year to 170,172 tonnes

of live weight in 2014, compared to 157,565 tonnes in 2013. Prices in ruble terms

increased by 47 per cent year-on-year from 65.68 RUB/kg in 2013 to 96.25

RUB/kg in 2014. Compared to the price of

111.52 RUB/kg in the third quarter of 2014, the price in the fourth quarter

of 2014 decreased by 13 per cent to 96.90 RUB/kg. In dollar terms, price

for pork increased by 22 per cent year-on-year from $2.06/kg in

2013 to $2.51/kg in 2014 (live weight). Compared to the price of

$3.08/kg in the third quarter of 2014, the price in the fourth quarter of

2014 decreased by 34 per cent to $2.04/kg. Dollar-denominated price has

significantly decreased due to ruble devaluation in the fourth quarter. Meat Processing Division Sales volume in the Meat

Processing division increased by seven per cent year-on-year to

144,189 tonnes in 2014 from 134,530 tonnes in 2013. Price in ruble terms

increased by 12 per cent year on year to 167.29 in 2014 from 148.78

RUB/kg in 2013. Compared to the price of 170.64 RUB/kg in the third quarter

of 2014, the price in the fourth quarter of 2014 increased by two per

cent to 174.15 RUB/kg. Prices in dollar terms

decreased by seven per cent year-on-year to $4.35/kg in 2014

compared from $4.67/kg in 2013. Compared to the price of $4.72/kg in the

third quarter in 2014, the price in the fourth quarter of 2014 decreased by

22 per cent to $3.67/kg. Dollar-denominated price has significantly

decreased due to ruble devaluation in the fourth quarter. Grain Division In 2014 Cherkizovo

harvested more than 242,000 tonnes of grain (gross harvest), or nearly

40 per cent more than the result in 2013, which was about 175,000 tonnes

(gross harvest). The standard weight of the grain harvest was 229,000 tonnes.

About 60,000 ha were worked in Voronezh, Lipetsk, and Orel Regions during the

agricultural campaign. Sales volume in the

Grain division increased by 70 per cent year-on-year to 237 106

tonnes in 2014 from 139 565 tonnes in 2013. Wheat, barley and corn accounted

for 81 per cent of sales in 2014. Prices in ruble terms

increased by 20 per cent year-on-year from 6.01 RUB/kg in 2013 to

7.21 RUB/kg in 2014. Compared to the price of 5.95 RUB/kg in the third

quarter of 2014, the price in the fourth quarter of 2014 increased by

35 per cent to 8.04 RUB/kg. Prices in dollar terms

year-on-year was flat. Compared to the price of $0.16/kg in the third

quarter of 2014, the price in the fourth quarter of 2014 increased by

six per cent to $0.17/kg. - See more at: http://www.themeatsite.com/meatnews/26740/cherkizovo-group-sees-sales-rise-in-2014#sthash.KkvkuScw.dpuf ���|�[�����h���@�C���f�B�N�|���Ђ�63���~�Ō{���H����g�� Indykpol to Invest

$53 million in Expanding Processed Poultry Meat Output 22 January 2015 POLAND - Polish poultry meat processor

Indykpol has unveiled plans to invest about 200 million zloty ($53 million)

in the next four years with the aim of significantly expanding its output

capacity, writes Jaroslaw Adamowski.�gThe Polish poultry market has been

experiencing growth for year, and its pace has been very rapid,�h Krystyna